Four sources linked to regional financial institutions explained to CONFIDENTIAL what were the financial reasons why the LXII Assembly of Governors held on September 23 in Mérida (Yucatán, México), rejected the capitalization plan proposed by the executive president of the Inter-American Bank for Economic Integration, (CABEI), Dante Mossi.

In 2020, thinking of “satisfying the needs of the region”, the owners of the Bank (all of Central America and eight other countries) increased the capital of 5 billion to 7 billion dollars.

In 2021, Mossi He proposed to increase it to 10 billion, “to be a much bigger and much stronger bank”, that could offer more resources to its clients… although that implies that those clients (in other words, the countries), had to put more money, because the Bank is a kind of financial cooperative.

The experts consulted by CONFIDENTIALconsider that the reason why the owners of the Bank said ‘no’ to Mossi, is because the CABEI is the most expensive of all multilateralit is the ones they can turn to for resources. “Financing with CABEI is always more expensive than with the [Banco Interamericano de Desarrollo] IDB, [el Banco de Desarrollo de América Latina] CAF, or the World Bank”, said the professor and former director of Costa Rica before the Bank, Ottón Solís.

“CABEI has always been more expensive, and that is why some countries do not seek to finance themselves there. Many of us think that when the Bank improved its rating to Double A, it should have resulted in it obtaining more favorable rates when seeking its own financing”, and therefore, being able to offer loans at more favorable rates, said the former CABEI director of a non-regional member from the bank.

By way of example, he recalled that on occasions, “Mexico and Colombia request loans from the Bank, although in reality it is cheaper for them to seek resources in their own capital markets”, or that Argentina, a nation for which CABEI was “a not an interesting alternative”, he managed to establish “some type of operation, for very specific reasons”, among them “to strengthen a relationship with the Bank”, upon receiving one of its loans, he added.

peer-to-peer business

Although it seems a contradiction to finance oneself with the most expensive, the expert recalled that “of all the multilaterals, the CABEI is the most ‘flexible‘, because it has a much weaker governance, so it is easier to achieve what is sought with them, without having to submit to adequate evaluation, follow-up and monitoring mechanisms”.

For this reason, those who turn to the Bank the most are the countries that have the weakest governance, and therefore, less direct access to financing markets, he added.

An economist who knows how CABEI works explained that “it is better for countries like Guatemala, with such a good credit rating, to seek resources elsewhere, not just in CAF,” noting that in order to approve the capitalization that Mossi urgently needs , Guatemala would have to put up 75 million dollars -or more- “and it will not make any profit.”

CAF could be, according to another expert who knows the internal workings of the Bank, the reason why some countries once again rejected the capitalization proposal, explaining that they feel that this is not the time, because they are joining CAF, which It implies that they have to make their own capital contributions to that multilateral.

“Given the current situation, CAF can be more successful and flexible in managing funds; the countries are seeing it as a new source that is not corrupted, because a lot of corruption is seen in other multilaterals. Being new, there is hope that it will not be contaminated, ”she argued.

Nine members of CABEI (Argentina, Colombia, Costa Rica, El Salvador, Spain, Mexico, Panama and the Dominican Republic) are integrated into CAF. Honduras was only admitted this September.

Another endorsed by the expert is that some countries rejected capitalization, “so that Nicaragua – which is the largest recipient of Bank resources, as Mossino himself admits – does not benefit more, with the resources that they will all contribute”.

The economist also cited the case of Korea, a nation that entered CABEI in January 2020 “to be able to do business in the region”, paying 472.5 million dollars (data cut to 2021) and owes another 157.5 million more. In that case “are you going to ask for additional resources, in addition to the fact that it is possible that CABEI gets another partner that could compete with Korean interests?”, he inquired.

Second “no” to Dante Mossi

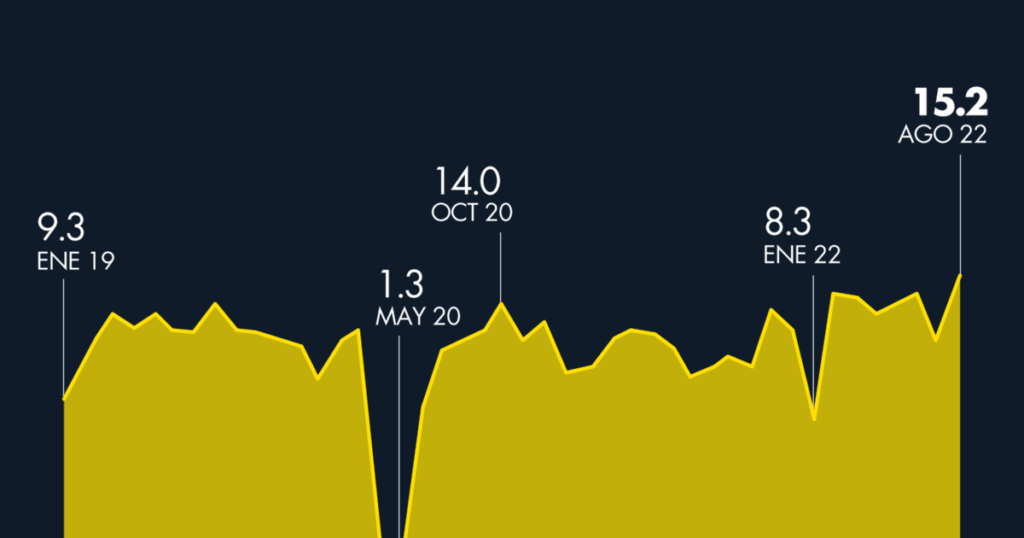

On September 3 of last year, the multilateral organization held its 61st Assembly of Governors in Tegucigalpa (Honduras), where Mossi presented his proposal to capitalize the Bank, to take it from the 7,000 million it was nominally at, to 10,000 million dollars, with the express intention of obtaining a Triple A rating.

The response of the Assembly was to instruct “its board of directors and the Administration, to prepare an action plan with a view to increasing the capital,” he euphemistically admitted. this press release published on the Bank’s website.

The proposal to increase the capitalization does not mention the fact that at the end of 2021, the real capital of the Bank was not USD 7,000 million, but USD 5,162.3 million, because the countries chose to pay their corresponding part in eight installments.

In that way, when the Assembly ordered to instruct “the elaboration of the applicable mechanism to advance in the implementation process of a ninth capital increase”, was only repeating last year’s response, motivated by a series of reasons, in which, in addition to financial, there are also personal ones.

“I think there is an ‘energy’ in somecountries, of mistrusting Dante’s management, for hehe massive increases he has madepartly, to win over countries and to the Bank Administration”, said the Costa Rican Solís.

The former director of CABEI’s extra-regional partner country also subscribed to the thesis of personal discomfort with the Bank’s executive president, saying that “Not even the representatives of the countries that support him like Mossi,” which would explain why they voted against, or had refrained from doing so, during the appointment in the southeast of Mexico.