AEBU maintains that these data confirm “how the concentration of wealth deepens” andn Uruguay, highlighted that the increase in bank deposits during the January-June period occurred in accounts with balances greater than US$250,000, and considered that this was fostered by the “economic policy” of the government of Luis Lacalle Pou .

Another look

The economist Alicia Corcoll, manager of the consulting firm Exante, has another vision on the subject and exposed through a thread on Twitter why this “is not attributable to economic policy” and said that it has a “positive” effect on credit and the economy “in the long term”.

“Deposits are growing strongly so far this year (+13% year-on-year as of July). The rate of increase is similar to that seen in 2020 and 2021, but contrasts with the pre-Covid dynamic (when deposits on average grew less than 2% per year),” he said.

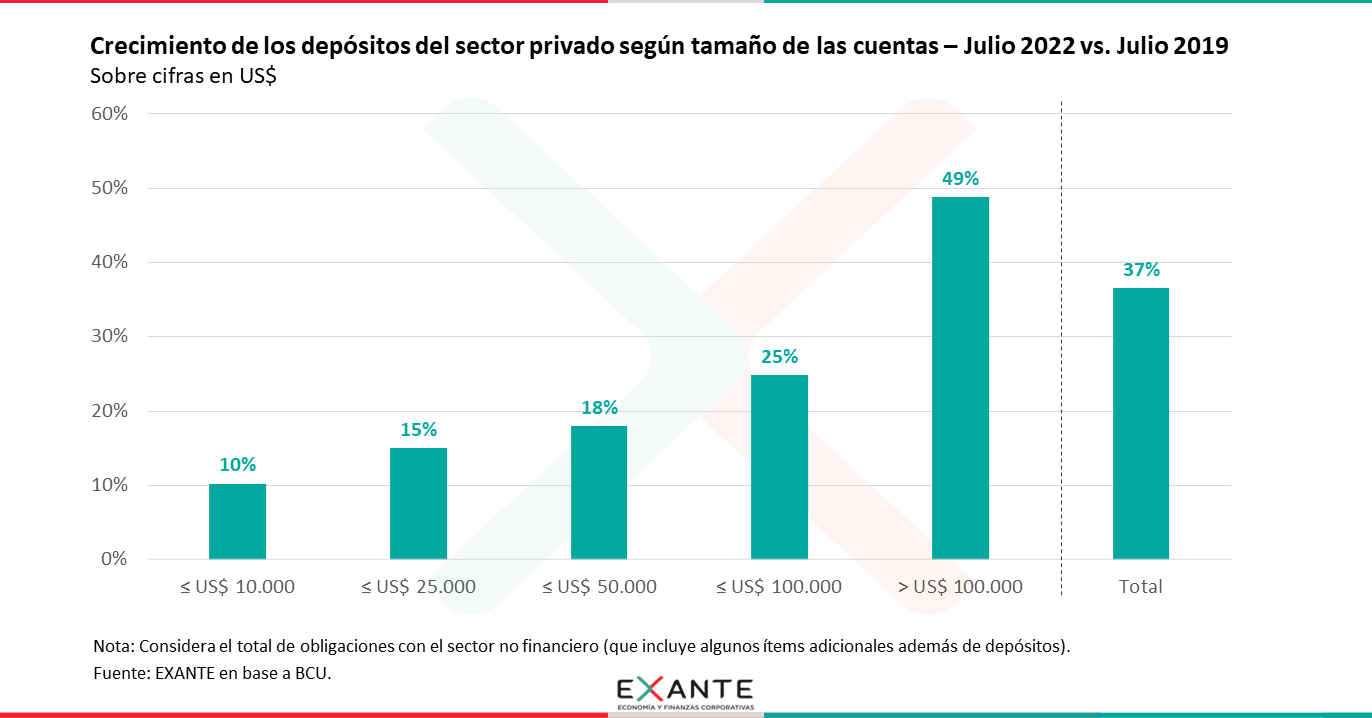

Corcoll pointed out that the accounts with the largest amounts (generally associated with companies) “were the ones that had the greatest growth compared to 2019, but that is not attributable to economic policy.” The amount of accounts with amounts greater than US$ 100 thousand increased 49% in July compared to the same month of 2019.

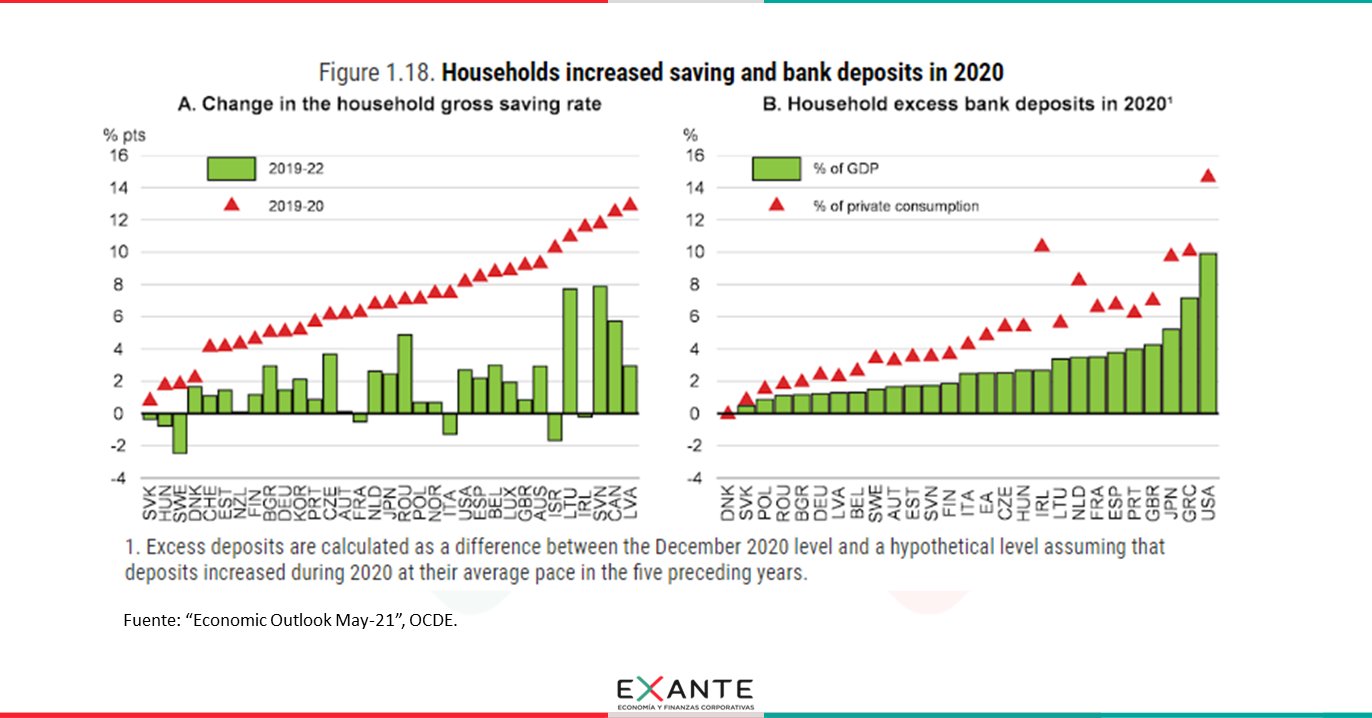

The economist assured that the rise in deposits in Uruguay was in line with what was seen in many countries, “associated with lower consumption and a greater preference for maintaining available balances. With the covid income fell but savings increased (concentrated in the higher-income sectors),” he said.

“That deposits grow should be seen as positive. Deposits rise at the request of savings, and savings are necessary to make investments that allow the economy to grow in the long term,” he said.

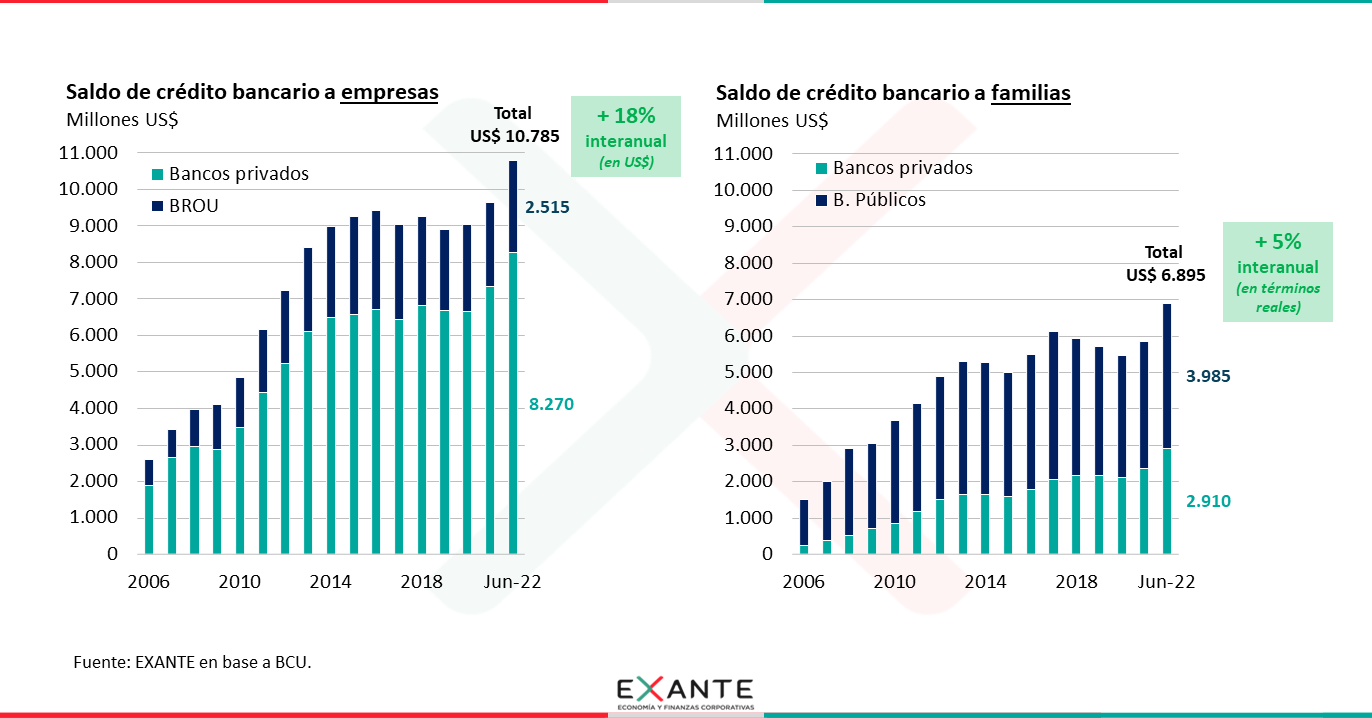

In addition, the Exante economist recalled that the “increase in deposits also contributes to more credit in the economy. In fact, we are seeing credit with intense growth, both to companies and individuals.”

The balance of bank loans to families from public and private banks as of June totaled US$6,895 million and grew 5% in real terms in year-on-year terms. For its part, the balance of bank loans to companies totaled US$ 10,785 million, with growth of 18%.

“The greater availability of credit helps sustain consumption in contexts of falling incomes, contributes to a better business climate and facilitates the financing that companies require to grow,” Corcoll concluded.