Economy and Business > Markets

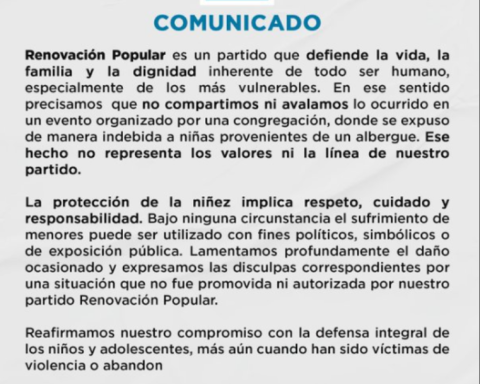

The country risk index (UBI) prepared by República AFAP closed the week at 75 basis points

Reading time: –‘

December 23, 2022 at 19:59

The country risk index (UBI) prepared by República AFAP closed the week at 75 basis pointsthe historical minimum since it began to be measured in 1999.

The UBI is calculated daily and reflects the average “spread” or difference between the yield on Uruguayan bonds and the yield on US treasury bonds considered risk-free.

This differential is usually attributable to a premium for the risk of “default” or breach of the conditions of the debt. The greater the risk, the greater the probability of default by the debtor State and therefore the interest rates are higher.

Thus, if today Uruguay went out to finance itself in international markets, it would have to pay a spread of just 0.75% over the yield of US Treasury papers, according to this indicator.

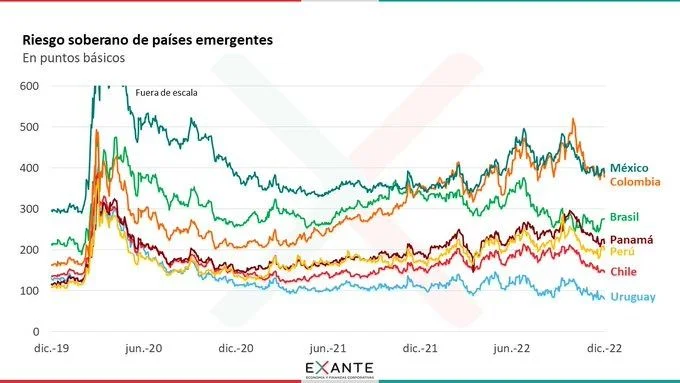

Also in the JP Morgan (EMBI) indicator, Uruguay’s country risk (sovereign spread) reached a record low today of 102 basis points, economist Aldo Lema highlighted on his Twitter account.

With these values, Uruguay stands out widely among countries in the region, as seen in this graph from the Exante consulting firm. “This better perception of country risk partly responds to the dynamics of public accounts: the government lowered the fiscal deficit and is on track to comfortably meet the goal set for 2022,” they said.

Login

Still don’t have an account? Register now.

To continue with your purchase,

login is required.

or log in with your account at:

Enjoy The Observer. Access news from any device and receive headlines by email according to the interests you choose.

Thanks for signing up.

Name

exclusive content of

Be a part, go from informing yourself to forming your opinion.

If you are already a Member subscriber, log in here

Loading…