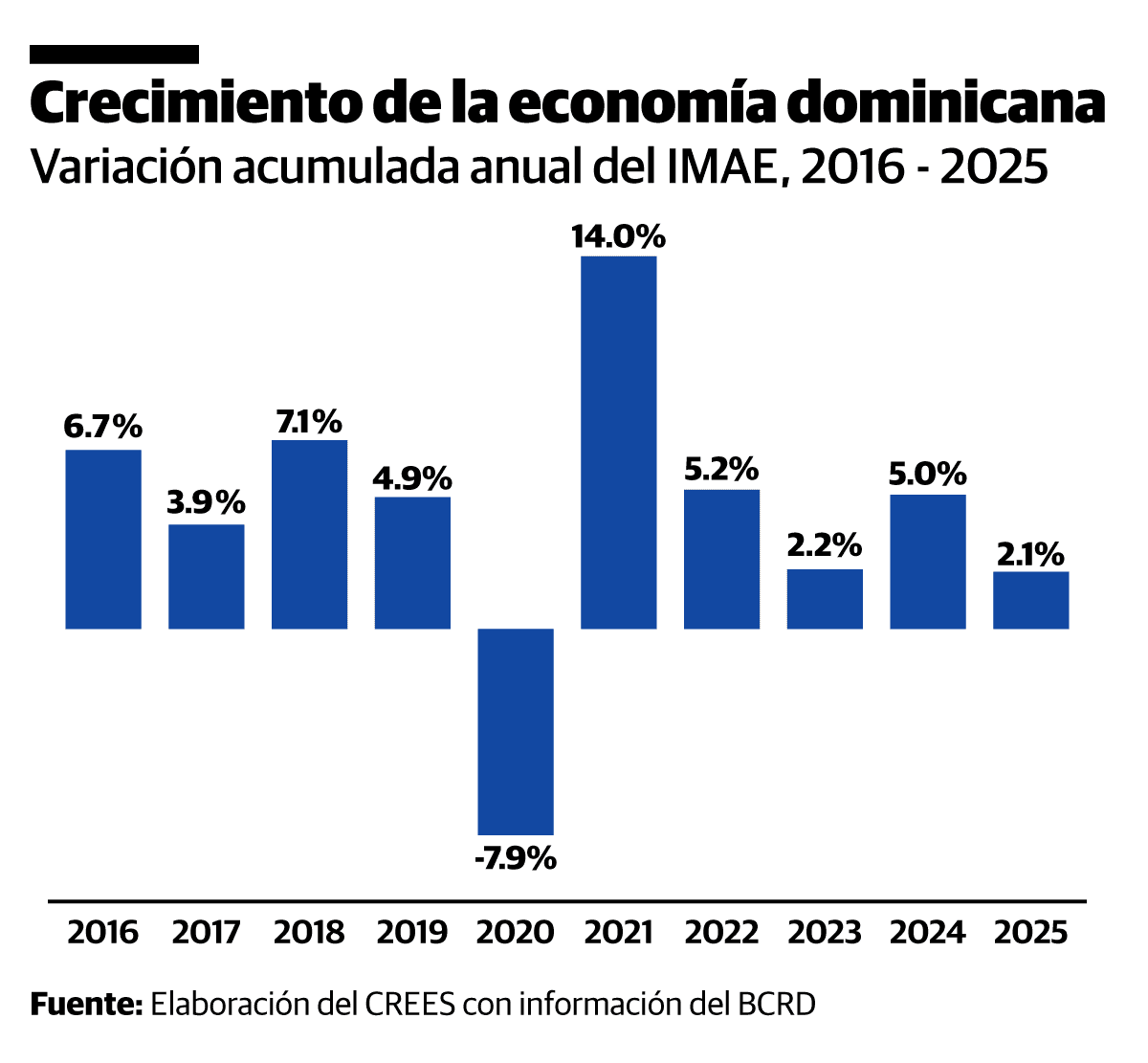

Recent data from the IMAE show that the Dominican economy has lost dynamism after the post-pandemic rebound. The growth recorded in 2025 is not only low, but comparable to that of 2023, suggesting that the slowdown may not be transitory, but part of a trend that deserves attention.

Faced with this scenario, short-term stimuli have been resorted to. These include monetary measures such as the release of legal reserves, rapid liquidity facilities and the redemption of Central Bank securities, as well as fiscal impulses derived from budget revisions that increase capital spending. These tools may temporarily raise measured growth, but they do not guarantee sustained improvement in well-being.

It is important to clarify what is meant by real growth. It is not just about expanding spending or credit, but about strengthening the productive capacity of the economy. Therefore, explaining the slowdown exclusively by external factors is insufficient. By 2026, ECLAC projections indicate that, in a similar international context, several economies would grow faster than the Dominican Republic, which points to unresolved internal challenges.

In this context, it is necessary for the Dominican Republic to advance structural reforms. A tax reform that reduces the burden and simplifies compliance, changes in the labor market that reduce costs and rigidities, reform of the electricity sector, deregulation processes and substantial improvements in education are key to increasing growth. Without these changes, the country risks having to settle for increasingly modest expansion rates.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Crees).