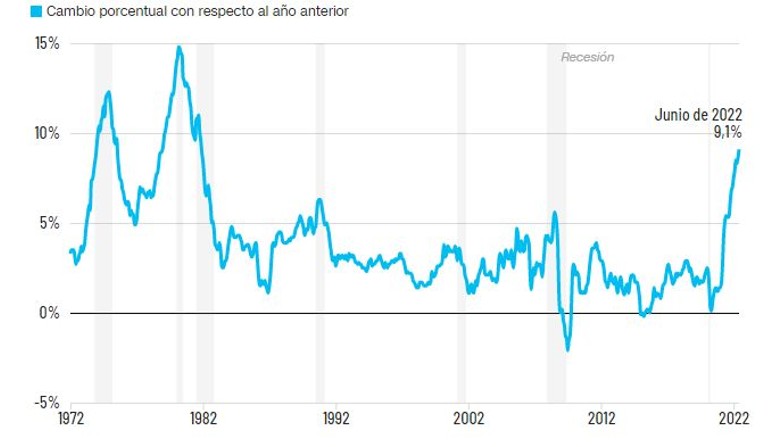

Washington. The inflation In the United States, it continues to rise and in June it stood at 9.1%, a rate not seen since 1981 and pushed, as has become usual in recent months, by the rise in energy and food prices.

In one month, consumer prices rose 1.3%, according to data released by the Bureau of Labor Statistics (BLS).

Figures that confirm that consumer prices in the United States do not yet show the effects of the restrictive monetary policy of the Federal Reserve (Fed) from the US, which has been raising rates since last March and intends to continue doing so until inflation is contained.

The rise in energy prices, and above all in gasolineas well as food was, once again, what most influenced this new rise in inflation in June.

Thus, the increase in energy prices was 7.5% in one month and contributed to almost half of the monthly increase, and in the specific case of gasoline, it rose 11.2% in the last month. The rise in food was 1%.

In the last twelve months, prices of energy have risen 41.6%, the highest since April 1980.

As for food, its prices have grown by 10.4% in one year, the highest rise since February 1981.

The year-on-year rate of core inflation, which measures the rise in prices excluding energy and food, was 5.9%.

The Federal Reserve has raised interest rates in its last three meetings, and has also done so progressively -0.25 points in March, 0.50 points in May and 0.75 points in June.

The Fed has already warned that its intention is to approve a new increase after its meeting of politics currency of this month, which will be held on the 26th and 27th.

The priority for Federal Reserve is to contain prices, and this body has already made it clear on several occasions that it will continue to act to meet that objective, even though its restrictive monetary policy may have negative consequences on economic developments.

High inflation and, above all, the rise in gasoline prices, is one of the main concerns of American citizens and one of the reasons for the low popularity ratings of the US president, Joe Biden.

Read more: Can a second stage of supply-side inflation occur?

Yesterday, the White House anticipated the publication of this indicator and in a call with journalists, a US government official stressed that the rate that was going to be published today, corresponding to last month, does not reflect the drops that are already being registered in the fuel prices.

He pointed out that fuel prices have been falling since June 14.

Specifically, he said that price half a gallon of gasoline (3.7 liters) in June was 4.92 dollars, but at this time it is already at 4.66 and added that the futures markets point to a drop to 3.30 dollars.

In the telephone meeting with the press, another Biden administration official spoke of fears of a recession and although she acknowledged that the technical definition is two quarters of drop of GDP stressed that there are other indicators that must be taken into account and that demonstrate the robustness of the US economy.

He thus cited the good behavior of the labor market or the strong savings of households among other indicators that show, he said, that the country’s economy is better prepared than others to face the global challenges that come in the coming months.

The International Monetary Fund (IMF) yesterday published its conclusions on article IV for the United States and again lowered its economic forecasts for the country.

The Fund calculates that the GDP will grow by 2.3% this year and 1% next year, 6 and 7 tenths below, respectively, the estimates that it pointed out just 15 days ago when the director of the institution, Kristalina Georgieva, presented the Article IV papers on this country.