The agricultural unions are right when they claim for him exchange rate delay.

The dollar strengthens against the strongest currencies in the world, but weakens against the Uruguayan peso, how strange, right?

This happens because – and congratulations – Dollars enter for good exports and some (little) investmentbut also because, to combat inflation, The Central Bank of Uruguay raises the interest rate and issues bills in pesos at very high rates.

In this way, whoever had savings in dollars sees that they are paid, let’s say, 12% if they switch to pesos and with the dollar flattening or falling, they get an equivalent rate in novela dollars. Then, dollars are sold to change to pesos and thus the price of the dollar is further depressed.

Even international operators looking to arbitrage all over the world, can bring in dollars just to get these super rates.

And on the demand side for dollars, we have made no progress, for example, lowering tariffs to import more or allowing the AFAPs to use pesos from our salaries to buy dollars and place them, for example, in US treasury bonds.

So when a claim for exchange rate delay arrives, it is not worth answering with the face of “I was not it” that the dollar floats.

It is clear that we have a persistent exchange rate delay due to failures in macroeconomic policy: fiscal deficit (which forces to issue pesos and bring dollars as debt); indomitable inflation (the Central Bank of Uruguay itself imposes an inflation range that it never meets, why does it do it?; permanent fight against inflation through the interest rate instead of attacking its generating causes… all at cost of hundreds of millions of dollars that leave nothing to society other than foreign exchange delays, higher dollar prices and the inability to add value to our exports.

And, in general, the same ones who always infringe on us the exchange rate arrears comment that “not only the exchange rate influences competitiveness”. Certain! But let’s see what factors affect competitiveness.

An important one would be labor productivity, but unfortunately here it seems that it is going down instead of going up.

Another would be the weight of the State in bureaucracy and taxes, but in this neither does aid arrive to neutralize the exchange rate delay.

Another one would be the cost of energy, which has not gone down either.

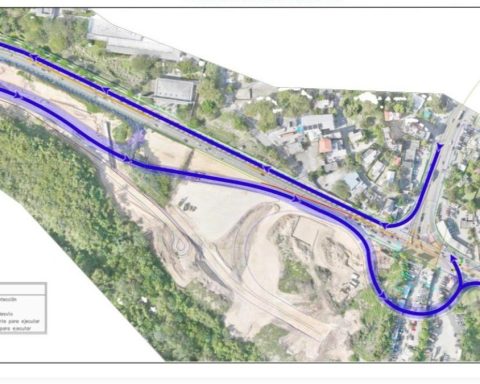

The infrastructure has been improving, but it has not yet managed to lower logistics costs.

Nor have we been able to lower tariffs abroad and we continue to lack a good capital market and long and cheap financing, as in other places.

So, the exchange rate delay makes us more expensive in dollars, but we can correct it quickly.

The other important competitiveness factors do not help or play against, correcting them will take years.

Thus, it turns out that we cannot add value: instead of tanning leather and making jackets and shoes –as we knew how to do– we send them abroad wet, the same with trunks that we care for 25 years or with soybeans that come out as beans instead of make flour or oil, the meat comes out in a high proportion with the bone… and it adds up and goes on.

In the end, it is a matter of priorities. In my opinion, Uruguay cannot be an expensive island in a cheap ocean.

You have to choose: We want to be a very competitive country that adds value to its exports and grows strong… yes or no?