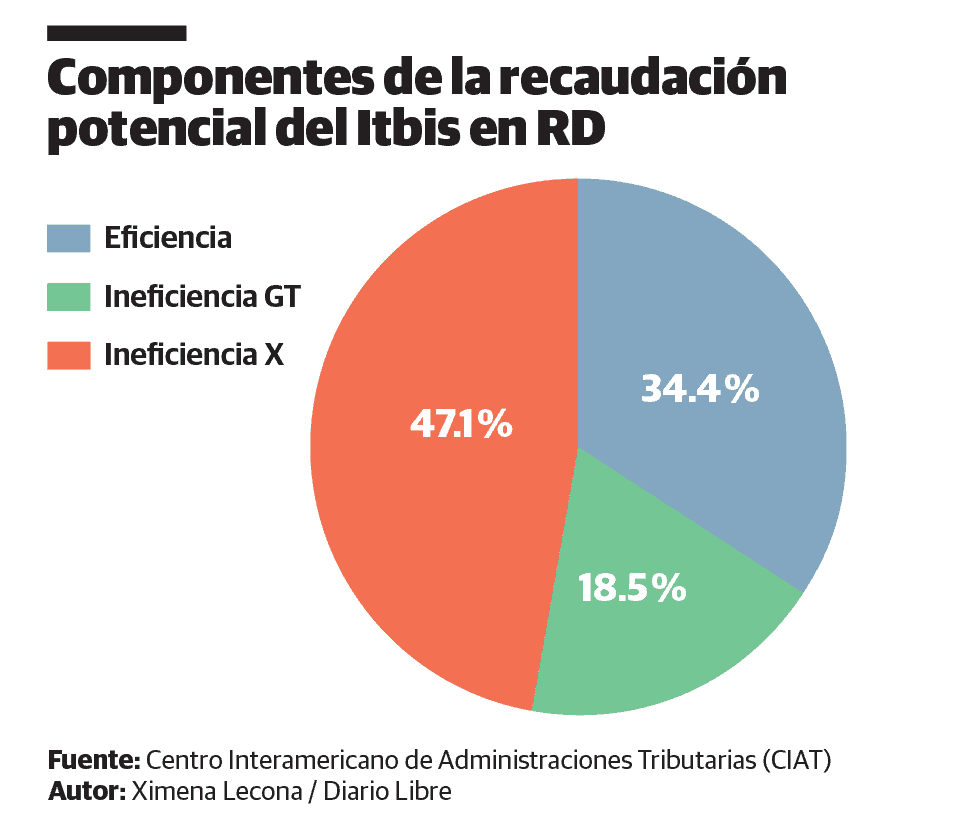

According to the Inter-American Center of Tax Administrations (CIAT), the Dominican Republic collects only 34.4% of its potential in terms of the Tax on Transfers of Industrialized Goods and Services (Itbis). However, in the management of the Tax on the Rent (ISR) of companies, the efficiency level is 62%.

According to the most recent report “Collection Efficiency and Tax Gap in Latin America and the Caribbean: Value Added Tax and Corporate Income Tax”, the country was among those lower tax collection efficiency in the period 2019-2021 due to various factors, among which the non-collection due to exemptions and non-compliance stand out.

The document indicates that 18.5% of the gap corresponds to estimated tax expenditure, while 47% is due to evasion, inefficiency, smuggling, informality and other tax evasion mechanisms.

The study includes 17 Latin American countries, among which the Dominican Republic occupies last place in terms of tax management of taxes on transfers of goods and services, which currently taxes users with 18% of their total purchases.

“He Government has a great opportunity to increase revenues without having to touch tax figures, since we are the Latin American country with the lowest performance in revenue collections. Itbis. Of each peso that should be collected for this concept, only 34 cents are collected,” said the vice president of the National Council of the Private enterprise (Conep), Caesar Dargam.

During a meeting with journalists, the executive observed that the high level of informal employment, which is around 55.6% of the employed population, affects public finances, reducing government revenues and “undermining tax collection,” he explained. Conep.

First in ISR

Unlike the ITBISthe taxes paid by companies and employees on income are one of the components that are best managed. In fact, in the same report of the CIAT It is highlighted that the Dominican Republic exhibits the highest level of efficiency, with 62%.

The document indicates that of the 38 gap points, 12% corresponds to the tax expenditure of the Government and 26% to topics of tax evasion and tax collection inefficiency.

The National Council of Private Enterprise believes that a fiscal pact could be the strategy to improve the State’s finances. To this end, it cited eight essential pillars:

-

Agile and simple tax system that promotes employment, investment and formalization.

-

A tax system that brings with it progressivity, according to the contribution capacity of each sector.

-

Avoid distortions and taxes that hinder development and encourage unfair competition and illicit trade.

-

Promote quality, transparency and optimization of public spending.

-

Equitable distribution of regional resources.

A consolidated public debt framed within sustainability. -

A robust accountability system and measurement and monitoring indicators.

-

Encourage tax collection efficiency to increase citizens’ confidence in the tax administration.