Last Thursday, the Treasury paid more than USD 4.3 billion for the maturity of Globales and Bonares public securities in dollars, which had a significant impact on the international reserves of the Central Bank of the Argentine Republic (BCRA).

This payment affected the stock of foreign currency in the coffers of the monetary authority, reducing gross reserves by USD 1,728 million on the day of payment and another USD 272 million the next day. Today’s closing reported by the Central Bank reflects a balance of USD 30,904 million in international reserves.

According to Personal Investment Portfolio (PPI), the amount transferred to the private sector from the public sector totaled about USD 3.5 billion without new debt having been issued, generating excess demand for investment instruments of that magnitude.

Liquid reserves deteriorated from USD 16,040 million to an estimated USD 12,740 million after the payment, while net reserves without subtracting Treasury deposits deepened the red: they went from -USD 3,837 million to -USD 7,137 million.

However, net reserves under the International Monetary Fund (IMF) methodology, which considers Treasury dollar deposits and Bopreal payments as 12-month liabilities, will not be altered.

For this year, Argentina faces a total of foreign currency maturities that amount to approximately USD 21.5 billion. Of this amount, USD 7,925 million correspond to payments with international organizations such as the World Bank, the Inter-American Development Bank (IDB) and the IMF, while another USD 2,530 million are allocated to the debt of the provinces, and USD 8,700 million to dollar bonds.

Financing

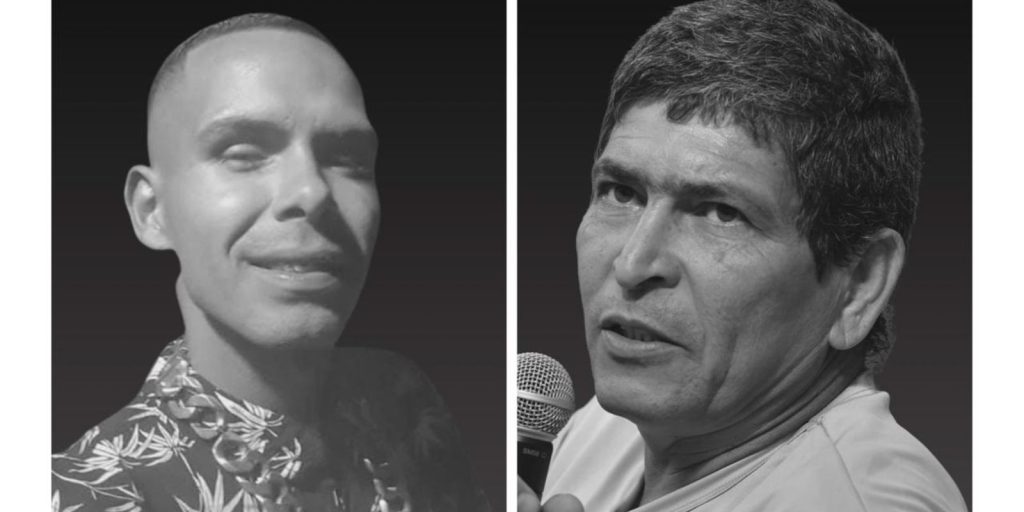

President Javier Milei has indicated that Argentina needs additional financing to eliminate exchange restrictions, estimating that between USD 11,000 and USD 12,000 million are required.. The Government seeks to obtain fresh funds to lift the exchange rate and ensure economic stability.

The Scalabrini Ortiz Center for Economic and Social Studies (CESO) proposes three scenarios depending on the arrival of fresh funds. In the optimistic scenario, the Government could reach the mid-term elections with the necessary resources to face debt maturities and sustain an economic recovery.

follow us on Google News and on our channel instagramto continue enjoying the latest news and our best content.