The obligation for applicants to go to a notary’s office to certify documents was eliminated.

The Bank of the Ecuadorian Social Security Institute (Biess) announced that the process, from the application to the granting of a mortgage loan, will be shorter. Specifically, it will go from 160 days to 90 days.

According to the institution, the first step to reach this result was the tables and workshops held with members, retirees, builders, real estate developers and other actors.

One of the main requests within those meetings was materialized with a provision issued by the State Attorney General’s Office during this Friday, March 18, 2022. This provision is related to the non-compulsory drawing of notaries for mortgage loan processes.

“The draw provided for by the Notary Law it is not mandatory for contracts that correspond to the specific line of business of financial institutions in the public sector, as is the case of mutual and mortgage contracts”, points out the statement of the attorney Íñigo Salvador Crespo, through official letter No.

18108.

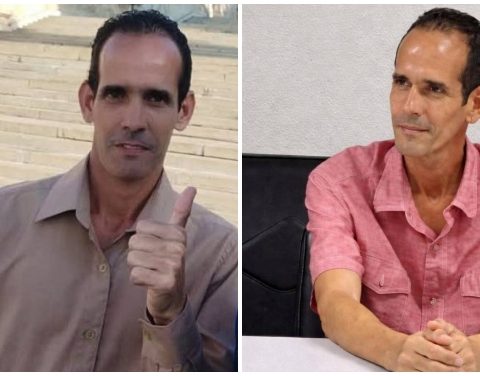

Iván Tobar, General Manager of Biess, stressed that this change will prevent credit applicants from having to go to notaries that were distant from their

places of residence or work.

This procedure implied problems of time and access, and even extra expenses for mobilization issues.

“In this way, the Biess projects greater agility in the granting of loans

mortgages to reduce the placement times of this credit product, and

fulfill the dream of having their own home of more Ecuadorian families, “says the statement from the IESS bank.

For 2022, the delivery of $752.4 million in loans has been scheduled

mortgages, with an interest rate of 5.99% and a term of up to 25 years.

These loans can only be requested by active members of the IESS (under dependency and volunteers); in addition to members up to 77 years of age. All the requirements and necessary paperwork can be reviewed at this link.

Apart from the IESS credits, the other cheaper option for buying a house is the 4.99% subsidized financing through the Ministry of Housing.