Colombia’s external imbalance once again set off alarm bells, after in its most recent report, JP Morgan warned that the country’s structural fiscal deterioration is fueling an increasingly widening trade deficit. driven by increased imports amid strong domestic demand.

Although this institution recognizes that remittances continue to act as a partial relief valve, it warns that the imbalance persists and could become a source of additional pressure for the economy, mainly from fronts such as debt or the exchange rate, later.

More information: AI is advancing faster than regulation, experts warn at the Portfolio Summit

According to the report, the merchandise trade deficit reached US$13.2 billion until August 2025, which represents US$4 billion more than in the same period of the previous year; while in August alone, the monthly deficit stood at US$2,000 million, expanding by US$320 million compared to 2024.

According to the entity, this behavior is not coincidental, but rather responds to the impulse that internal spending, largely financed with public resources, continues to exert on demand and external purchases.

The fiscal deficit is the great challenge to be overcome by the National Government.

Image from ChatGPT

JP Morgan warns that the growth in imports reflects an economy where consumption maintains a high pace, even in a context of lower growth, since in the first eight months of the year, external purchases increased 10% annually, with special dynamism in intermediate and final consumer goods, a pattern that suggests that households continue to spend above the country’s productive capacity.

Meanwhile, imports of capital goods have also gained ground, which reinforces the weight of the imported component in economic activity.

You may be interested in: Announcement of constituent assembly does not distract businessmen

Despite the fact that in terms of dollar value imports are still almost 11% below From the “overheated” levels of 2022, volumes are today 12% higher, which demonstrates that the trade imbalance does not originate in international prices, but in a robust and persistent domestic demand and for the bank, this phenomenon is consistent with the “ongoing structural fiscal deterioration”, an expression that associates the increase in public spending with pressure on the trade balance.

Meanwhile, the contrast with exports is stark and although international prices remain favorable, rising 3.3% year-on-year, exported volumes fell 19%, leading to almost zero total growth (+0.6%). Likewise, non-energy exports grew 21.4%, but this advance was insufficient to compensate for the sharp drop in oil and coal sales, both in quantity and value.

The fiscal deficit is the great challenge to be overcome by the National Government.

Image from ChatGPT

In historical terms, export volumes are 36% below pre-election levels. pandemic, while prices remain 40% above the 2015–2019 average.

As a result, the three-month annualized trade deficit rose to US$22.4 billion, the highest level since 2022. Even under the FOB-FOB measurement, the deficit reached US$18.5 billion, figures that confirm a persistent external imbalance against which JP Morgan maintains that, as long as domestic spending continues to exceed the national savings capacity, the country will continue to depend on financing. external to cover the difference.

Also read: Taxes on digital transfers would be a setback to financial inclusion

The relief of remittances

This bank’s report also says that remittances have helped moderate the impactbut they are not enough; since between January and August, they grew 13.3% year-on-year, reaching record amounts, although their pace shows signs of exhaustion. In the last quarter, the flow registered a sequential drop of -1.1% and according to the bank, this slowdown may be due to three factors, which start with the stricter immigration policies in the United States.

This is also influenced by a less dynamic US labor market and the loss of the momentum that advance shipments had at the beginning of the year due to possible tax or immigration changes.

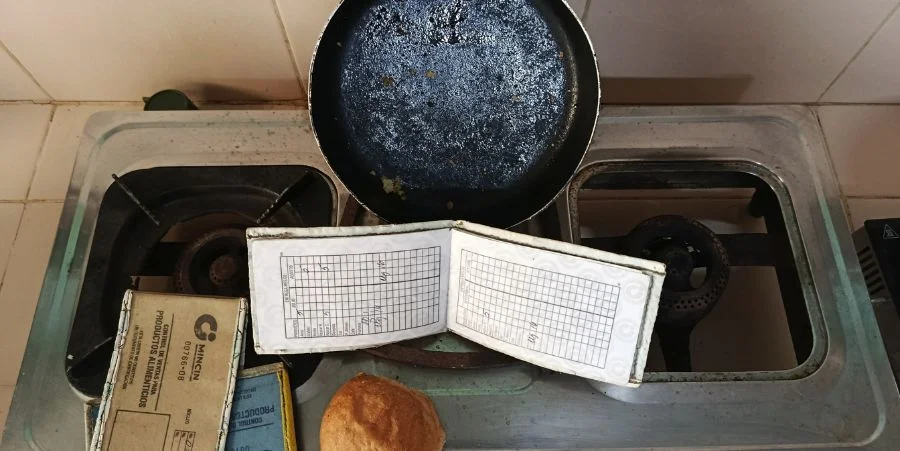

Colombia should look for other ways to finance the current account deficit.

Image from ChatGPT

In this way, the combined trade and remittances deficit reached US$4.5 billion in the first eight months of 2025, a figure that shows that external flows are no longer able to balance the accounts and for JP Morgan, the trend points to a deeper structural imbalance, where public spending and private consumption, both high, They continue to push the economy above its real capacity to generate external income.

Thus, the report concludes that, if this pattern is not corrected, the current account deficit will continue to widen, which could put pressure on the debt and the exchange rate in the coming quarters. In other words, fiscal deterioration is going from being an internal problem to becoming an external threat to Colombia’s macroeconomic stability.

DANIEL HERNÁNDEZ NARANJO

Portfolio Journalist