With the entry of the new government and the plans to be implemented, there is an issue that has caused different opinions regarding the country’s economy. The proposed tax reform, proposed by the Ministry of Finance, in one of its sections indicates the tax on single-use plastics.

(See: ‘Petro dividend tax would eliminate the country’s stock market’).

The bill raises the need for the introduction of a tax administered by the Nation of 0.00005 UVTs for each (1) gram of the container to single-use plastics, which taxes the sale and importation of plastic products used to pack, pack or package goods only once.

According to the document, this measure would allow “internalizing the negative externalities on the environment, generated by the consumption of single-use plastics”, given the polluting chemicals and greenhouse gases derived from the production and treatment of this type of product. .

(See: Tax vs. Colombians: the effects of the project on households).

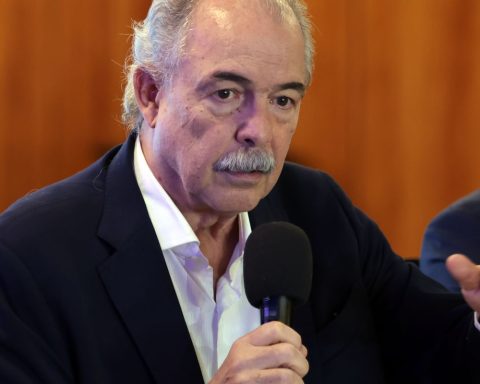

For his part, Daniel Mitchell, president of Acoplásticos, assured that “this decision goes against the same goals of the national government to eradicate hunger, since the tax will fall on packaged products, that is, on milk, cheese, meat, chicken, bread, cookies, beans, lentils, cereals, oils , flours, coffee, salt, sugar, panela, also drinks and cleaning and cleaning products, among many more”.

According to figures from the union, of the total production of packaging used in Colombia, 22% goes to food, 17% to beverages, 29% to toiletries, cleaning products, cosmetics, chemicals and fertilizers, 23% to commerce, restaurants and hotels, and 9% to other sectors.

(See: The good, the bad and the ugly of tax reform).

For Mitchell, the tax will translate into an increase in the prices of products in the basic basket, which would aggravate the current inflationary situation.

“According to our preliminary calculations, the value of the tax is equivalent to a rate of around 16% of the packaging. It must be taken into account that the plastic packaging represents, on average, about 5% of the value of the product, with some cases that can reach up to 19%.“, hill.

(See: Pensioners who would pay taxes with the tax reform).

BRIEFCASE