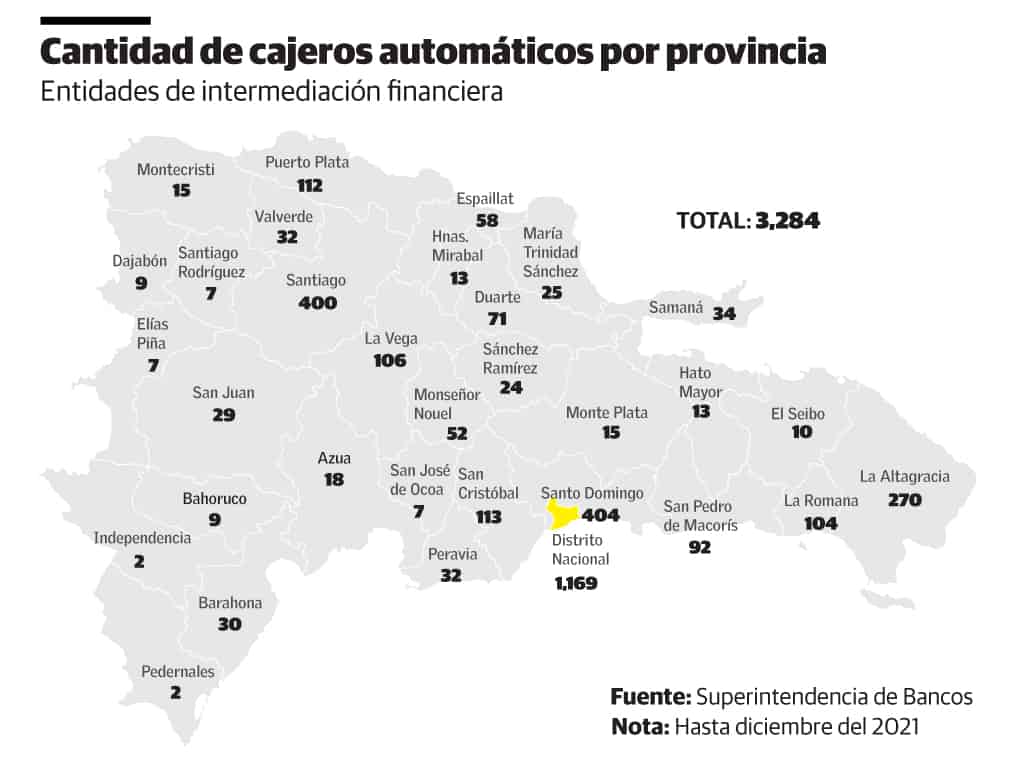

If you travel to the southern region of the Dominican Republic, keep in mind that this is the least ATMs available to clients of the national financial system: barely 7.58% of the total reported by the Superintendency of Banks.

The last statistical cut of the Superintendency indicates that, as of December of last year, there were two ATMs in the province flints and the same amount in Independencia, the two destinations in the country with the fewest of these cash dispensers and other transactions.

In addition to flints and Independencia, the southern region of the Dominican Republic is made up of the provinces of Azua, Bahoruco, Barahona, Elías Piña, Peravia, San Cristóbal, San José de Ocoa and San Juan. The National Statistics Office projects that by 2022, 1,793,085 people reside in the region, 17% of the total estimated population of the country.

Between Elías Piña (63,196 inhabitants), Independencia (59,472) and flints (35,557), the second is the most dynamic economically because it houses a formal border crossing in Jimaní. The other two are from the poorest provinces in the country.

The Government has an ambitious tourism development plan in Cabo Rojo, flintswhich could well revolutionize the economy of that territory.

Meanwhile, a person who requests access to credit in a border province for productive activities will have to pay an interest rate above the average, in financial intermediation entities due to the level of risk of the clients and the operational cost.

The Ministry of Economy highlights it in its report from last March “Monitor of the border”. The Association of Banks of the Dominican Republic attributes it to the fact that, in general, the provinces in the border area are characterized by the development of production activities such as agriculture, livestock, fishing, small businesses and micro-businesses, whose level of risk is higher “due to certain financial instability of the clients due to conditions of the offer and demand of products, the climatic conditions and other factors”.

In addition, usually, “the type of financial intermediation entities that operate in these locations tend to have higher costs than in metropolitan areas, which is transmitted to the interest rates of the financing.”

The area accumulates significant lags in terms of financial inclusion, adds the Ministry. It indicates that access to financing is lower due to a low presence of the consolidated financial system per inhabitant.

The Central Bank also counts a number of ATMs of management companies ATMs, but which are not regular financial entities. As of last February, the governing institution accounted for a universe of 3,425, with 7.24% in the southern zone.