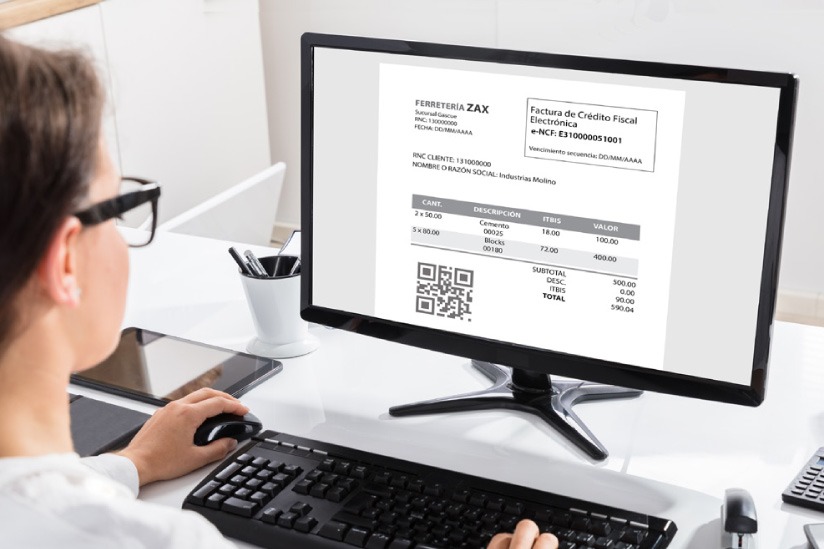

The bill of electronic billing of the Dominican Republic establishes the use of invoices in this format in a “mandatory” manner.

The piece, submitted by the Executive power and approved in the Senateis pending debate in the Chamber of Deputies, where it found comments from opposition legislators.

In its article four, the initiative states that the use of electronic invoicing “is mandatory” throughout the country as of the entry into force of the regulations. However, it clarifies that “exceptionally”, the use of the paper invoice will be allowed in some cases specified in the legislation.

Likewise, according to article six, all invoices issued must be recognized and authorized by the General Directorate of Internal Taxes (DGII).

Issuers (companies or individuals) must have a digital certificate for tax procedures, issued and digitally signed by a certification entity authorized by Indotel.

It could also be a certificate with an institutional link that identifies a subscriber during the validity period of the certificate and that constitutes proof that the subscriber is the source or originator of the content of a digital document or data message that incorporates its associated certificate.

It should be noted that when electronic invoices are digitally signed and sent to the DGII, they “cannot be modified”.

The legal specifications specify that all electronic invoices issued in the country must comply with the standard format established by the DGII, which will be validated by the sending and receiving computer systems and will only be admissible when they comply with this validation.

According to article nine, the DGII will be the competent authority for the validation and certification of the content and the certainty of the electronic invoice.

If the piece is approved, the Electronic Invoicing Fiscal System will be created, which will be mandatory and general in scope for all taxpayers and those responsible with tax obligations.

The DGII will administer the Electronic Invoicing Fiscal System.

Implementation schedule

The legislative project, in its article 37, establishes the obligatory nature of the use of electronic tax receipts through a calendar that establishes the terms, which range from one to three years, counted from the validity of the law.

In the case of large national taxpayers, they will have 12 months; large local and medium-sized taxpayers will have 24 months; meanwhile, small, micro and unclassified taxpayers will have 36 months.

The DGII will publish through a notice the list of taxpayers required by said law to issue (Electronic Tax Receipts) e-CF.

Taxpayers may, “by mutual agreement with the DGII, agree to the extension of the term” to join electronic invoicing, prior approval or rejection of the DGII.

The Executive Power will prepare the regulations for the application of this law, within a period of 60 days from the entry into force of the same.

Reasons for presenting the piece

One of the most relevant aspects of innovation in the legal systems of the region, as expressed in the piece in one of its recitals, has been to establish the mass use of electronic invoicing as a “mandatory” commercial modality.

This modality, according to the justification of the Executive Power, translates into an instrument of the third industrial revolution and documentary control, due to its capacity to generate and disseminate commercial data in real time, price and transaction transparency, low environmental impact, market regulation and tax effectiveness.

Opposition remarks

Deputies from the Dominican Liberation (PLD) and Fuerza del Pueblo (FP) parties have requested that the electronic invoicing bill be carefully reviewed and some of its aspects modified.

The legislators maintain that there is a large digital divide in the country, which, if the regulations are approved, will make it difficult for taxpayers to comply with it.

They consider that the terms of one to three years in article 37 are not enough for all taxpayers to be able to issue electronic invoices given the reality of the digital divide and “lack of electric power”.

They also denounce that there will be a monopoly, since, according to them, in the country there are only two private companies that will benefit from the certification of digital signatures for tax procedures.

The Lower House will decide the fate of the piece in next week’s session.