The Superintendent of Insurance, Josefa Castillo Rodriguez, He called on users with pending claims from insurance companies in the process of liquidation to verify their processes on the institution’s website to proceed with the payments of those pending debts, through www.superseguros.gob.do.

The official revealed that payments from insurance companies in settlement they were paralyzed for years, but that the will in their management is to pay that money that does not belong to the Superintendence of Insurance, but to the claimants, “that is money from the people, not from the institution.”

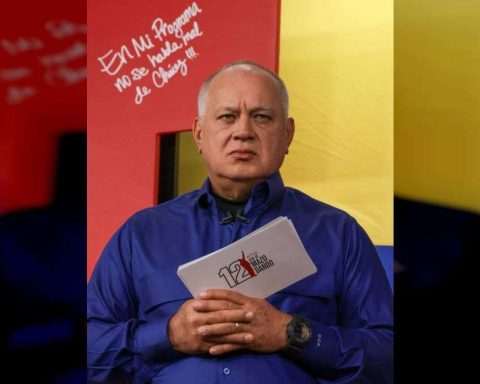

Josefa Castillo offered the information when she was interviewed on the program “Esta Mañana” on Channel 4 of CERTV, hosted by Alex Santiago and Wendy Mora.

The Superintendent of Insurance considered that the insurance sector is in good sustainability and thanks to the macroeconomic stability that the government of Luis Abinader has achieved, in full growth.

In this sense, Castillo Rodríguez highlighted that, in the first quarter of this year, the net premiums collected rose to 24 billion pesos and so far in its managementfrom August 2020 to date, net insurance premiums collected have exceeded 141 billion pesos.

Read more: Josefa Castillo delivers draft law on insurance and bonds

He highlighted the delivery of the preliminary reform project to Law 146-02 on Insurance and Bonds and congratulated the President of the Republic, Louis Abinader, having created by decree the Consultative Commission for the Reform of the aforementioned Law.

He specified that the new law must be inclusive, democratic and, above all, that it has effective protection for insurance users, as well as the regimes of consequences of violations of the regulations.

The official also highlighted the launch of the tool Indata Insurance RDa data monitoring program for the insurance sector in the Dominican Republic, which was explained by Arnulfo Rodríguez Veras, director of the insurance sector studies department, who accompanied him in the interview.

He highlighted the transformations carried out in the institution in the area of technology, with the incorporation of online services, digital exams and the creation of the User Service Center and the Insurance Training School (ESFOSIS).