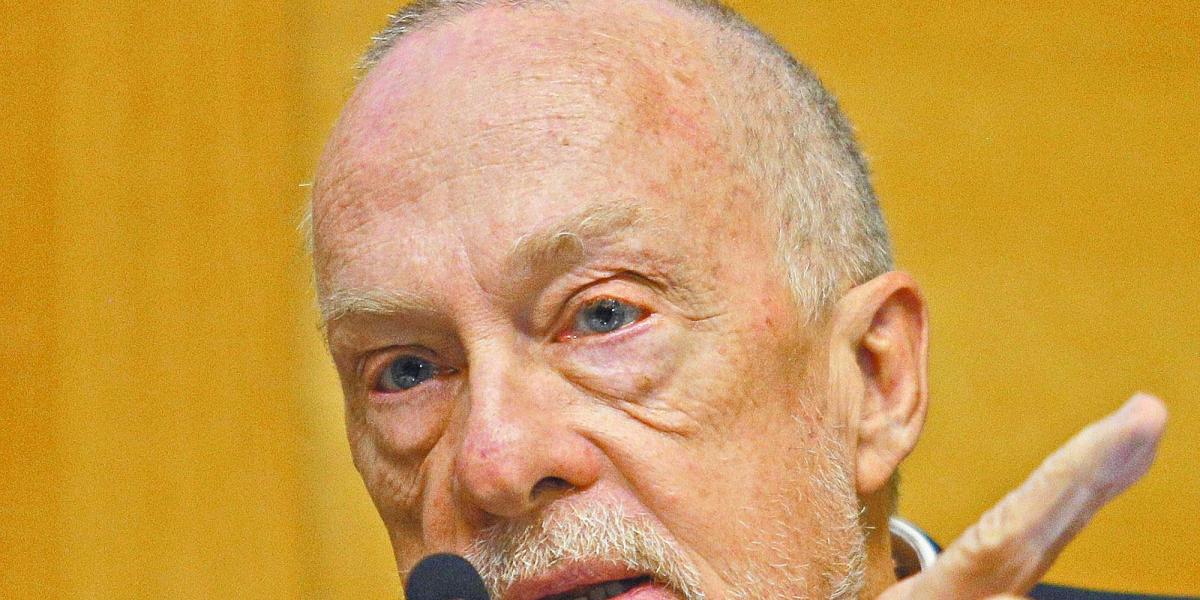

The deputy governor of the Bank of Mexico (Banxico), Jonathan Heathconsidered that the monetary stance should be maintained for longer, until we see that the persistence in the prices of services is truly broken, in the face of relatively dynamic household consumption and an economy that, although it is decelerating, maintains points where inflation could be supported.

Interviewed on Banorte’s Norte Economía podcast, the deputy governor explained that the core inflation It stood at 3.95% in the first half of September, which is already at levels prior to the outbreak of inflation, which is mainly explained by the drop in the prices of merchandise, but not in those of services.

“This means that we now have to focus on breaking the persistence of services inflation, which has simply remained above 5% since July 2022, projecting a very consistent lateral trajectory,” he said.

He added: “So, the only way we can make the underlying continue its downward trend, until reaching 3% next year, as our projections are, is to break the persistence of service prices.”

Economy slows, but not close to recession

Jonathan Heath He said that it is clear that the economy has slowed down in recent quarters, but he stressed that we have to be a little careful, “because I don’t think we are close to entering a recession either.”

He explained that household consumption maintains quite strong dynamism, mainly in the first quarter of the year, partly because in that period the social programs of the second quarter were brought forward due to the election issue.

“So you have to take the first and second quarters more as an average. On average we find that they still grow quite well. Now that we are entering the third quarter, social programs are returning to normal. The exchange rate is going to help shore up the purchasing power of remittances in pesos a little more,” he noted.

In addition to this, he commented that relatively strong salary revisions are being seen, which will maintain a certain dynamism in consumption, and the economy will grow in a range of between 1 and 2 percent.

“However, this is going to be explained more by a stagnation in exports, which we have seen for a long time, and surely there will not be much investment in the second half of the year, precisely because it is a characteristic that we always see when there is a change of six-year terms, but with consumption that can remain relatively dynamic,” he pointed out.

The latter, he stressed, is going to push up the prices of services, which are very susceptible, he said, to this type of conditions.

“And precisely for this reason, I believe that we must maintain the monetary stance for longer, until we see that we really break the persistence of service prices,” he emphasized.

FED decision will not have immediate impact in Mexico

At the international level, the deputy governor of the central bank commented that the recent 50 point cut base by the United States Federal Reserve (FED), will not necessarily have a direct and immediate impact on Mexico’s monetary policy.

However, he pointed out that, in the long term, Mexico cannot completely distance itself from the FED’s monetary cycle.