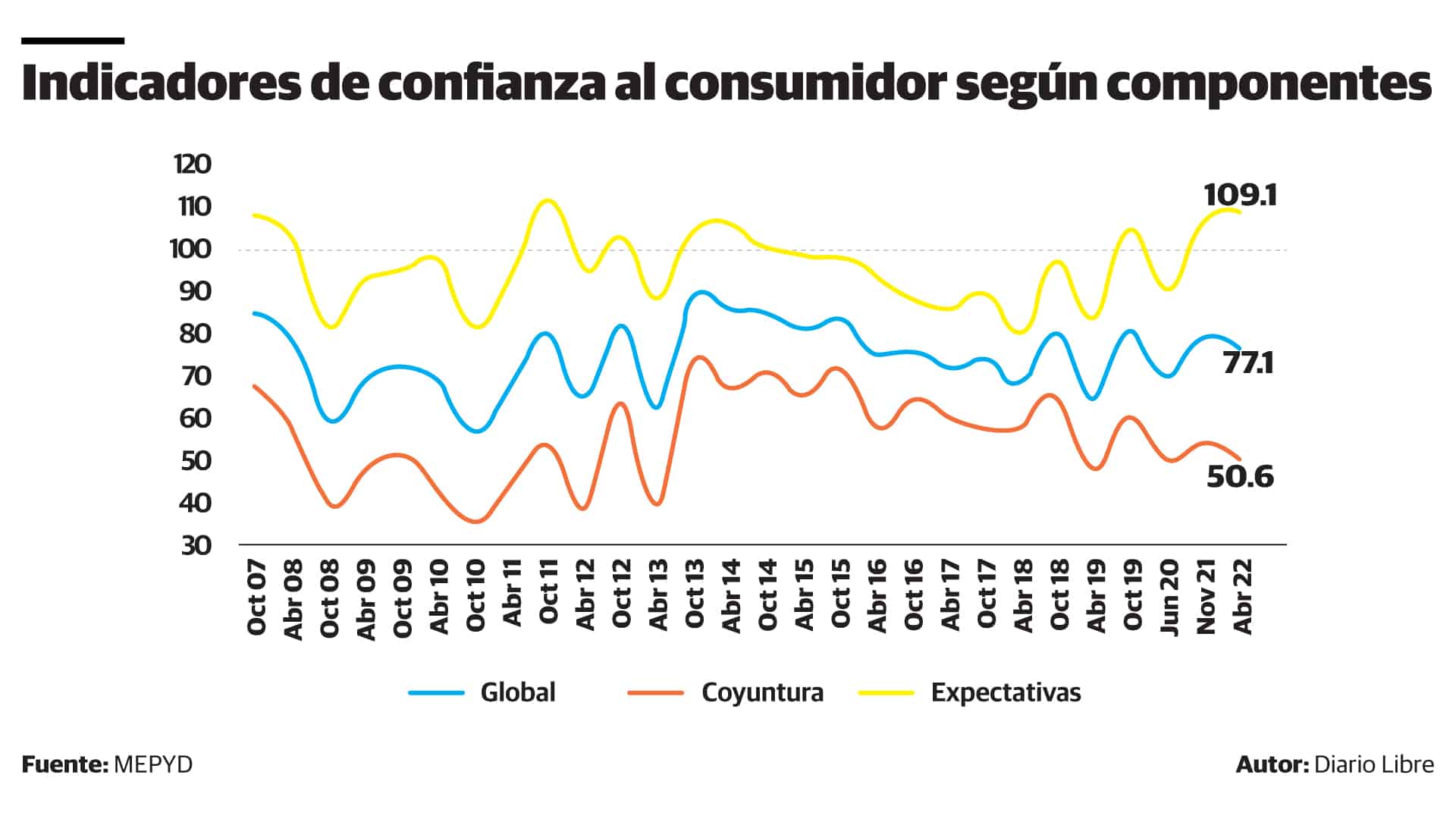

Despite the good growth forecasts for the Dominican economy this year (5%), consumers They are less optimistic. Inflationary pressures and the deterioration of the family situation are impacting their confidence and the index that measures it decreased by 1.9 points in April of this 2022, compared to the last measurement of November of last year.

For example, 87.1% of households consider that this is not the time to buy a vehicle and 81.5% that it is a bad time to buy appliances and other household furniture. Also, six out of 10 households consider that the situation to find employment has worsened a little or a lot in the last 12 months.

This is how the most recent report on the consumer confidence index (CCI) evaluates it, recently published by the Ministry of Economy, Planning and Development, which, based on household surveys, indicates that this measurement remains at moderately pessimistic levels and moving away from those observed in the pre-pandemic period.

“However, the fall in the global indicator was attenuated by greater optimism about the economic situation for the next twelve months, in particular, the conditions of the labor market and family savings,” the document notes.

But changes in consumer confidence are. The report indicates that “the persistence of inflationary pressures that has caused a reduction in the purchasing power of households and, therefore, a deterioration in the intention of consumption, explain the main changes registered in the current economic environment.”

Six out of 10 households consider that it is “a very bad time” to save, and that it is “fair or very difficult” to cover their needs given their economic situation.

In April of this 2022, the conjuncture ICC decreased 3.9 points. This fall, explains the Ministry of Economy, responded mainly to the deterioration of the current consumption intention of households, who were less willing to make purchases under the current economic condition.

The inflation accumulated in the first semester of 2022 was 4.96%, and the inflation interannual, measured from June 2021 to June 2022, of 9.48%, reports the central bank.

Contradiction

Although the confidence index has fallen, this contrasts with the behavior of the first four months of the year for private consumption, since the Ministry of Economy reports greater dynamism than in the previous period.

It indicates that the nominal sales of the main commercial chains and department stores in the country increased by 19.3% year-on-year in January-April 2022. Consumer loans also increased by 18.2% year-on-year in May.

Price Impact

The behavior of prices is another factor that has undermined confidence in the economic situation, highlights the economic report.

“The consumers were pessimistic about the current price situation –although with a relative improvement from the previous measurement-, in which the inflation it has experienced an accelerated growth rate, reaching 9.6% year-on-year in April,” it adds.

The Ministry of Economy recalls that the increase in prices responds mainly to factors of external origin, such as disruptions to the supply chain, the war between Ukraine and Russia, and the sanctions imposed on the Russians. Also, the lasting effects of the pandemic, which have caused an increase in raw materials.

The consumersGiven this reality, they are more pessimistic about the evolution of prices in the coming months. “These expectations -says the report- are aligned with the vision of the economic analysts consulted each month by the BCRD (central bank of the Dominican Republic), who expect higher price increases in the next 12 months”.

For the next 12 months, “Dominican households expect employment opportunities – new and of higher quality – to improve from little to a lot, although with less optimism than the previous measurement. While they expect savings to exceed current levels, showing improvements compared to previous months”, he concludes.