Likewise, the same article 18 of the US Code section 2339B establishes important obligations for the “financial institutions“, such as the obligation to freeze and report all funds that are detected to be owned or associated with these organizations. Although it is not entirely clear that banks and other Mexican financial institutions are considered “financial institutions” In terms of North American laws, the fact that the majority of Mexican financial institutions have correspondent accounts with US banks for international or dollar transactions, subjects them to reinforced regulation in terms of the Bank Secrecy Act and the US Patriot Act.

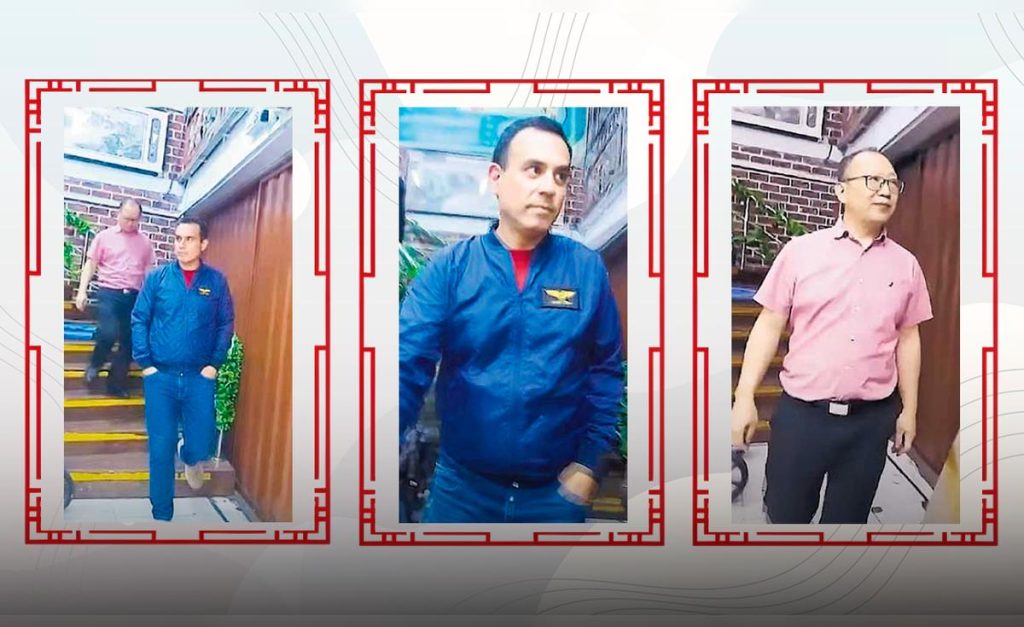

Therefore, the recent arrests and indictments -which have been issued against various Mexican individuals involving accusations of material support for terrorist organizations-, can have impacts on various sectors, whether individuals or companies, that may have economic connections, as well as a strong relevance for the financial sector.

It is important to highlight that the actions undertaken by FinCEN during 2025 through which North American banks were ordered to suppress co-responsible accounts with the Mexican financial institutions Ci Banco, Intercam and Vector – through a similar process against 10 casinos located in the north of the country -, as well as the inclusion of 27 subjects on the OFAC lists, indicate that the strategy against the cartels goes far beyond the arrest and prosecution of the ringleaders; The legal arsenal is also focused on transversal actions that involve the financial sector.