Despite digitalization and the increasingly common techno-financial solutions, education around personal finance continues to be a challenge for Latin America that is reflected not only in access to formal services but also in the vulnerability of people to contingencies.

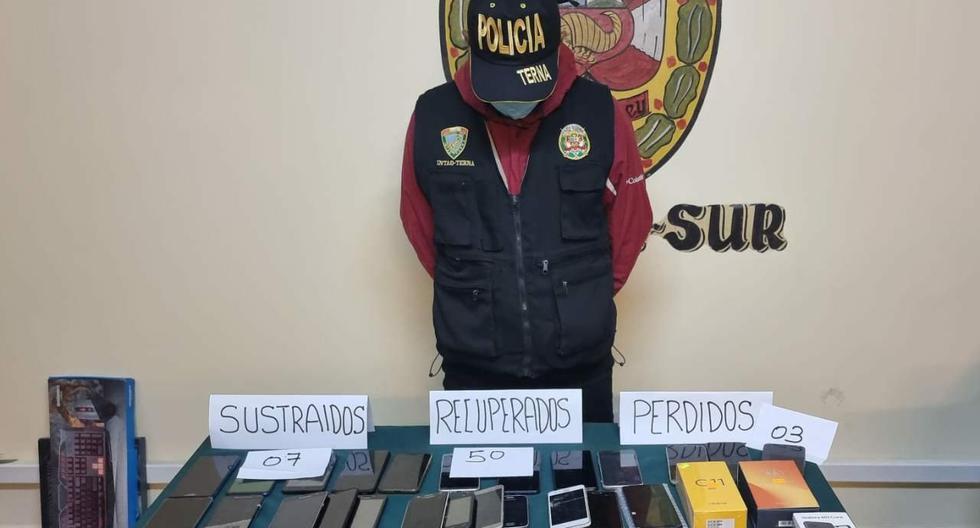

Proof of this reality is that 61% of the people surveyed by the Development Bank of Latin America-CAF in Brazil, Colombia, Peru and Ecuador do not save and those who do do so through informal alternatives.

This situation is aggravated by people’s poor financial decisions, which make them even more vulnerable to unexpected events such as dismissal, illness or any other eventuality for which they are not prepared. Regarding this, Bloomberg Line compiled a list of debts that no one should assume to take care of their finances, according to experts in the field.

Consulted by Bloomberg Line, the founder of the financial education platform My Own Finances, Juan Pablo Zuluaga, said that one of the most common debts and that no one should assume are those related to vacations, since they are generally free investment credits to high rates.

They are commitments that “make people have a good time for a week and suffer the rest of the year paying that debt. It is better to do good financial planning ahead of time, and go on vacation with savings, bonds, or extraordinary income that arrive during the year”.

Although they are an alternative that is increasingly popular and desired by people, the specialist believes that no one should go into debt to buy cryptocurrencies since they are very volatile investments. In this case, “debt is a double-edged sword in this type of investment. The return can be huge, but at the same time the drop will be 10 times stronger when you have debt. If you are not an expert, I do not recommend getting into debt when investing in stocks and even less in cryptocurrencies, ”he says.

Zuluaga says that a third debt that should be avoided are those loans that people assume knowing deep down that they will hardly be able to fulfill them and that they will affect their finances.

Circulating money, investing and maximizing capital will always be important to fulfill long-term financial projects, but it should always be done with planning and more so when it comes to commitments such as a loan to purchase a home or a car.