For Óscar Ocampo, a specialist in the energy sector at the Mexican Institute for Competitiveness (Imco), Mexico faces technological and human capital obstacles to “substitute imports”, as proposed by Plan Mexico, specifically in sectors such as automotive and transportation. petrochemistry.

For the specialist, the country is not fully inserted in the value chain of electric batteries and, in regulatory terms, there is currently no certainty because the sovereignty over the use of lithium in the national territory does not provide clarity for investments in this crucial aspect for the energy transition and electric mobility.

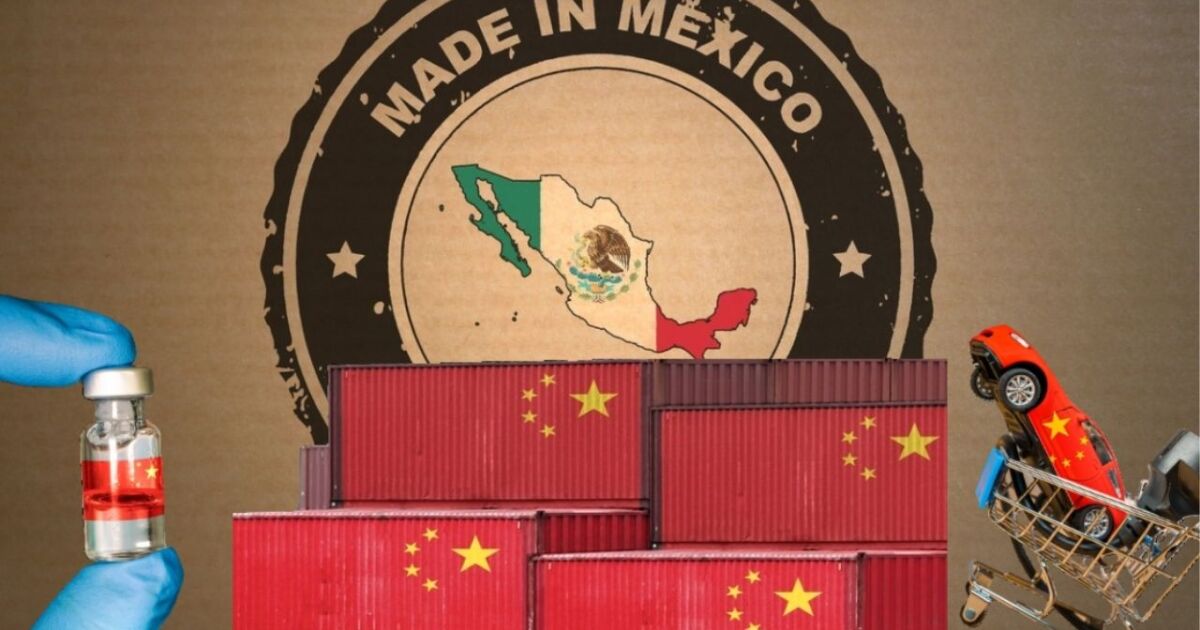

According to data collected in Plan Mexico, imports from Asia exceed $210 billion, and machinery, appliances, electrical, automotive, chemicals and textiles together represent more than 70% of said imports. Hence, the objectives set in these sectors.

The bet on tax incentives

In response to these possible obstacles, the Mexican government recently published tax incentives on Tuesday to encourage the relocation of companies in the country, under the condition that they invest in dual education and industrial innovation.

To put this effort in context, Mexico only invests 0.3% of its GDP in research and development, and business spending in this area barely reaches 19% of total spending, far from the 51% average of OECD countries. .

The Mexican government stops earning the equivalent of more than 4 percentage points of GDP due to tax exemptions and tax incentives. This is one of the main concerns for experts like Alejandra Macías, director of the Center for Economic and Budgetary Research.

“They bring a budget of about 100,000 million dollars (for Plan Mexico throughout the six-year period). Where are we going to get it from if we already started 2025 with cuts in public spending, in investment in health?” specialist.

The fiscal stimuli will be applicable until September 30, 2030 and the total amount that will be authorized to companies will not exceed 30,000 million pesos during their validity, added the decree signed by Sheinbaum, who concludes his administration in 2030.

Alejandra Macías believed that to meet the ambitious objectives of Plan Mexico, differentiated policies need to be applied that address each sector of the industries in which import substitution is most sought.

Between now and 2030, the Mexican government seeks to encourage innovation with deductions for investments in manufacturing, assembly and transformation of magnetic components for hard drives and electronic cards for computing.

How to avoid an electrical collapse for Plan Mexico?

According to Óscar Ocampo, Plan México involves ambitious objectives in electrical terms, with investments by the Federal Electricity Commission (CFE) of approximately 22,000 million dollars for the six-year period.

Although these investments are sufficient to cover current demand, they will not be if demand grows more than projected or if clean energy climate goals for 2030 are to be met, the expert believes.

Petrochemicals and pharmaceuticals are promising

The Mexico Plan proposes to replace 14,000 million dollars in imports of strategic petrochemical products. To achieve this, it will seek to impose tariffs on products whose imports have increased more than 100% in the last two years, dual education to produce talent and facilitate imports of inputs to support the industry. In addition to increasing Pemex’s production in secondary petrochemicals.

The Imco specialist recommended increasing these investments, modernizing and expanding logistics infrastructure, especially in ports and railways. For example, regarding the ports of Coatzacoalcos and Salina Cruz, he points out that their energy vocation must be strengthened, and not think of them as possible competitors of the Panama Canal, as proposed by the Transisthmian Project of the last six years.

“The Port of Coatzacoalcos has to be thought of as an energy port, not thinking that it will replace Panama. Take advantage of your comparative advantage, which is energy, and bet on this, but to do so you require a lot of logistical infrastructure,” he said.