In a world where credit and electronic transactions are part of everyday life, it is hard to imagine a time when credit cards did not exist.However, not even 100 years have passed since the history of this financial tool began.

(Further: The best benefits of credit cards in 2024 and how to choose the ideal one).

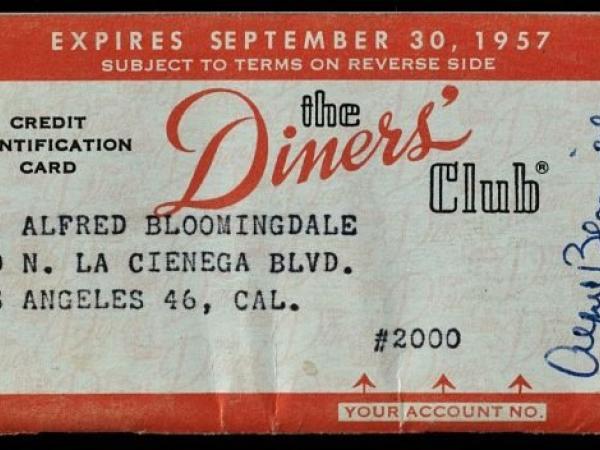

Its beginnings date back to 1949, when Frank McNamara and his partners introduced the Diners Clubone of the cards that, to date, continues to demonstrate exclusivity to its clients.

According to ‘Forbes’, this invention, which revolutionized the payment system, arose one night at Major’s Cabin Grill restaurant in New York, when McNamara was having dinner with his lawyers and, when he wanted to pay the bill, he realized that he had forgotten his money at home.

(Read: Pay your credit card balance in dollars? Here’s how to do it).

The businessman quickly called his wife and asked her to bring his wallet to the restaurant. That way he solved the situation and invited his companions to drink another round of liquor, but when he got home the bad time he had had put his brain to work.

So, a year later (in 1950) McNamara decided to bring out his new invention: a payment card that would allow you not to carry cash and that would be accepted in several establishments.. This is when the first credit card, Diner’s Club, was born.

(See: What happens if you pay more than the minimum amount on your credit card?).

The principle behind the Diners Club Card was simple: Holders could accumulate charges in a centralized account, which they had to settle at the end of the month.This innovation allowed consumers to enjoy more financial flexibility and facilitated business transactions.

Credit cards.

iStock

Although the initial card was exclusively for use in restaurants, its success soon inspired expansion to other businesses and services.

Years later, in 1958, the financial institution Bank of America created the credit card Bankamericard, which later became what we all know today as VISA, and the Interbank Card Association, now Mastercard, was created.

(Further: Here’s how you can manage your credit cards intelligently, based on AI).

Today, bank cards are enjoying a true Golden Age, driven by the growth of online commerce and the reduction of bank branches.

BRIEFCASE