After this morning’s meeting on the 26th, the BCU reported that inflation closed 2025 at 3.65%, below expectations, and that two-year expectations continue to align with the goal. Analysts, financial markets and companies project records close to the official objective.

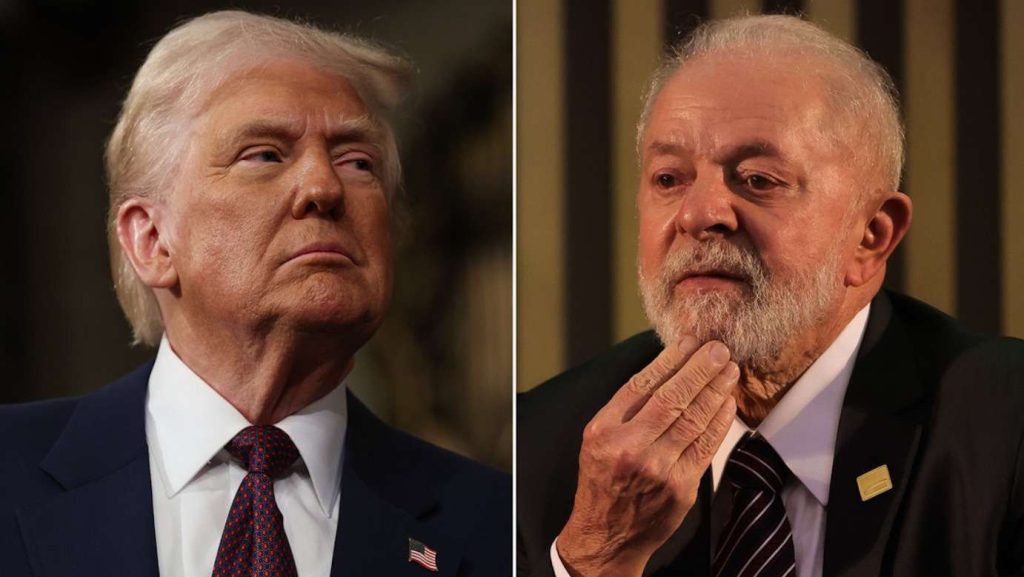

The organization noted that the increase in international uncertainty and the weakening of the dollar impacted the Latin American exchange market, generating specific episodes of lower liquidity and volatility. Faced with this scenario, the Board of Directors decided to advance and deepen the cycle of lowering rates, beginning an expansionary phase of monetary policy.

The BCU warned that, if exceptional situations are repeated at the domestic level, it will use the necessary instruments to maintain inflation within the tolerance range. In addition, he called for an additional Copom meeting for the month of March.