Market closure.

With values on the rise and a supply of groomed cattle that will remain limited in the near term, the livestock market recovered dynamism after Easter.

There are 12 weeks of rise for fat cattle. A good part of the business for steers is between US$4.20 and US$4.30 per kilo, with some top lots that cross that range.

Free-range cattle businesses destined for refrigerators have a wide range of values depending on the type of agreement. Sales have been made for US$ 4.50 per kilo.

There is a clear preference for cows in the market. Peak prices go as high as $4.10 and in very heavy cases you get a few cents more.

work in low

Several plants are not operating and last week the slaughter was 28,224 cattle. So far this year, the volume slaughtered is 20% below the same period in 2022.

“The reduction in activity has not been able to compensate for the low availability of supply that exists, and that makes the market not only maintain firmness, but also achieve a few cents more this week,” said Gustavo Basso, director of Gustavo Basso Negocios Rurales.

Going forward “there is almost no chance that a lot of supply will appear, the restriction continues,” said the operator.

From his point of view, when cattle begin to come out of the pens in the next 481 quota window, the industry could have a better supply of well-finished cattle. “I think that demand is going to try to restrict activity as much as possible to try to contain a rise, which according to the imbalance between supply and demand seems inevitable,” he said.

The rise in the values of the fat man does not correspond to an improvement in foreign markets, commented an industrialist consulted. China is weaker in price and demand. For now, the export price consolidates an improvement in 30 days, with an average of US$ 4,476 per tonaccording to the latest provisional data from the National Meat Institute (INAC).

Market closure.

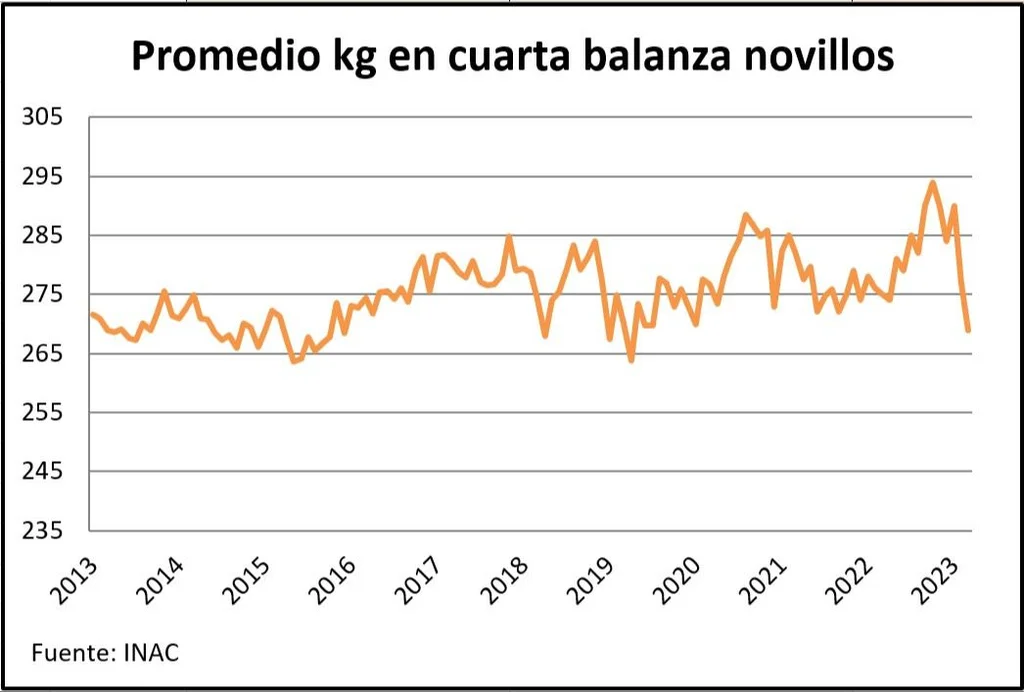

There is an interesting drive for fodder, but the water deficit is not behind us yet. Aguadas in a large part of the country are still unable to recover. The impact of the drought has been felt in the weight of cattle sent to the plant. The steer in the fourth scale showed its lowest weight in five years, 269 kilos, according to the latest data from INAC. And the standing value in the last two months had the steepest drop in at least the last ten years.

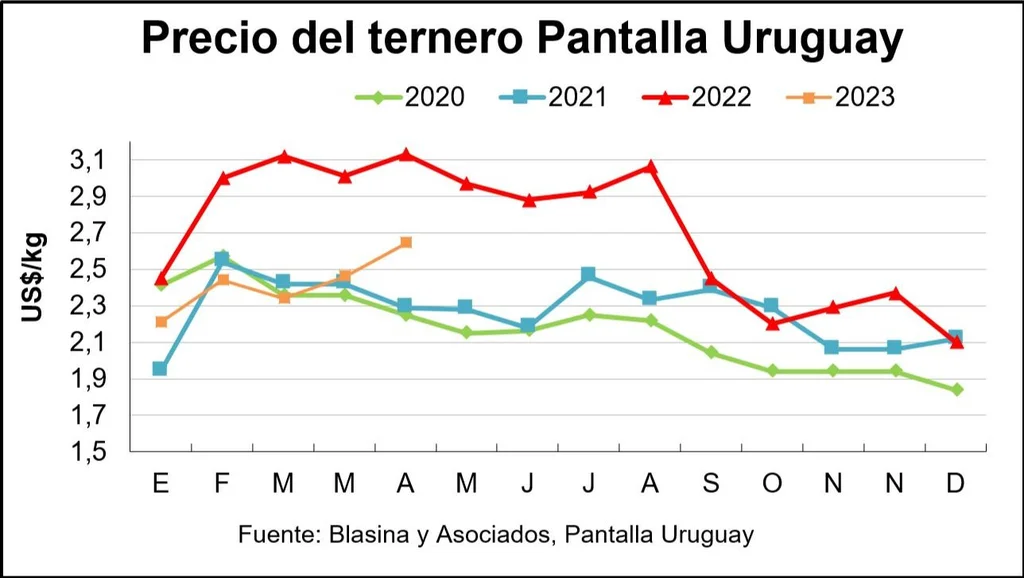

In the replacement market there is good demand, but selective. In the Select auction of Pantalla Uruguay this week, 100% of the offer was sold with an increase of 7% in the average of calves to US$ 2.64. In Plaza Rural, the placement was also total for calves, with an average of US$ 2.58, 2.6% above the previous auction.

Market closure.

In wool, the market continues with a good level of activity, with firm prices and agile placement for all categories. Heavy lambs average US$3.40, capons US$3.12 and ewes US$3.03.

Unlike bovine slaughter, with almost 150,000 heads less than the previous year, sheep slaughter has grown 31% so far in 2023 compared to a year ago, totaling 460,983 animals.

Despite the recovery of the volume slaughtered and also exported, the values paid by foreign markets are still widely lower than last year. In the last 30 moving days, the average per ton exported was US$4,052 and in the annual accumulated US$3,898, 24% below the US$5,127 achieved in the same period of 2022.

Reduced soybean production in South America.

The panorama in grains

In Argentina, the expectation of soybean production was adjusted again from 27 to 23 million tons, according to the Rosario Stock Exchange. In Uruguay, the first threshed fields show low yields (1,000 kilos per hectare or less) and it is estimated that between 60% and 70% of the soybean area was lost as well as 90% of the corn area.

Market closure.

In the soybean market, Chicago futures adjusted downward on Friday, closing the week with a slight increase from US$548 to US$551 in the May position and from US$537 to US$539 for July. .

The prospects for the Brazilian harvest continue to rise and the large volume placed on the market pushes prices down and concentrates demand from China, in a week in which Brazilian President Luiz Inacio Lula Da Silva completed his postponed trip to Beijing.

Adding to the downward pressure is the fact that China’s Ministry of Agriculture has proposed reducing the use of soybean meal in animal feed rations from 14.5% to less than 13% in three years. In turn, weather conditions for planting in key regions of the United States have improved in recent days.

The expectation for soybean sales in Argentina with the stimulus program that improves the exchange rate also has a downward effect.

Corn closed higher than US$5 on Friday and registered its fourth straight week of gains, supported by Chinese purchases in the United States. The ton of corn for the May position closed at US$262 in Chicago compared to US$253 last week and US$250 for May, with a weekly increase of US$6 per ton.

Market closure.

Tensions in the Black Sea area contribute to generating upward pressure, as a result of uncertainty over the supply of grain from Ukraine.

The strengthening of the real also influences, which reduces the competitiveness of Brazilian exports, as well as the increase in the price of oil that provides support to the raw materials used for biofuels.

Wheat returned to the upward path and managed to close a week with a positive balance, after the adjustment of the previous day. It traded at US$250.78 for May and US$254.45 for the July position, with adjustments of 1% and 0.65% respectively.

In the wheat market, concern is growing about the situation in the North Sea ports, with Moscow’s firm position to end the current agreement on May 18 if the conditions for access to financial markets and the reopening of energy and fertilizer exports.

The weather conditions continue to be worrying for Kansas wheat, the main producing state in the United States, due to the intense drought that affects 80% of the crops, while the prospects for spring wheat and for crops in the Union improved Europe and in Russia.