He Dominican state will operate in 2026 with a higher deficit at 280 billion pesos. But, despite the need for resources, three tax figures: that of transfers of industrialized goods and services (Itbis), the patrimony and the income tax (ISR) will concentrate the greatest burden of the tax expenditurewith a participation of 88.3% of the total.

The Government estimated that it will stop receiving next year 393,541.5 million of pesos for exemptionsdeductions, credits and other preferential tax treatments, of which amount, the Itbisthe ISR and equity represent 347,525.6 million pesos, as stated in the draft General State Budget for 2026.

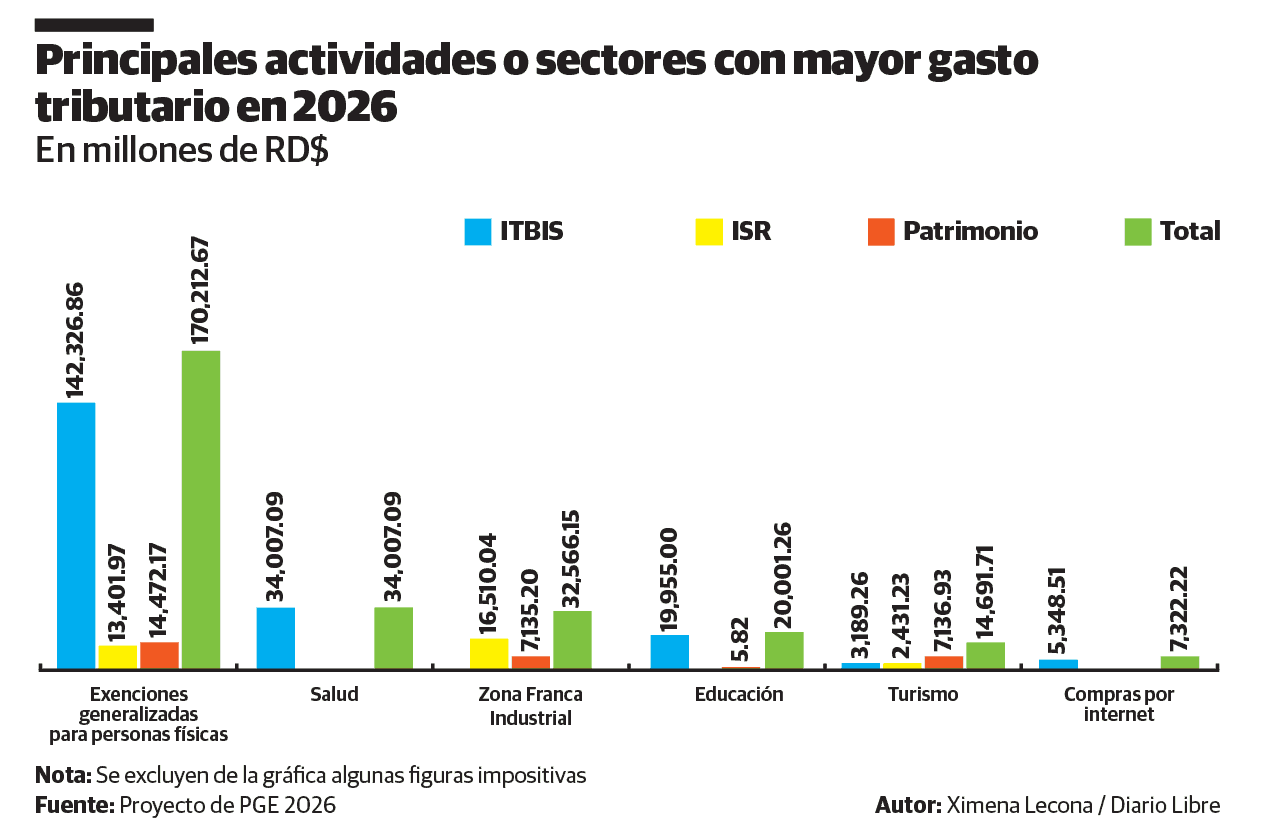

Among seven tax figures, the Itbis is the one that largest tax sacrifice represents, with 216,843.2 million pesos, equivalent to 55.1% of the total. Within this tribute, the exemptions to natural personshealth and education represent the largest amount, totaling 196,288.8 million pesos.

A series of goods are exempt from payment of Itbisamong which are milk and other dairy products, fresh, refrigerated and frozen meats; fuel, natural and mineral water, books, fertilizers, flour and sausages and services such as health, funeral homes, beauty and hairdressing salons, finance, electricity, water and garbage collection, among others.

As for the tax expenditure Due to the wealth tax, the Government projected that due to this tax they will stop entering the public coffers 73,520 million of pesos, representing 18.6% of the total.

Of the aforementioned tax, the natural persons (exemption for homeowners over 65 years of age and the exemption of properties in rural areas) will benefit the most, with a projection of 14,472.1 million pesos, followed by tourism (7,136.9 million) and free zones (7,135.2 million).

Furthermore, the trusts will represent a sacrifice in the estate tax for 4,977 million of pesos, adding between the four of them 45.9% of the total tax expenditure for that tax.

Meanwhile, for the income tax, the tax authorities estimate that they will stop receiving 57,162.3 million pesos, an amount equivalent to 14.5% of the total.

The exemptions by ISR would benefit to a greater extent the free zonesprojecting 16,510 million pesos for this concept, and at natural persons (deduction of educational expenses, exemption on Christmas salary and on interest received in the stock market), for 13,401.9 million pesos, totaling between them 29,911.9 million.

Other taxes and deficit

The remaining four liens: tariffthe selective consumption tax (ISC) on hydrocarbons, other ISC and the use of goods and licenses, will represent a tax sacrifice for the Government of 46,015.7 million of pesos.

In general terms, the State will stop receiving 2026 an amount equivalent to 4.5% of the gross domestic product (GDP).

The Government planned a fiscal deficit of 280,575.3 million of pesos for the 2026which represents 3.2% of the GDPproduct of estimated income of 1 billion 342,258.2 million pesos and expenses of 1 billion 622,833.4 million pesos, according to the budget project.