December 9, 2022, 20:33 PM

December 9, 2022, 20:33 PM

Fabio De Masi, a former lawmaker from Germany’s left-wing socialist party Die Linke, who was involved in a parliamentary inquiry into the Wirecard case, said that “Mr. Markus Braun was not a victim, but the godfather of the criminal operation to defraud investors”.

De Masi recalled Parliament’s 675-page report on Wirecard, published in 2021, which stated that Braun was involved in signing funds to third-party companiesdespite warnings that it was giving away “the latest Wirecard liquidity.”

Wirecard was once the star of the German financial technology sector. The company started in 1999 as an online payment processor for pornography and gambling websites, and built a steady stream of income that helped him survive the bankruptcy of the dot com. The company expanded its retail customer base thanks to the global boom in online shopping and, later, mobile payments.

Under the leadership of Markus Braun, a former KMPG consultant who joined in 2002, the company grew at a breakneck pace, taking over smaller payment companies and expanding into the banking sector. It even launched a joint venture with Chinese e-commerce giant Alipay. to allow Chinese tourists to pay for goods and services abroad.

Wirecard went public on the Frankfurt Stock Exchange in 2005 and, 13 years later, unseated traditional lender Commerzbank from the DAX index. At its peak, the company was valued at more than 24 billion euros, surpassing even Deutsche Bank.

What brought Wirecard down?

In 2016, the American financial research company Zatarra published a report on Wirecard, reporting fraudulent activities in the company. It accused senior executives of committing money laundering and committing fraud against Visa and Mastercard.

Three years later, the journalist from Financial Times Dan McCrum picked up on the scandal, citing accounting irregularities at Wirecard’s Asian units in a series of articles. In June 2020, the company admitted to the auditor EY that 1,900 million euros in cash that had to be kept in two Philippine accounts they probably did not exist. Wirecard’s share price plunged 99 percent and it became the first DAX company to file for insolvency, owing its creditors almost 4 billion euros.

Complaints against two FT journalists

An FT investigation found that third party acquirers (TPAs) – companies that process payments for Wirecard when it lacked its own license to operate- they accounted for about half of Wirecard’s reported revenue and much of its profits. But the address of one of these companies led to a family home in the Philippines. Another was a Manila bus company.

The scandal also revealed that the German market regulator, Bafinhad not only failed to detect the fraud – despite suspicions raised by investigative journalists and financial market analysts – but also filed criminal complaints against two FT journalists, alleging market manipulation, which were later withdrawn.

The scandal forced the resignation of the head of BaFin and the head of the German accounting watchdog, and even prompted a Netflix documentary, according to McCrum.

How is the legal process progressing?

Markus Braun and two other top managers of Wirecard are on trial in Munich, accused of inflating profits through fictitious transactions involving a complex network of subsidiaries and associated companies. Oliver Bellenhaus, a former director of Wirecard’s Dubai branch, and Stephan von Erffa, another former director, are also charged. the three men They could face up to 15 years in prison if convicted. of various charges, including fraud and market manipulation.

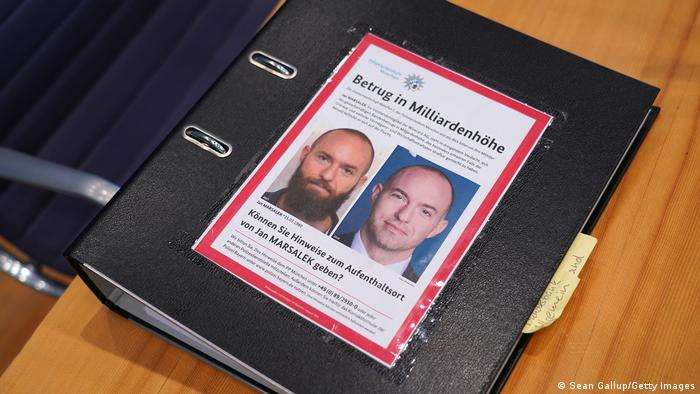

The Wirecard case will not be complete without the testimony of former COO Jan Marsalek, who has been identified as the mastermind of the fraud. Marsalek, for his part, fled to Moscow.