RONIN-PERU21 REPORT

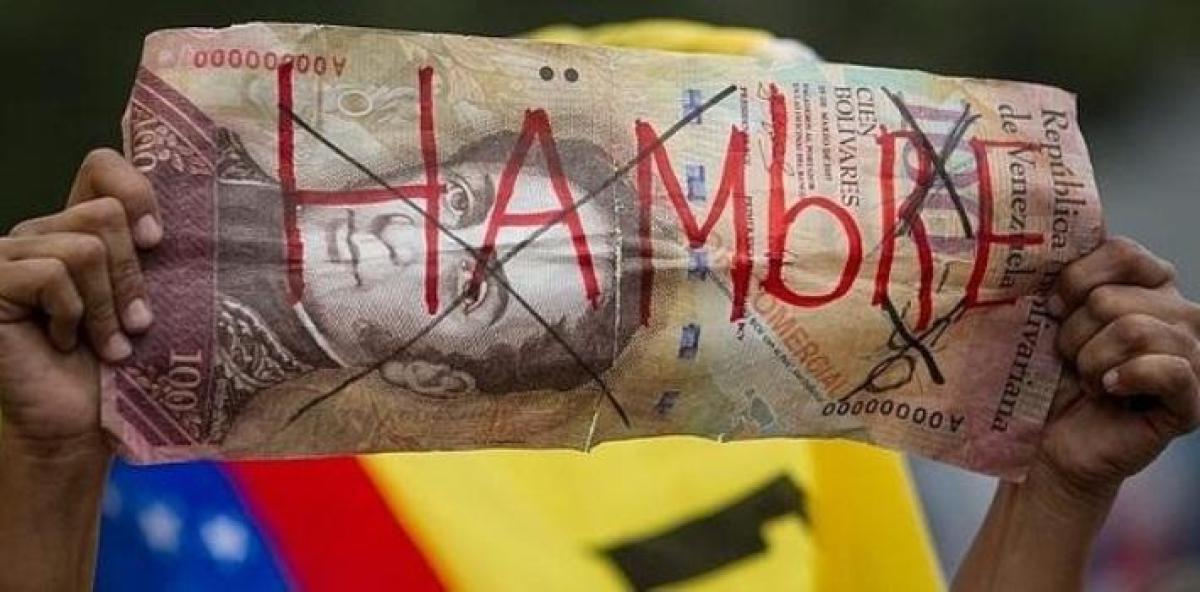

The Venezuelan crisis represents the most severe economic collapse outside of a context of war in modern history. This case demonstrates, tragically and categorically, how bad public policies can quickly destroy decades of progress and offers irrefutable lessons for the management of the Peruvian economy.

The decline of the Venezuelan economy was the result of a sequence of misguided interventions, exacerbated by dependence on oil. First, the massive imposition of price controls completely distorted market signals, eliminated incentives for domestic production, and generated acute shortages. Secondly, the nationalization or confiscation of companies, carried out without efficiency criteria, bankrupted productive capital and scared away private investment in the absence of legal guarantees.

Third, an irresponsible fiscal and monetary policy financed the deficit through inorganic issuance by a central bank without autonomy, lighting the fuse of hyperinflation. Fourth, rigid currency controls created an artificial official exchange rate, paralyzed essential imports, and commercially isolated the country. Finally, the high dependence on oil left the economy at the mercy of the volatility of international prices, and the post-2014 decline exposed the fragility of a country that lacked alternative competitive sectors to cushion the external shock.

Consequences

As a result, Venezuela’s GDP per capita went from almost US$13,000 in 2012 to around US$3,000 in 2025, a drop of more than 70% (see graph 1). Inflation was above 50% for more than ten consecutive years, reaching hyperinflationary rates (greater than 1,000%) for three years in a row (2018-2020), and exceeded 130,000% in 2018 (see graph 2). The public debt exceeded 300% of GDP and, according to the latest information available as of 2024, it is above 150% of the product. Finally, oil production fell from almost three million barrels per day in 2013 to less than one million today, a reduction of more than 70%.

Nearly eight million citizens have left Venezuela as a result of this economic disaster, of which 1.6 million reside in Peru. This migration poses challenges and opportunities for the country. On the one hand, the increase in a young workforce and, in many cases, with qualified human capital of professionals and technicians, has increased GDP, internal demand and has contained labor costs. On the other hand, it has generated costs associated with a greater demand for social services such as health and education, pressures on the informal labor market and a greater perception of insecurity linked to migration.

The Venezuelan experience reinforces key economic lessons for the Peruvian future that must be taken into account in the current context of electoral offers. The autonomy and constitutional impediments that prohibit the financing of the treasury by the Central Bank are sacred and constitute the pillar to defend the value of the currency.

Any subordination to the government of the day or the implementation of “creative” proposals that seek to add new functions to the monetary entity is the first step towards uncontrolled inflation.

Likewise, price and exchange rate controls are forms of self-sabotage that distort the efficient allocation of resources and generate scarcity and corruption. Inflation control is based on the credibility of the Central Bank to anchor long-term inflation expectations, not on administrative price control.

The pillar of private investment

For Isaac Foinquinos, chief economist at Ronin, legal certainty is the fundamental pillar of private investment, since without clear rules and respect for private property—as happened in Venezuela—the engines of growth end up stopping.

He pointed out that productive diversification is key to economic security, especially in a country like Peru, dependent on copper and gold.

In this context, he maintained that it is necessary to promote new development engines to avoid exposure to populist policies in high price cycles.

Likewise, he emphasized that fiscal discipline in times of prosperity allows us to respond better in times of crisis and reduce vulnerability to external fluctuations.

Receive your Perú21 by email or WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of the discounts here.

RECOMMENDED VIDEO