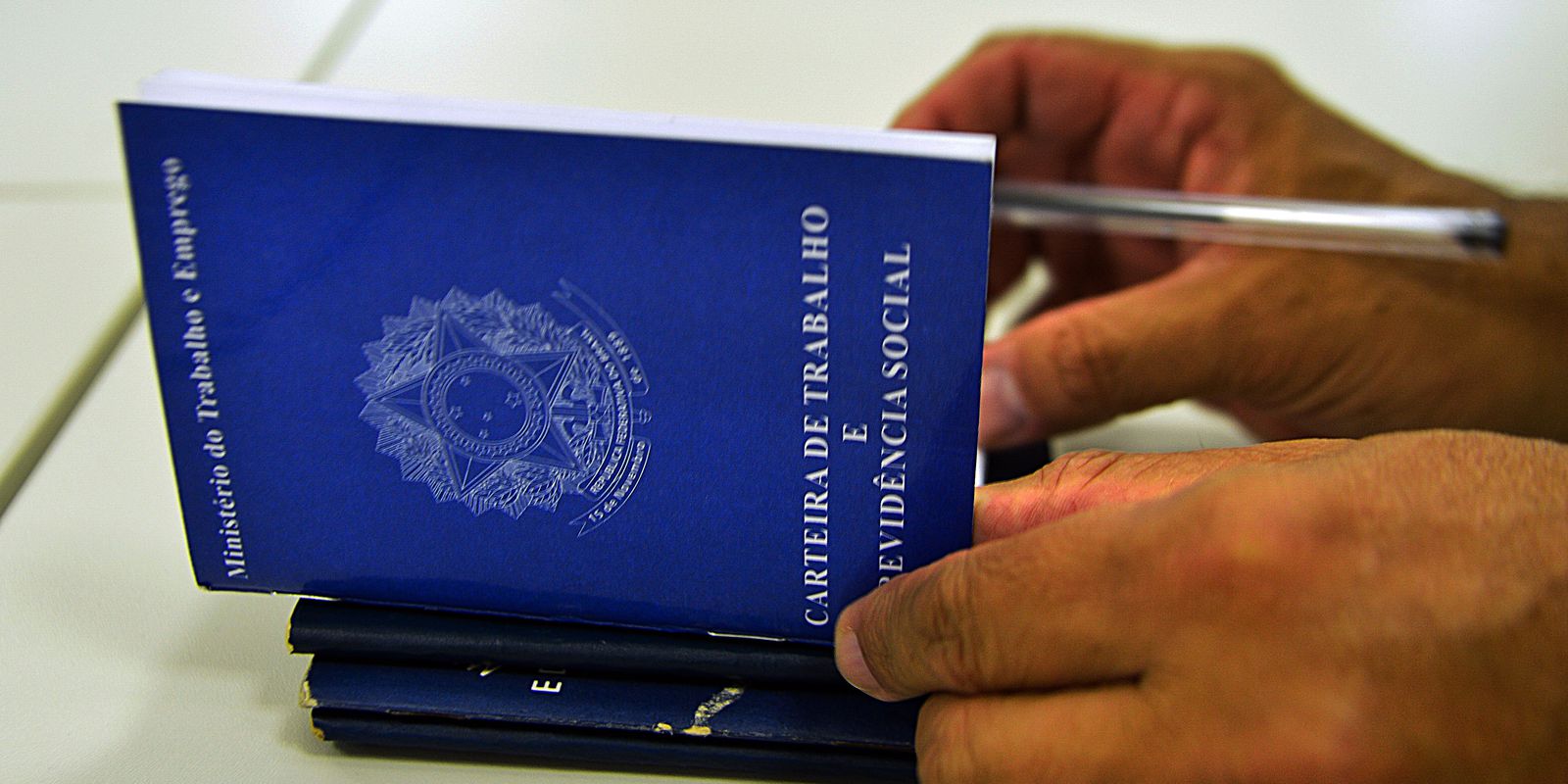

The Federal Supreme Court (STF) scheduled for next Thursday (20) the judgment that should define the rate of monetary correction of the Severance Guarantee Fund (FGTS), with potential for significant gains for workers with a formal contract. .

In the action, opened by the Solidarity party, ministers can determine that the values in the FGTS accounts should always have been corrected by inflation, and not by the Referential Rate (TR), as has been the case since the early 1990s. in the Supreme.

The judgment is of great relevance both for workers and for the Judiciary itself, which, at least in the last 10 years, has been flooded with hundreds of thousands of individual and collective actions claiming correction of the FGTS balance by some inflationary index.

Since 2019, the progress of all cases has been suspended by decision of Minister Luís Roberto Barroso, rapporteur on the matter at the Supreme Court. He made the decision after the Superior Court of Justice (STJ) decided, in 2018, after receiving thousands of appeals, to unify the understanding and maintain the TR as the FGTS correction index, in a decision unfavorable to workers.

This created the risk that the actions on the subject would be rejected en masse before the Supreme Court addressed the issue, which is why the rapporteur determined the national suspension of all processes, in any instance, until the final decision of the plenary of the STF.

This is the fourth time that the direct action of unconstitutionality (ADI) on the matter has entered the agenda of the Supreme Court’s plenary. The others were in 2019, 2020 and 2021. On all occasions, there was a rush to file individual and collective actions, hoping to benefit from a possible decision favorable to workers.

According to estimates by the Fundo de Garantia Institute, a group that is dedicated to preventing losses in the FGTS by its members, workers’ losses with the correction by the TR instead of the Index National Consumer Price Index (INPC) – one of the official inflation indices.

The institute provides a calculator in which it is possible to know what would be the difference in the FGTS balance in case of correction for inflation.

Jurisprudence favors workers

The expectation of the legal community is that the Supreme Court decides that the application of the TR to correct the FGTS balance is unconstitutional, establishing some other inflationary index as the correction rate — the INPC or the Extended Consumer Price Index (IPCA).

“The Supreme Court has already decided that the TR is unconstitutional as a monetary correction rate for labor deposits and also for judicial debts. Therefore, there are these precedents that lead to believe in a similar decision on the FGTS”, said the lawyer Franco Brugioni to Brazil Agency.

In 2020, the Supreme considered unconstitutional to apply the TR for monetary correction of labor debts. The understanding was that the way of calculating the TR, which is defined by the Central Bank, takes into account a logic of remunerative interest, not focusing on the preservation of purchasing power, which is the central objective of monetary correction.

The biggest complaint from workers with a formal contract is that the TR is usually always below inflation, which, in practice, erodes the purchasing power of the FGTS balance. Due to its calculation method, the TR was zeroed for long periods, especially between 1999 and 2013. The rate was zeroed again in 2017 and 2019. The rate was zeroed again for long periods in 2017 and 2019, due to example.

“The TR is not an index capable of mirroring inflation. Therefore, allowing its use for monetary restatement purposes is equivalent to violating the property right of the holders of linked FGTS accounts”, argues Solidariedade, the author of the action on the subject in the Supreme Court.

Who has the right?

In theory, if the Supreme Court decides to apply an inflation index, all citizens who have had a formal contract since 1999 would be entitled to review their FGTS balance, explains Brugioni. However, it is most likely that there will be some modulation to soften the immense impact on the Union’s coffers, evaluated the lawyer.

“It is possible that the Supreme Court will modulate the issue in such a way as not to allow new actions from now on. Maybe it doesn’t even include who entered now, maybe put a timeline. The opposite is also possible”, said Brugioni.

The Federal Public Defender’s Office (DPU) entered as interested in the action, due to the large volume of low-income workers seeking assistance in search of FGTS revision. The DPU even issued a public note advising interested parties to wait for the analysis by the Supreme Court before filing a lawsuit with the Judiciary.

The DPU reported that, since 2014, it has filed a public civil action on the matter in the Federal Court of Rio Grande do Sul, and that this process has already had its national scope recognized. In the event of a favorable outcome in the Supreme Court and in the JF, “an announcement must be published in order to communicate the interested parties so that they propose individual actions with the objective of executing the favorable decision”, said the Public Defender’s Office in the note.

About FGTS

The FGTS was created in 1966 as a kind of savings account for workers with a formal contract. Previously optional, joining the fund became mandatory as of the 1988 Constitution. Under current rules, all employers are obliged to deposit 8% of their employees’ salaries in the fund. This applies to urban and rural employees and, since 2015, also to domestic workers. The permanent money belonging to the employee is linked to an account, managed by Caixa Econômica Federal, and can only be withdrawn under conditions provided for by law, one of the main ones being dismissal without just cause. Today the fund serves to finance different public policies, especially the Housing Financial System.