This week the Executive Branch defended the tax change made in 2020, by which the VAT discount on debit card purchases was reduced from four to two percentage points.

For the first time, the government used numbers publicly to argue in favor of that decision. On Monday, President Luis Lacalle Pou affirmed that the debit card was used mainly by the “upper middle” and “high” classes.

“Do you know how much the lowest quintile uses it? 3.81%, or 4%. If we are talking about justice, of those who have less, I can assure you that that 2% (additional discount), the one who used it was the people who had the most”, He stated in an interview with Underlined.

The president’s argument was based on a document prepared by the Tax Advisory of the Ministry of Economy and Finance (MEF), which mentions data from the latest household financial survey. That survey dates from 2017, although neither the president nor the document mentions it.

In part of the document it is stated that although the implementation of the Financial Inclusion Law “promoted the penetration” of electronic payment instruments to the entire population, “it has not achieved its generalization in the lowest income quintiles.”

“There is no updated information”

The former coordinator of the Financial Inclusion program of the Ministry of Economy and Finance (MEF), Martín Vallcorba, stated that today “there is no updated information” that “allows us to analyze how the use of electronic media is discriminated according to income level”.

“The latest data available is a 2017 survey. The figures handled by the president are not up to date, and they respond to a reality that is totally different from what we have today,” he stated in statements to TV Ciudad.

Vallcorba recalled that 2017 was when the electronic payment of salaries began to be progressively implemented. This is mandatory. This mechanism ensured that any worker or retiree could access a means of electronic payment free of charge associated with a bank account or electronic money instrument.

“So it is reasonable that few low-income people had access to an electronic means of payment at that time (by 2017),” he said.

plus debit

The economist explained that the updated information that is available today is regarding the number of cards and how much they are used, but not on uses by income level. These are the data published by the Central Bank (BCU) in the Retail Payment System report twice a year.

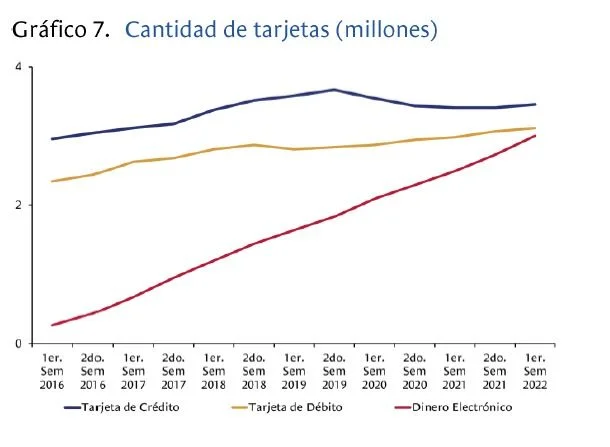

As an example, Vallcorba pointed out that between 2017 and the second half of 2022, “more than 3 million” electronic money instruments (meal tickets or prepaid cards) were issued. Meanwhile, the number of operations with debit was multiplied by four.

“There has been a very intensive use and one would reasonably expect that this increased use that we have today compared to 2017 has covered all segments of the population,” he said.

The figures published by the Central Bank (BCU) show that the number of operations with debit cards was just over 4 million at the beginning of 2014. In the first half of 2017 they climbed to 44.9 million operations, and 151, 4 million in the second half of 2022. In electronic money instruments there were 8.3 million operations in the first half of 2017, and 34.4 million in the first half of 2022.

Source: BCU

Source: BCU

What does the law say?

The Financial Inclusion Law approved in 2014 contemplates the permanent discount of two VAT points for sales that are charged with debit cards or electronic money instruments that work in a similar way to cash payment (food tickets or prepaid cards). The other two additional points are a power of the Executive Power that can be changed by decree.