The reduction in stocks in the United States pushed up the price of soybeans and, to a lesser extent, that of corn on Friday. He fat cattle in Uruguay reached a stability in the axis of US$ 4.15 per kilo for end steerswhile the values of replacement cattle are recovered. Wool is still low, with a lot of offer in Australia and little local operation. In various fields, the impacts of droughtalthough it rained, they persist and will continue to affect.

First summer threshing

The first threshes in the prime maize crops in Uruguay that were not lost are producing yields of between 3,000 and 5,000 kilos, according to the area, said the new president of the Copagran cooperative, Juan Manuel García. The figure would be below the national average of 4,668 kilos of 2022, a harvest already affected by the lack of water.

Most of the second-rate corn failed to bear fruit and was harvested for silage or chopped for feed.

In soybean, the harvests have not started, not even preliminary. Only the farms that were decommissioned, lost due to the drought, were raised and will leave between 500,000 and 600,000 tons for the 2022/23 harvest, about a fifth of last year. Anticipating low yields and quality issues already soybeans began to be imported to mix and improve quality in order to meet commitments.

Yeah the sunflower harvest began, a more rustic and drought tolerant crop than soybeans and corn, with good oil yields and a price bonus.

Many producers are losing between US$700 and US$1,000 in investment per hectare, and giving up productive income of between US$2,000 and US$3,000 per hectare, which will affect the entire agricultural chain, including contractors and transporters.

In Argentina, the first soybean threshings showed disappointing results this week: yields lower than expected and severe quality problems. The estimate of 25 million tons is maintained for now, although it will surely drop, the operators anticipate.

The price of a ton of soybeans in Chicago recovered this week and closed with increases of 5.4% in the May position and 4.9% for July, with gains of US$28.4 and US$25.4 per ton .

Corn also closed with increases, although less, of 2.7% in the May position and 2.1% in the July position, with values of US$260 and US$250.4 per ton.

The prices in the grain markets responded to the increase after the reduction of stocks foreseen in the reports published this Friday by the United States Department of Agriculture (USDA). Soybean stocks in the United States were established at 45.86 million tons, below private estimates, which forecast 47.41 million tons. Stocks are almost 13% lower than in March 2022.

In turn, the perspective of soybean planting is slightly lower than the private estimate and remains unchanged compared to a year ago, with 35.41 million hectares.

Corn, as expected, will increase the planted area by 1.38 million hectares (3.85%) compared to the previous year, a perspective that exceeds that of private estimates by 450 thousand hectares.

The corn stocks estimated by the USDA are 188 million tons, that is, 1.75 million less than what was forecast by private operators and 10 million less than a year ago.

The weak exports of wheat lead to stocks higher than expected by the private sector, with 25.75 million tons for March 2023, although 8% lower than the 28 million tons of March 2022.

Prices in Chicago remained stable this week: US$254 in May and US$258 for July, with slight increases of less than one percentage point.

The sowing of wheat will grow by 1.7 million hectares (9%) compared to the historical floor of 18.5 million hectares in 2022, some 420 thousand hectares more than what was forecast by the private sector. Although winter crops will cover the largest area since 2015, spring crops will occupy the smallest area since 1972 with only 4.3 million hectares.

Weekly closing of markets.

balanced fat cattle

With a limited volume of supply and fewer operations, fat cattle values stabilize. The export price continues to strengthen and the special steer stands at US$ 4.15 per kilo in fourth scale. In the replacement, with auctions of all screens in the last week, it was clear that the weather sets the pace for business with a rebound in values.

Peak prices that were achieved last week for the best steers, above US$ 4.20, were not reached at the end of this week. Even so, the scenario is firm, in general with values very similar to those registered days ago. The best prices for the cow are US$3.80 to US$3.85 with entries between a week and 10 days.

The values show “a ceiling”, said Gastón Araújo, from Araújo Negocios Rurales.

Weekly closing of markets.

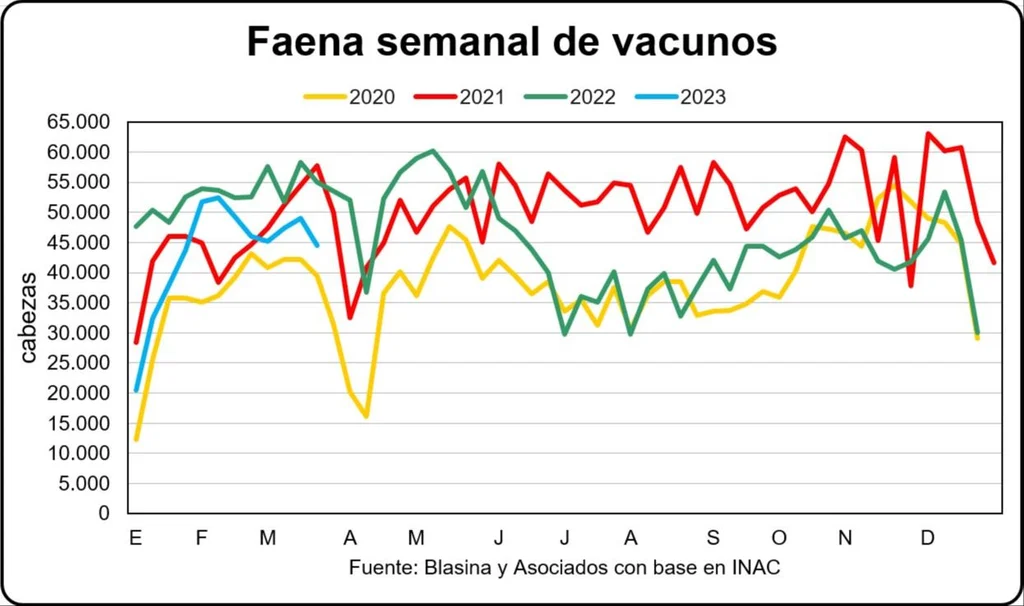

Demand pressure is easing, with kosher crews ending their operations and some plants not slaughtering or reducing their activity these days. Last week the slaughter was below 45 thousand heads for the first time in two months: 44,525 cattle. Less activity is also expected at Easter.

So far this year, with 520,538 heads processed up to March 25, industrial activity shows a year-on-year drop of 17.5%.

“I see the stable market. With the rain, some who were forced to sell due to the drought are now taking advantage of adding a few more kilos”, commented the operator.

In Brazil, after the suspension of beef exports to China was lifted after 28 days, there was a rebound in values that brought the fat steer to US$3.90 this week.

From the industry they observe a slower China for business after the return of Brazil, with somewhat weaker values. Europe has adjusted downward in recent weeks and has tended to stabilize in recent days.

The Argentine analyst Víctor Tonelli expects that, hand in hand with a strengthening of the demand from the Asian giant, a recovery of values will be achieved starting in the second quarter of the year.

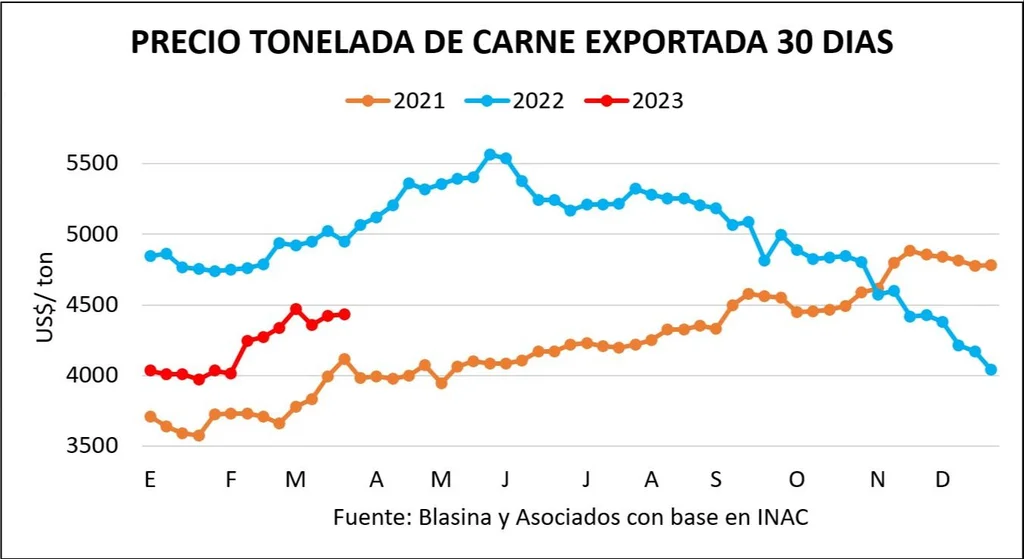

Preliminary data from the National Meat Institute (INAC) confirm a gradual rise in the export price, from a floor registered in January. The week averaged $4,813 per ton for beef, nearly $500 above the previous week.

Weekly closing of markets.

With rains that changed the mood, the replacement showed upward adjustments both in field businesses and in virtual auctions this week. In Plaza Rural, calves averaged US$2.51, compared to US$2.35 at the previous auction. On Screen Uruguay, calves went from US$2.34 last month to US$2.46 at this week’s auction. And in Lot 21 that category averaged US$2.44 compared to US$2.35 in the previous auction.

The market for sheep remains firm and in demand, with high slaughter volumes and prices in the axis of the ACG grid, which marked US$3.37 for heavy lamb, US$3.10 for capons and US$3 for ewes .

You don’t see a price ceiling as in beef, Araújo commented.

The value of the exported ton of sheep meat was US$ 4,525 last week, gradually recovering. It was the best weekly average since the beginning of December last year, with foreign sales almost 30% higher in volume than in 2022.

Weekly closing of markets.

wool stability

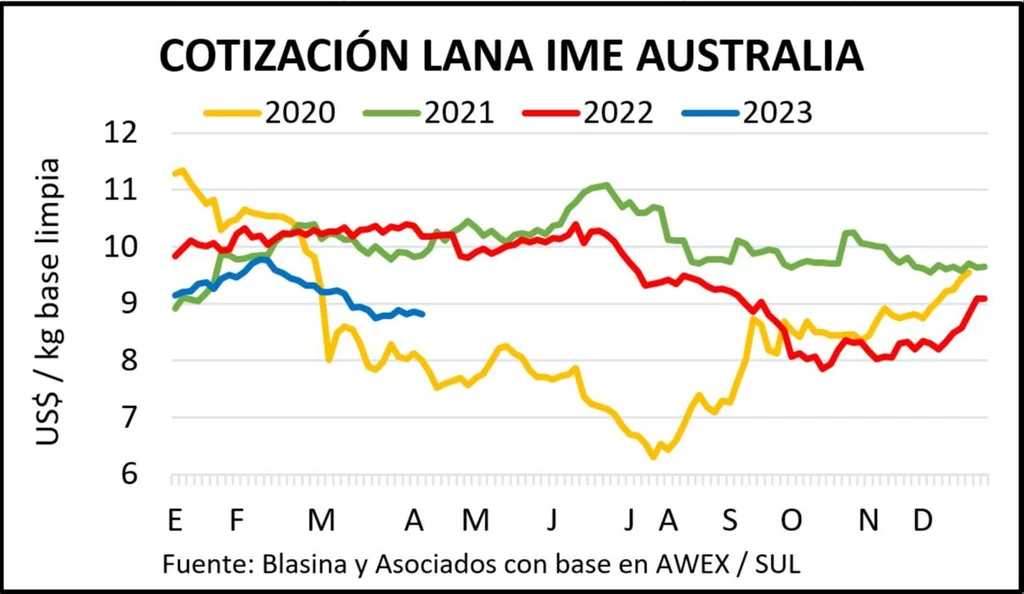

The higher quality fine and medium Merino wools, demanded by Chinese buyers, allowed to maintain stability in the Australian wool market. In local currency, the value of the Eastern Markets Indicator (IME) remained at AU 13.18 and in US dollars it fell slightly from US$ 8.88 to US$ 8.81 due to the effect of the exchange rate, as the dollar strengthened Australian, after a volatile week with price fluctuations. The IME is 13.5% below the value of a year ago.

In the Uruguayan market, operations are punctual in the face of a price scenario that does not suit the producers.

Between January and February of this year Uruguay exported 4.3 million kilos of wool, 9% less than in the first two months of 2022.

Billing fell 16% to US$ 22.4 millionwith Italy accounting for 23% of imports and China for 21%.

The washed wool market, with a 43% drop in dollars, shows a greater weakening than dirty wool, which fell 6% in dollars, and combed wool (tops), which increased its volume by 8% although revenue fell 14% , with Italy and Germany as main customers.

In Australia there will be only two days of operation next week, with an important supply of almost 53,000 bales. The first quarter of 2023 registered the highest volumes of wool placed on the market since 2015, a theoretically bearish factor for price expectations. However, the level of supply is in line with a demand driven by the post-covid opening of China and the textile activity in Europe.

For the following week, which will be a recess in Australia, the operators hope that the pause will serve to oil the logistics and financial situation that slows down business growth.