HE this week accentuated the rise in prices in the fat farm market, with a shortage of well-finished animals for slaughter. The replacement market, for its part, shows the impact of drought and lack of pasture. Grains closed another week down, with wheat pressured by smooth sales from Russia. Huge volumes from Brazil in soybeans and corn weighed on the downside, outweighing the further cut in Argentina’s crop forecast. In wool, prices fell againin a market affected by logistical difficulties that influenced more than the stable demand for the fiber.

markets.

Farms: price jump

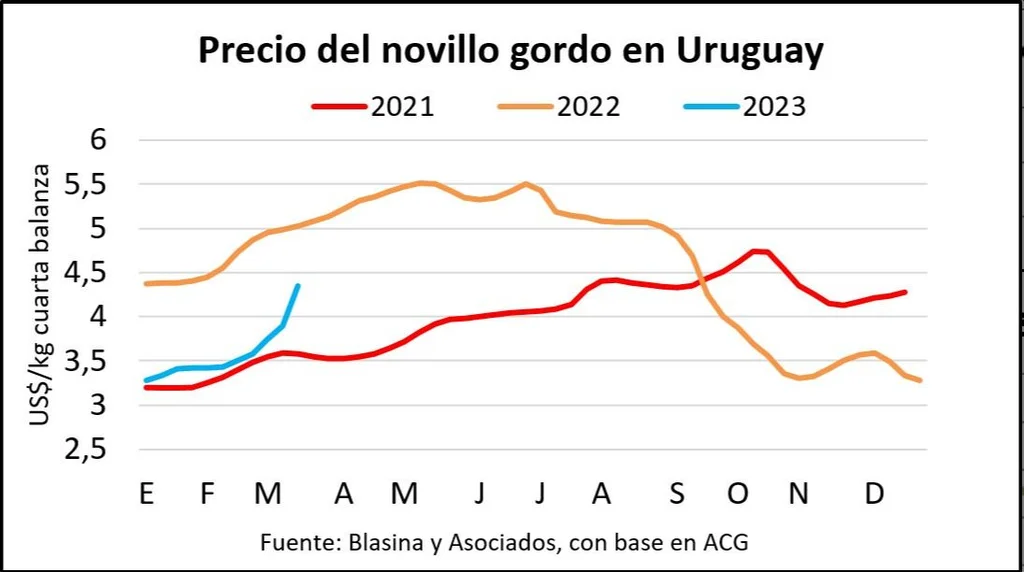

The price of fattened steer soared in Uruguay in the last week, reaching US$4.30 and US$4.35 per kilo carcass and even crossing US$4.40 in the cases of operations of volume and animals of very good finishing, close to 550 kilos.

The jump of the steer due to the demand of the meatpacking industry in a busy week widened the price gap with cows, which trade at US$ 3.60 for general cattle and US$ 3.80 for top animals , with the plants demanding a very good finish.

The calf harvest began early, with a large supply and price corrections. The references of the Plaza Rural auction this week, with more than 24,000 head in the catalogue, showed downward adjustments of between 1.5% and 14%. The categories that resisted the most were heavy steers destined for feedlots, a business that is beginning to show better prospects.

The wintering cow, pressured by the wide supply, and the breeding pieces, are the categories most susceptible to the weather and the scarcity of pastures.

Prices for all categories are between 20% and 30% below the March 2022 values.

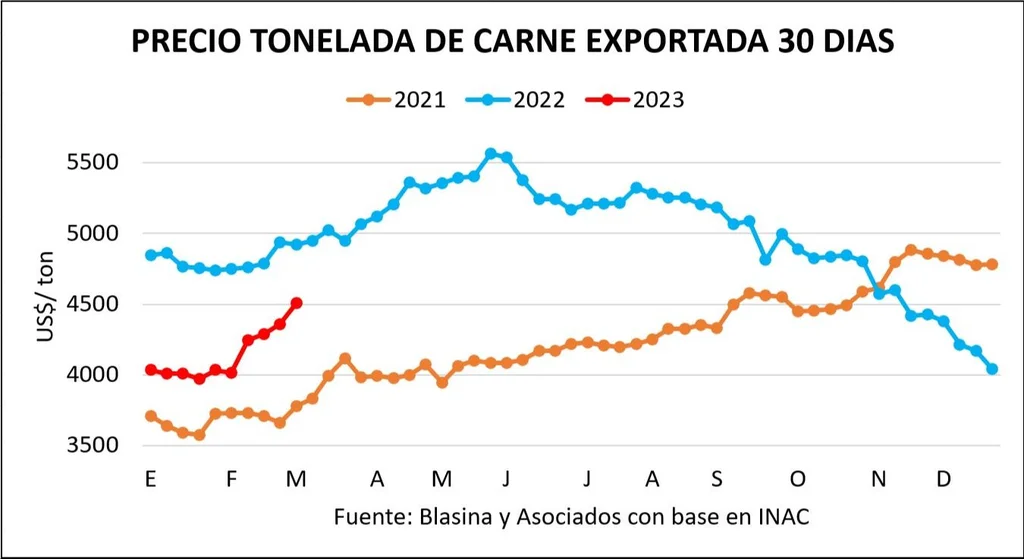

The trajectory of meat values in the foreign market seems to accompany the firmness of the fat market.

The average price of a ton of meat exported for the last 30 days rose for the sixth consecutive week and exceeded US$ 4,500 for the first time since November 2022 according to the IMEx indicator of the National Meat Institute (INAC). It rose 13.5% from the $3,971 floor on January 21.

markets.

The work

The cattle slaughter fell for the third week in a row, although it remained above 45 thousand heads, a floor from which he has not come down for six weeks. For the first time since June of last year, the monthly cattle slaughter exceeded 200,000 heads. The INAC data for this Monday indicate that the industry processed 45,173 cattle in the week of February 24 to March 4, and 201,229 cattle in the shortest month of the year.

The situation of Brazil in relation to the Chinese market continues to have a question mark. Brazil had expectations that this week China would authorize the resumption of meat imports from that country, suspended since February 23 due to an atypical case of mad cow, but that did not happen.

It could take longer than producers and the industry project, considering that the Minister of Agriculture, Carlos Fávaro, will travel to China between March 20 and 22, anticipating in a week the official visit to Beijing that President Lula Da Silva has scheduled for March 28.

In February, the export of meat from Brazil fell 16% in volume and 29% in foreign currency, showing a first impact from the suspension as of February 23, which will be more eloquent in March.

In sheep, the offer continues to be good in the Uruguayan market and firm placement in all categories, in a slaughter scenario that exceeds 35 thousand heads per week, higher than that of the last two years. Prices continue in a progressive upward adjustment, with the exception of heavy carcasses, and short entries.

With an increase of 15% in the last week, the average export of sheep meat was US$ 4,209, the highest of the year.

The average annual price is US$ 3,811 and is almost 25% below that of 2022. The exported volume grew almost 30% against 2022 until March 4, reaching 4,738 tons. This increase is reflected in the billing, which is only 2.5% below that of 2022: US$ 18 million.

Carlos Pazos

External demand for Uruguayan meat continues to be positive.

Grains: low week

Although the losses in the corn and soybean crops in Argentina worsen, It was a new week of downward adjustment in the international price of grains that was once again led by falls in cereals: wheat and corn.

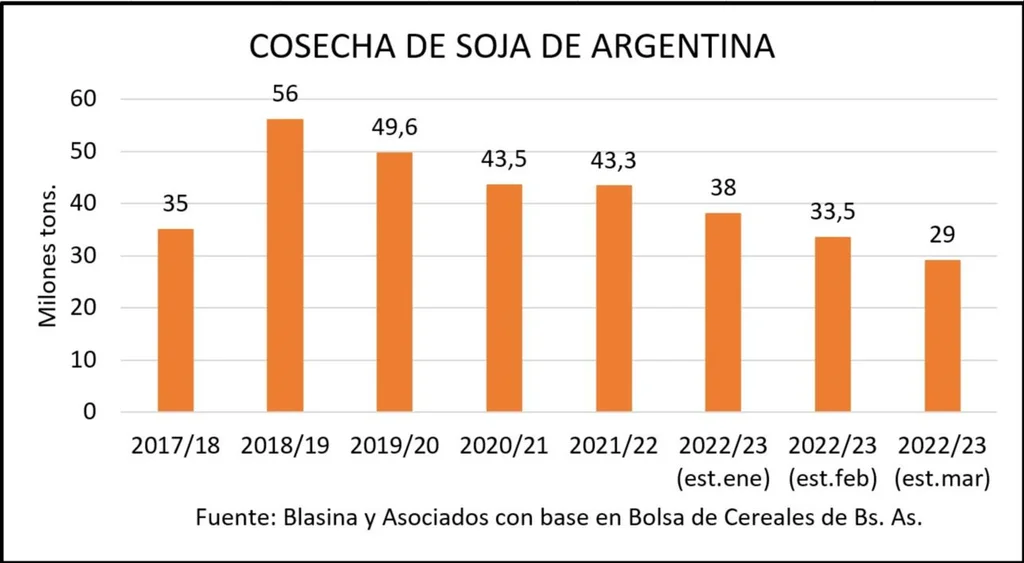

in soydespite the fact that Argentina is already projected to have its worst harvest since 2008 and will not reach 30 million tons, A weak weekly report on US exports weighed moreand that there would even be cancellations of sales. The May position fell to US$553.7 from US$558 the previous week.

Meanwhile, a Brazilian harvest is advancing that will exceed 150 million tons for the first time and plans to export almost 15 million tons in March alone.

On Wednesday, the United States Department of Agriculture (USDA) cut its forecast for the Argentine soybean crop from 41 to 33 million tons. The Rosario Stock Exchange (BCR) adjusted its estimate from 34.5 to 27 million, the lowest volume since 2008/2009. More moderate was the Grain Exchange of Buenos Aires (BCBA) which raised its harvest estimate from 33.5 to 29 million tons.

John Samuelle

Week of drops in grain prices.

The heat wave and the depleted water reserves aggravated the losses of harvestable area and deepened the yield reduction up to 50% compared to the averages of the last five harvests.

There was a slight cut in the projection of the soybean harvest in Brazil, but the record figures remain. The National Supply Company (Conab) adjusted the production estimate from 152.9 to 151.4 million tons.

The USDA maintained its estimate of production for Brazil at 153 million tons and export expectations at 92.7 million for grain, 21.1 million for flour and 2.35 million for oil.

In the corn market, Brazilian production continues to put pressure on global markets, not only due to current exports, but also due to the good production that is projected in the future. The bearish impact of this scenario pushed Chicago corn from $252 a ton to $243 this week. A quote that is US$ 100 below the price of corn in the local market today. Possibly for the first time it is Brazilian corn that supplies Uruguay this year.

In its monthly report, Conab increased its expectations on the safrinha, which is in full planting. It increased its forecast for the harvest and exportable stock by one million tons (up to 124.7 million tons). The USDA maintained its projections for production and exports of corn from Brazil at 125 and 50 million tons, respectively.

In Argentina, this week the estimated volumes of the corn harvest fell by 17% compared to what was forecast in February. The USDA cut seven million tons and raised its forecast to 40 million. Less optimistic are the updated forecasts of the Rosario and Buenos Aires Stock Exchanges: 35 and 37.5 million tons respectively.

Wheat ended the week with a slight recovery, but remains at pre-war lows and had its fifth straight week of declines, falling 4%, losing more than $10 a ton to close at $249.5 a ton .

Traders are still awaiting negotiations in the Black Sea area to renew the agreement enabling agricultural exports from Ukraine, which expires on March 18.

Russia objects to the continuation of the agreement and complains about sanctions against key financial entities for the trade of raw materials and fertilizers that – they say from the Kremlin – were never lifted.

markets.

What from here

In Uruguay, the price of corn remains at a historically high price of US$340 a ton, while soybeans rose to US$560 and available wheat is trading at US$300, according to the Country’s Mercantile Chamber of Products. (CMPP).

Wool: new difficulties

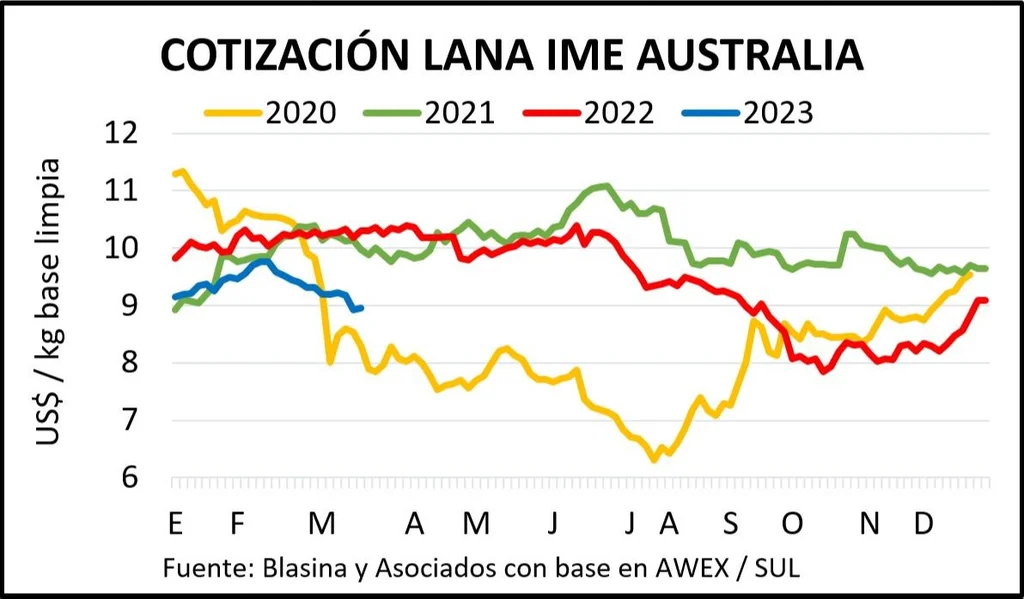

The price of wool closed its fourth week of decline in the international market, breaking the floor of US$ 9 per kilo clean base that it had managed to maintain throughout 2023. The Eastern Markets Indicator (IME) ended this week at US$8.95 and fell 8.4% from the peak of US$9.77 in February.

The escalation of values in January and February generated optimism. Producers flooded the market with large volumes of supply, and despite the fact that a good proportion was absorbed by buyers, prices failed to hold up.

In the last week, the 2.4% depreciation in the Australian currency made the fall more moderate in local currency.

markets.

Australian traders say that while demand is strong and Chinese buyers have kept up a smooth stream of business, other factors are playing a role.

Many exporters are experiencing difficulties and delays in accessing credit, as well as complications in shipments, which has impacted market values.

“It is disappointing that logistics, rather than demand, is pushing prices down when all indicators point to an improvement in prices,” said the Australian Wool Innovation (AWI) agency.

In the local market, the supply is cautious and operations are punctual. The latest sales reported by the Uruguayan Wool Secretariat (SUL) place green and certified Merino Grifa wool between 18 and 19 microns on the axis of US$ 7.60 per kilo fleece. For those from 19 to 20 microns, conditioned and certified, US$7 per kilo is handled as a reference and US$6 for Merinos from 20 to 21 microns.

The 27 and 28 micron Corriedale wools, conditioned with a green tap, remain in the range of US$ 1 per kilo of dirty basea price that continues to be below the claims of producers in a market with excess stock.