The CPA consultancy estimated a growth of the Uruguayan economy of almost 6% for this year but warns of a marked slowdown in the rate of expansion of activity due to an adverse international context. Meanwhile, the inflation I would give in and stay below 8% at the end of the first quarter of 2023something that would allow the dollar in Uruguay can strengthen against the Uruguayan peso.

economists Gabriel Oddonde and Alfonso Capurro of CPA Ferrere presented this Wednesday on the local and international scenario in the framework of a new meeting of the Economic Analysis and Forecast Service. The presentation was titled Uruguay 2023: recalibrating decisions to cushion the external shock.

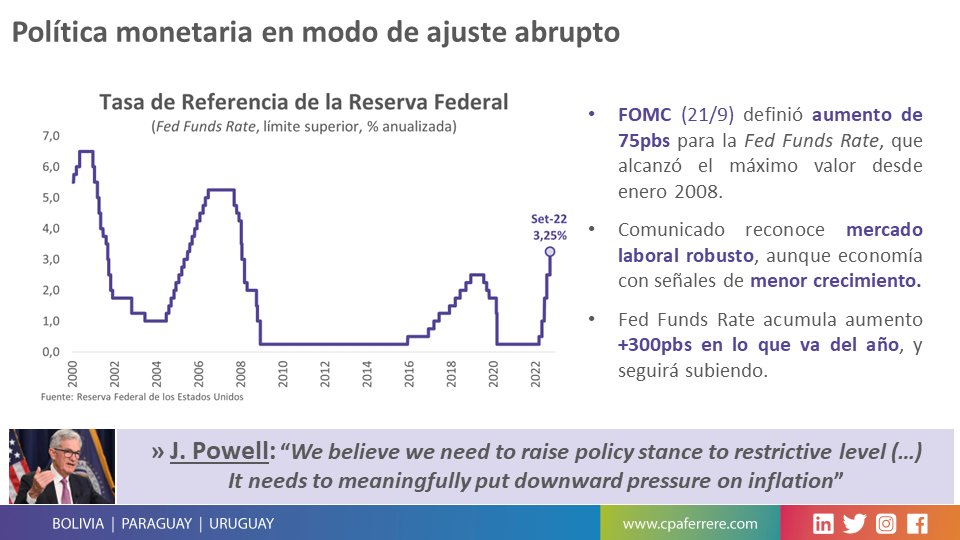

According to experts, a triple shock: the impact of the war in Europe between Ukraine and Russia, the health measures in China to contain covid-19 and the tightening of monetary policy in the US imply a slowdown in global activity.

On the other hand, they considered that the underestimation of inflation in 2021 has eroded the credibility of the Fed. In this scenario, they warned that the Fed could maintain high rates for longer than strictly necessary, generating higher costs in terms of activity.

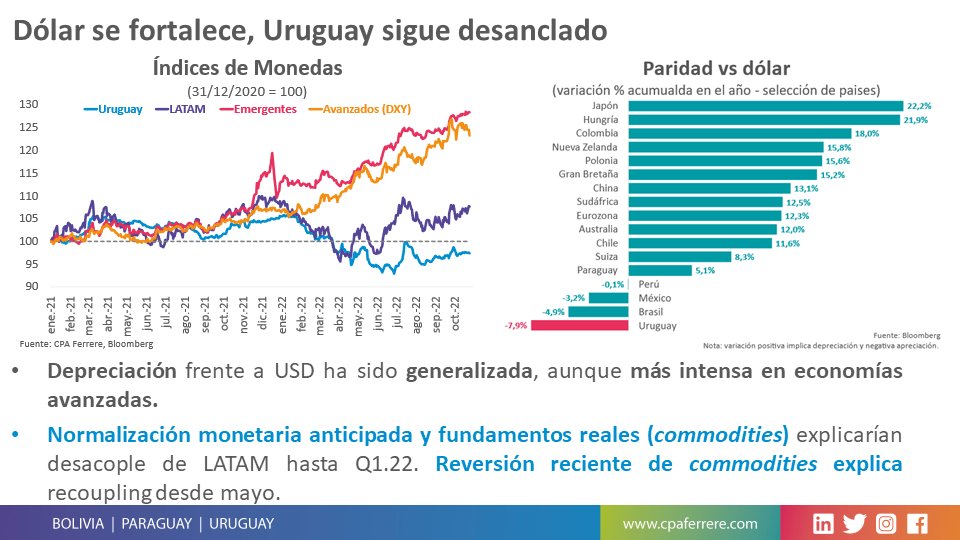

The rise of the dollar that is delayed in Uruguay

According to the presentation of Capurro and Oddone, in 2022 the strengthening cycle of the dollar was consolidated at a global level, reaching maximums of the last 20 years. However, the Uruguayan peso was decoupled from this trend and appreciated 7.9% against the US currency so far this year; in Brazil this appreciation was 4.9% and 3.2% in Mexico.

On the other hand, CPA indicated that commodities presented a general increase in prices until April. Later, they began to reverse due to the slowdown in global activity and more restrictive financial conditions.

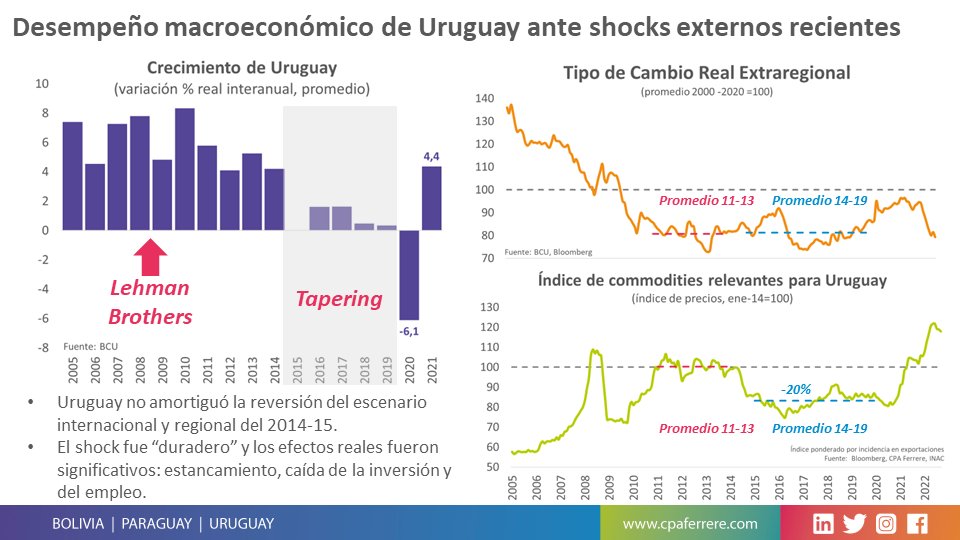

The room for maneuver

before a stage external adverseeither, Uruguay has room for action to gauge the duration and intensity of the shock, in order to later define the most appropriate response, considered the economists, who recalled that the country did not cushion the reversal of the international scenario that occurred between 2014-2015. That shock was “long lasting” and had significant effects in stagnating growth, falling investment and job losses.

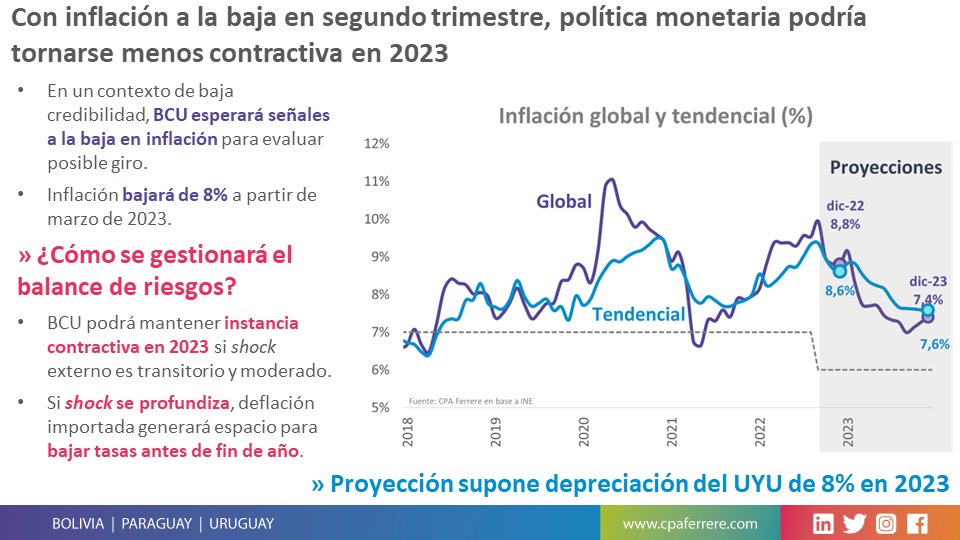

In the short term, CPA considers that inflation is a challenge and that the Central Bank of Uruguay (BCU) will maintain a contractionary bias. The consultant estimates that as of March 2023, inflation would fall (below 8%) so that monetary policy could adopt a buffer role, creating room for a moderate reversal of the real exchange rate (RER).

In this sense, he considers that from the second quarter of next year (April-June) the monetary policy could become less contractionary, although in a context of low credibility, the BCU will wait for downward signs of inflation to evaluate a possible turn in its monetary policy.

CPA understands that the BCU could maintain a contractionary instance in 2023 if the external shock is transitory and moderate. On the other hand, if the external shock deepens, imported deflation (lower prices) will create room to lower interest rates before the end of the year.

The consultant plans a depreciation of the Uruguayan peso against the dollar of 8% by 2023 In uruguay.

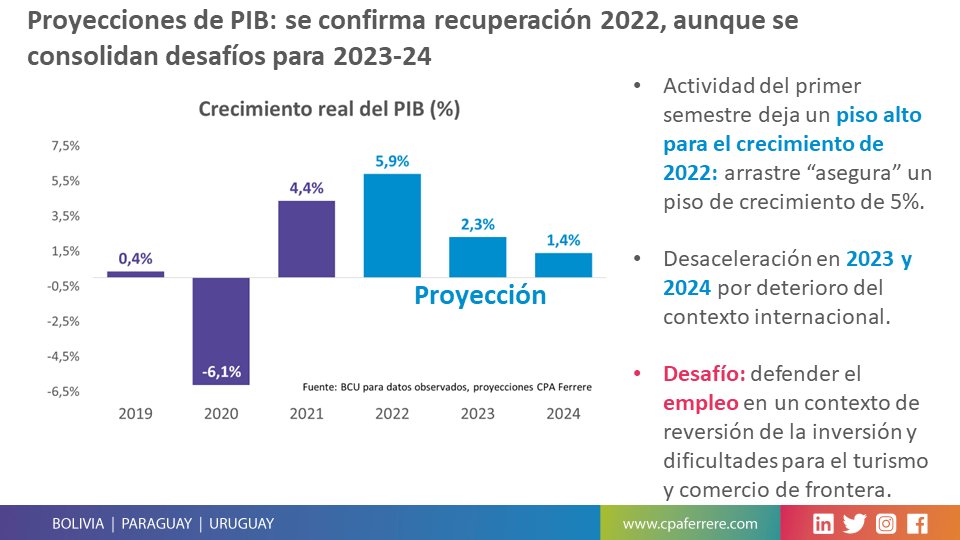

On the other hand, regarding the performance of the Uruguayan economyCPA considers that the activity will continue to grow, although at a slower pace. In this sense, it is noted that the recovery of domestic demand will be key to defending GDP growth. The consulting firm raised its GDP growth forecast for 2022 to 5.9%this is 1 point above the 4.8% projected by the economic team in the last Rendering of Accounts.

Nevertheless, CPA forecasts a sharp slowdown in Uruguay’s GDP for 2023 (+2.3%) and 2024 (+1.4%) as a result of the deterioration of the international context. In that sense, it is considered as “challenge” for economic policy to defend employment in a context of investment reversal and difficulties for tourism and border trade.

The Ministry of Economy expects the GDP to expand 3% in 2023 and 2.8% in 2024, with the creation of 30,000 and 20,000 new jobs, respectively. For this year, the official projection is that some 40,000 new jobs will be created.