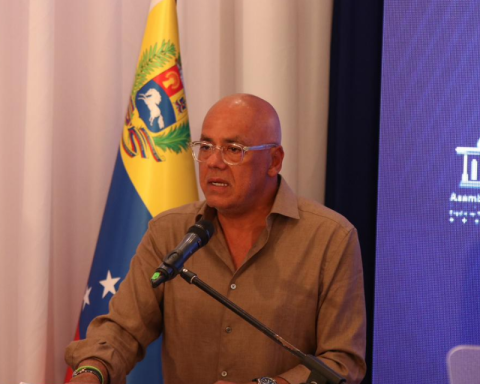

Roberto Orta Martínez, president of the Real Estate Chamber of Venezuela (CIV), pointed out that financing for the purchase of homes in the country could be reactivated if there is a reform of the Mortgage Debtor Law.

In an interview in Venevisionexplained that it is necessary to reform the norm so that it is allowed to constitute a mortgage in a currency other than the bolivar.

“That would even enhance own financing, which is when a builder offers payment in installments and facilitates real estate pre-sale,” he explained.

He indicated that the bank is beginning to grant small financing for consumption, but he believes that other alternatives could be considered, through the Stock Exchange for the construction of new projects.

Orta Martínez stated that currently young families do not even have a 30% down payment for a home.

Reform to the Leasing Law

“What we expect is a much stronger reactivation, much more complete with legal reforms, with the reactivation of bank loans and other proposals that we want to make,” he stressed.

He explained that it is also important to reform the Leasing Law, which would massify the supply of housing in rent and it would allow people to have much more access.

“We propose that the judicial procedure be simplified, with clearer rules,” he insisted.

He pointed out that the conditions of months in advance to rent a house, is produced by the legal insecurity that exists and the owner’s fear that the lease will not be fulfilled.