Madrid/The euro has lived this 2025 an unstoppable escalation and, or knowing about it, it was expected that September would change for 500 Cuban pesos in the informal currency market. However, the milestone has been consummated this Wednesday and thus could continue for a good part of October, if the predictions of those who believe that the currency flies mounted on the back of the Democratic Memory Law of Spain (LMD) are fulfilled.

In the mentiseros, the economists predict that by November the price of the European currency will begin to descend and attribute it to the demand is not, like that of the dollar, street, but consular. The deadline to request Spanish nationality by virtue of the octave additional provision of the LMD is October 21 and that entails having the documentation required in each case, which, sometimes, makes it necessary to pay some expenses for which the country’s currency is required.

The passport, which must also be paid once nationality is obtained, has the fixed spending of 30 euros, another share with which to count in advance.

The passport, which must also be paid once nationality is obtained, has the fixed spending of 30 euros, another share with which to count in advance

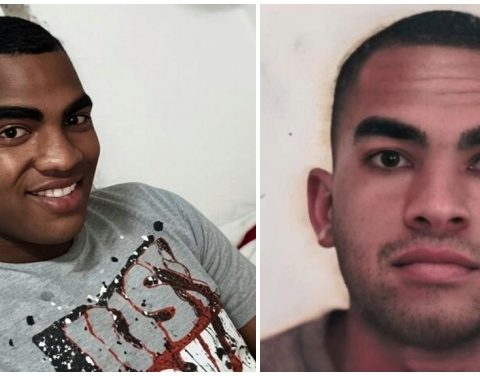

The opinion of the experts is also after the street. “I imagine that those who have to pay at the embassy must soon be crazy. The euro is lost,” says Maria, a habanera in process to get the Spanish nationality that, for their particular case, has not yet had to disburse anything, but it is feared what comes from now on. “The last time I saw a euro was when my cousin sent my aunt a suitcase and added a few euros In handten euros that were to pay the car. And they are the last ones I saw, in early July, ”he adds.

Luis, who is dedicated to the informal sale of currencies occasionally, thinks the same. “I think that as there are so many people doing procedures …”, he observes. “The euro has not seen it for a long time. It is so expensive, so expensive, that when you receive a spring they do not give it to you in euros. Before yes, when they were more equated, but since such a large gap was opened between the two, the remittances give you dollars and blatantly they stay with the euros. They grab the euros they give them, and they give you the dollar.”

In mid -September, experts saw a slight containment from the community currency. August had closed with the euro to 460 pesos and Pavel Vidal, which every month prepares a report with a forecast of the value of the currencies in the informal market, said: “The forecast models, for now – and taking the contradictory signals that emanate from the market metrics -, they estimate in the central scenario that would be stopped in September the increase in the value of the currencies”.

According to its calculations, the dollar had to end at least 400 and 428 maximum, while the euro could move between 455-481 pesos. However, the forecast has been more than short and not only with the European currency. The dollar is this October 1 to 440 pesos, according to the average rate published The touch Daily, although in social networks there are those who ask up to 445 and it is feared that it ends up following the euro in its climbing, in this case for speculative reasons, according to different opinions.

However, the forecast has been more than short and not only with the European currency. The dollar is this October 1 to 440 pesos

As you remember today The touch In an information published about the figure, “the value of 500 pesos per euro lacks a history in the recent history of the island. Not even during the special period of the 1990s, when the Cuban economy sank into its worst crisis after the disappearance of the Soviet Union, similar levels of depreciation of the national currency were recorded against foreign currencies” (at that time, the euro still did not exist).

According to the Observatory of Coins and Finance of Cuba (OMFI), of Pavel Vidal, among the strongest reasons are the fall of the gross domestic product, chronic deficits of electricity generation, lack of productive investment, tourism contraction and accelerated dollarization of internal trade stores of state property. To this are added emigration, the control of reserves by the Gaesa military conglomerate and the strength of the euro because it gives “more stability than the dollar to those who travel or have economic ties with Europe.”