Littio is an application that allows users to save and access financial services in dollars. Now, after more than a year of operation, the platform takes the next step to complement the experience with a new product.

(See: ‘Fintech’, a tool that innovates and contributes).

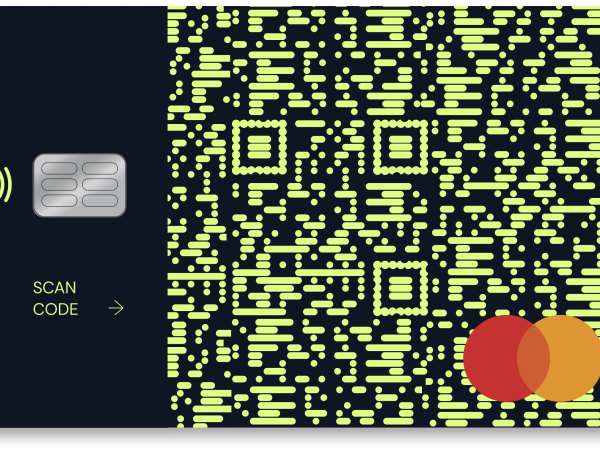

The ‘fintech’, which emerged as an alternative to help people protect their money from devaluation and facilitate savings with the US currency, announced the launch of a physical card that does not charge a handling fee and that can be used anywhere in the world.

Thanks to the Littio Card, users will be able to use digital dollars (USDC) that recharge your account, for national and international purchases in electronic and physical stores, as well as for withdrawals at ATMs.

According to Iván Torroledo, COO and co-founder of the app, the objective with the addition of this tool is to provide a 360 experience. That is, through Littio, not only will it be possible to save capital and make it grow, but also it also makes it possible to make use of those resources and simplify transfers.

(See: ‘Fintech’ versus traditional banking).

“We know that the user understands and recognizes products with which they are already familiar. We want the Littio ecosystem to not only generate great benefits for you but also feel friendly and accessible. In that sense, the card is a complement”, pointed out Torroledo.

It should be noted that the platform also has a virtual debit card that can be controlled directly from the application. Through this, users can keep track of their expenses, make physical and virtual purchases and Carry out procedures in case of theft or loss.

(See: Fintech apps: an even easier way to bank).

Both products can be requested through the app, which is available at App Store and Play Store.

lithium

Littio is a free platform that operates as a global account with which people can save their capital in dollars, send and receive them from anywhere in the world.

“We want people in Colombia, Latin America and emerging economies to be able to improve their finances using technology. This is a super simple application with which you can access products that were previously impossible to have in Colombia or very difficult to have due to the number of requirements and procedures involved.”, highlighted Torroledo.

(See: ‘Fintechs’, allies of companies to cover cash flow).

To start, the user must register to create an account. After going through a validation process, you will be able to recharge in Colombian pesos through different payment methods, such as Nequi or PSE, and by entering your money you will be acquiring digital dollars.

In addition, from time to time the user may receive a profitability reward as a reward to build financial habits.

The platform also has different financial education dissemination channels and within their long-term plans there is its expansion to other regions of Latin America, as well as the expansion of the product’s capacity.

BRIEFCASE