The financial turbulence unleashed after the bankruptcy of Silicon Valley Bank and Signature Bank in the United States, together with the acquisition by the Swiss investment bank UBS of its peer Credit Suisse, undoubtedly marked the future of global stock markets during last March. In this edition of The City, by Sun Capitalwe will deal with the last of these banks, Credit Suisse, once a historic giant of Swiss banking.

How did the crisis break out?

Credit Suisse, founded in 1856, is the second largest bank in Switzerland (after UBS), and by the end of 2022 it had total assets of about US$575 billion (ten Uruguayan PBIs). In turn, its asset management division (asset management) was responsible for the figure of US$ 1.7 trillion in assets. Not bad for a bank in a country with less than nine million inhabitants.

With such a volume of business, to which is added a global presence, Credit Suisse is one of the 30 financial institutions designated as systemically important (Global Systemically Important Banks or G-SIBs) by the Financial Stability Board (FSB) or Council of Financial Stability, which is an international body that monitors and makes recommendations on the organized global financial system. All this means that if Credit Suisse’s problems escalate, the consequences would affect the entire international banking system (too big to fail or too big to fail).

After this introduction, how did the crisis start? Something that has been known since time immemorial is that the greatest asset of a bank is the trust of its customers, if this is lost the crisis breaks out and under a fractional reserve banking system (that is, the bank takes deposits, maintains a percentage of the same in cash and lends the rest) cannot resist the massive influx of savers who are going to withdraw their money. This was partly what was happening with Credit Suisse in the week before the acquisition, when it was suffering daily withdrawals of $10 billion, unsustainable.

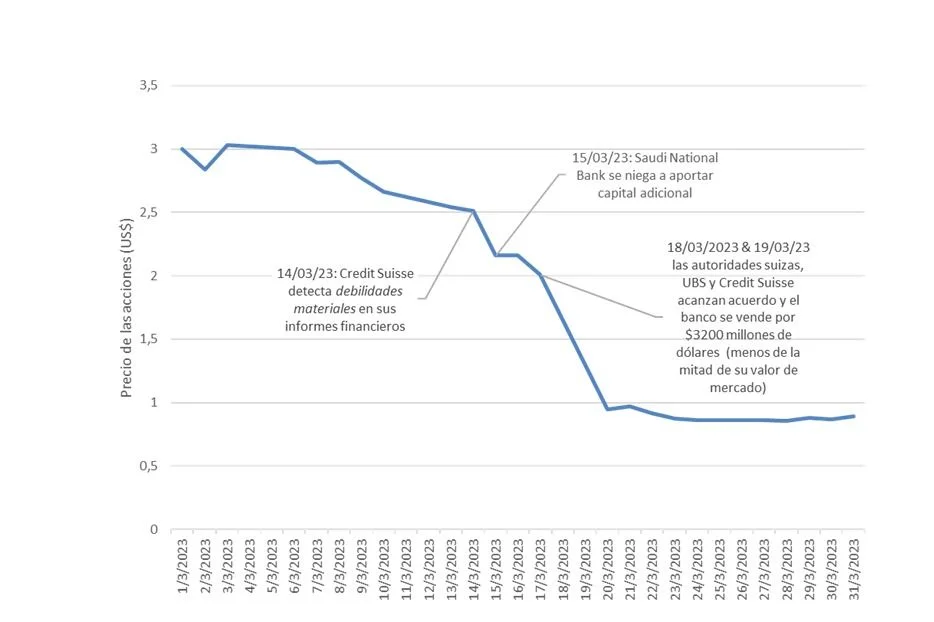

However, there were two specific factors that triggered panic among savers and the market in general. The first of these was the publication of the 2022 annual report (March 14) where the bank identified “material weaknesses” in internal controls over financial reporting, while auditor PricewaterhouseCoopers (PwC) included in the report an “opinion adverse” on their effectiveness. The following day the Saudi National Bank (majority shareholder of Credit Suisse, with 9.9% of the shares) announced that they did not intend to increase their participation or contribute additional capital to the bank. At the same time, with all the events that were taking place in parallel in the United States, nervousness was widespread, so that any bank that showed signs of weakness would be the victim of the adverse reaction of the market, which massively sold the shares of the swiss giant. Not even the support in credit lines for more than US$ 50 billion from the Swiss National Bank could stop the bleeding in the prices as seen in the following graph.

The resolution of the crisis

What were the main antecedents? As often happens, the background is usually deeper, and this was no exception. If we go back to the last great financial crisis, which took place in 2008, we are going to find a Credit Suisse that handled the situation much better than its peers, in its case without the need for a government bailout, unlike UBS that was bailed out. But with success comes arrogance and the bank, traditionally with quite an appetite for risk, very enterprising, neglected management, internal controls, etc. And since then everything went from bad to worse, to the point that in recent years the bank has been targeted by numerous scandals (Archegos, Greensill, Luckin Coffee, Mozambique) earning the reputation of an institution with a bad business culture already the drift from the point of view of management, with many changes in the management team etc.

During 2022, a new management took over with the aim of making a 180-degree turn towards a new business model that would reorient the bank towards increasing profits (only in that year it lost 7.3 billion Swiss francs). So much so that, in October 2022, Credit Suisse published an update to its strategy, which included a capital increase of 4 billion Swiss francs, a cost reduction of 2.5 billion, and a new focus focused on its best segments. of business. The strategy included objectives for 2025 of 6% Return on Capital and a Capital Ratio (CET1) greater than 13.5%, among others. It was a good project but reality had other planes, the strategy was not credible and the bank experienced a net asset outflow of 110 billion Swiss francs during the fourth quarter of 2022. In addition, the bank had also indicated that it expected a loss substantial by 2023.

A clear way of seeing the importance of trust, as the greatest asset in this business, is obvious when we analyze some key metrics by which the financial health of a banking institution is evaluated. For example, the Liquidity Coverage Ratio (LCR) was 144% for the fourth quarter of 2022 and during a conference on March 14, the CEO indicated that it had increased to close to 150%, that is, a very solid level ( the minimum required is 100%). As another example, for the same period, Credit Suisse had a Capital Ratio (CET1) of 14.1%, well above the requirement, implying excess capital of approximately 9.3 billion Swiss francs, all figures higher than that of many rival banks. In addition, it is worth noting a low delinquency rate, barely 1.1%.

However, as we mentioned earlier, the events surrounding Silicon Valley Bank had generated such concern among investors that they quickly began to sell any bank that aroused the slightest suspicion of being risky, and at this point, Credit Suisse’s vulnerability makes time was an open secret. Anywhere in the world, no bank can resist this dynamic for long, and if it also has to face withdrawals, it was impossible for the firm’s capital structure to remain standing for long. Although the Swiss authorities (SNB and FINMA) supported the bank, reiterating its solid financing and liquidity positions, noting that its situation was not comparable to that of its troubled American peers, none of this was enough.

How was the resolution of the crisis? Over the course of a weekend (March 18-19) the Swiss financial market changed radically. The authorities of that country announced the purchase of Credit Suisse by UBS, paying shareholders 0.76 Swiss francs per share (they had closed at 1.86 on Friday of that same week), for a total amount of approximately 3 billion dollars. As part of the transaction, it was determined that Credit Suisse’s AT1 bonds (known as CoCos) would be carried to zero, for which investors around the world lost some US$ 17 billion that became part of the bank’s capital, according to the rules under which said instruments were subscribed.

To this was added, as a guarantee, by the Swiss authorities, another 9 billion Swiss francs for UBS (in case the losses from the acquisition exceed a certain threshold), where all this is supposed to be more enough to cover restructuring costs. The Swiss National Bank also provided extraordinary liquidity assistance to Credit Suisse and UBS totaling 200 billion Swiss francs.

As an additional detail, due to an emergency regulation of the Federal Council, the purchase did not depend on the approval of the shareholders of UBS and CS (legitimate owners), which also leads us to wonder how far the rule of law and the defense of property rights these days. Let’s not forget that the book value of Credit Suisse’s estate was around 40 billion Swiss francs, and UBS buys it for 3 billion, seems a bit unfair. At the same time, in times of fears about banks that represent a systemic risk, it is curious that the answer to the crisis is to create an even bigger monster, with total assets of more than 1.5 trillion Swiss francs, which it represents almost twice the gross domestic product of Switzerland. In turn, with 5 trillion Swiss francs in Investment Assets, it will position itself after the merger as the second largest Wealth Manager worldwide and the third largest in Europe. To solve a serious problem at a systemically important bank, they created an even bigger monster.

For now, the last few days have been relatively calm in the financial markets with a recovery in asset prices globally. As for Europe, it would seem that the liquidity of the banking sector is at good levels, the banks are reasonably capitalized, and this crisis would have been a local phenomenon, specific to a particular bank, which already had many problems. Therefore, the risk of contagion would be contained, however, the repetition of atypical events in the banking sector, with bankruptcies and acquisitions of various institutions, suggests that the risks of the financial business may not be correctly evaluated. The latter will undoubtedly maintain a certain level of uncertainty that should translate into less dynamism in bank credit, already affected by the historic cycle of interest rate rises, especially in the United States, and consequently by economic activity. at the level of developed countries, with consequences for the rest of the world. To be continue.