This year there is a triple combo for soy: high prices in Chicago, positive premiums and prospects of good yields in the farms. This is quite an unusual combination.. Yes OK soybeans did not explode like wheat or corn due to the conflict between Russia and Ukraine, the price of oilseeds is at its highest levels since 2012.

The market has already discounted lower production in South America, especially in the cases of Brazil and Paraguay.

In the case of Argentina, the latest rains stabilized the expected soybean production, which would be around 40 million tons.

On the demand side, China is buying US soybeans and has encouraged prices.

In Uruguay this week premiums were handled in collection US$ 20 above the Chicago reference.

Also the oil is still very firm. Rapeseed futures remain above $700 a tonne.

The values for canola 2022 are very high, although there are no local plans at the moment.

OE

The wheat, the star

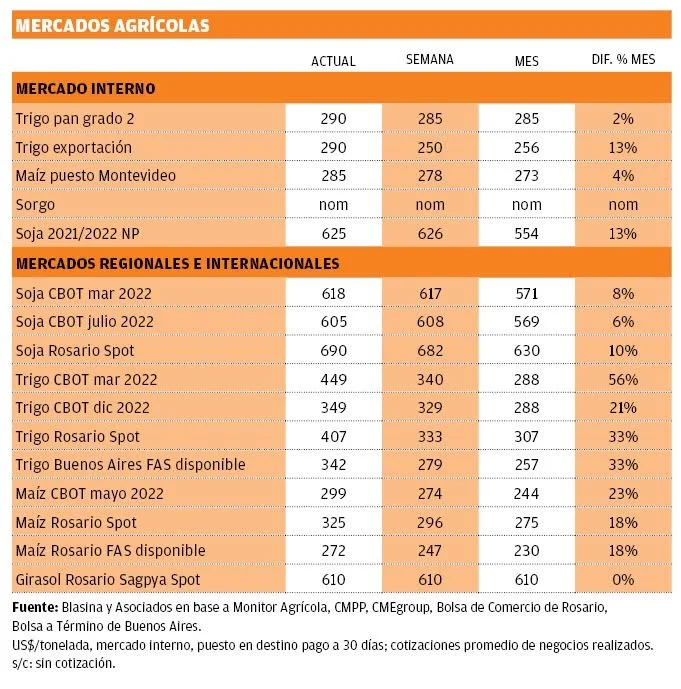

Wheat has been the star of the market. At the close of the week the May wheat contract in Chicago light crossed US$ 400 per ton.

After this price rally, the local references jumped and there is movement in the market after almost two months with practically no operations.

The US$ 320 per ton in the local market placed in port “is a reference that is today without a problem and probably more towards US$ 330 per ton”Said Fernando Villamil, from Hajnal y Cía, on Tiempo de Cambio on Radio Rural.

This will allow exporters to extract as much as possible from the cereal prior to the soybean harvest.

The corn is also firm, with a dragging effect of the wheat. And with Ukraine being a very important supplier of corn to China. There have been marked increases in prices in Argentina.

In the local market it is difficult to find a value for corn, with producers waiting to see what ranges the corn imported from the neighboring country will find.

OE

The report of Uruguay XXI

This week Uruguay XXI, in its analysis of exports of goods, alluded to what happened with grains:

- Wheat exports stood at US$ 54 million in February, for which they increased 158% in the year-on-year comparison. The rise is due to both better prices and higher volumes exported. In the first two months of the year, wheat sales totaled US$90 million, which marks an increase of 64% compared to the same period in 2021. The placements went mostly to Algeria, but also to Chile and Brazil.

- Rice also had a positive impact on the month’s variation. Rice exports tripled compared to the February 2021 record, standing at US$ 46 million. Still, the record for that month had been particularly low. At the destination level, the increase was due to higher sales to Mexico, which totaled US$23 million in February. Sales to Brazil, Costa Rica and Belgium also grew. Meanwhile, in the January-February period, rice exports accumulated US$61 million, growing 41% in the year-on-year comparison.

- Barley exports also showed a strong increase, reaching 170% in February, totaling US$ 28 million.. Thus, barley had a significant impact on the monthly variation, ranking 11th in the ranking by product. Sales went to China and to a lesser extent to Iraq. In the accumulated of January-February 2022, these exports were located at US$ 53 million, a figure significantly higher than that of the same period of 2021.

In February 2022, export requests including free zones totaled US$ 1,020 million, indicating a growth of 51% in year-on-year terms. Bovine meat was once again the product with the highest incidence in the month’s increase. Exports of dairy products, rice, wheat, cellulose, vehicles, barley and wood also explain the increase. In the accumulated of the first two months of 2022, exports were for US$ 1,862 million. This figure implies an increase of 44% in the interannual comparison. The main boost in sales is given by bovine meat, while dairy products, beverage concentrate and vehicles also show significant increases.