In this context, he reviewed what are the “bottlenecks” that investors encounter when they come to the country. In order to determine it exactly, Ceres previously consulted professionals who are in permanent contact with investors about the most repeated problems. And then he carried out a mapping of the entire state to identify the “investment lock-in offices”according to Munyo.

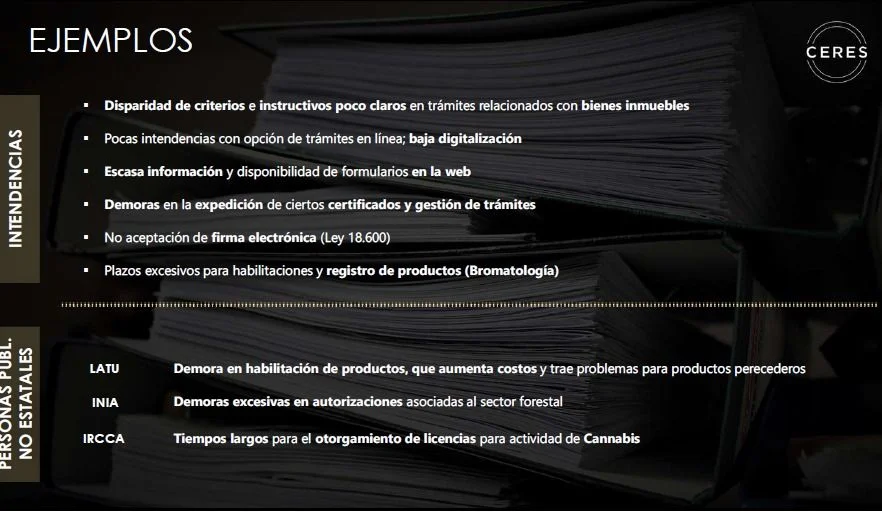

This work found “bottlenecks” in departments such as the General Tax Directorate (DGI), the Central Bank (BCU), the National Directorate of Migration, the MSP Relevance Board, the Social Security Bank (BPS) and the University of the Republic (Udelar). ), among others. Problems were also reported in the municipalities, and in non-state public entities such as the Technological Laboratory of Uruguay (LATU), the National Institute for Agricultural Research (Inia) and the Institute for the Regulation and Control of Cannabis (Ircca).

The interviewees stated that they face daily problems such as: excess requests for requirementslittle digitization and difficulties in web procedures, excess orders in inspections, slowness and difficulty of digital processes, excessive delays in certain procedures, delays in registering products, inefficiency in the entry of files, excessive time for qualifications, repetition of procedures, and high lack of coordination between departments within the same agency and between agencies, for example.

“When you see this you realize the missed opportunities. It hurts to see that the investment could be much bigger if you didn’t have to go through those investment lock-up offices. Some have their reason for being, but you have to press the accelerator seriously. (…) Instead of opening doors, we close them”, said Munyo.

On the other hand, Ceres also made a comparison on how cumbersome it is to comply with the requirements of the public administration in Uruguay with respect to countries with similar income. The result was that regulatory complexity is higher on average in Uruguay (68 points vs. 61 points).

The comparison group is made up of countries with a GDP per capita between US$10,000 and US$20,000, comparable to that of Uruguay (US$15,045). Among them Portugal, Estonia, Bahrain, Czech Republic, Saudi Arabia, Greece, Lithuania, Latvia, Oman, Trinidad and Tobago, Poland, Hungary, Seychelles, Venezuela, Barbados, Chile, Antigua and Barbuda, Croatia, Panama, Turkey, Costa Rica , Russia, Argentina, Kazakhstan, Romania, Malaysia and China.