The Federal Administration of Public Revenues (AFIP) advances with its ‘Strategic Plan 2021-2025’ with the objective of improving tax collection and reducing non-compliance, especially in Value Added Tax (VAT) and Profits, to meet the tax goals set in the agreement with the International Monetary Fund (IMF).

General objectives of the plan

In the ‘Strategic Plan’, the AFIP summarizes seven general objectives, among which the following stand out: improve tax collection; reduce tax noncompliance; improve the progressivity of collection and its distributive incidence; increase labor regularization; handle problems arising from international taxation.

Likewise, there are five bets: improve voluntary compliance; detection and deterrence of non-compliance, which includes comprehensive control of relevant economic activities, such as granaria; incorporation of appropriate tax technology for each of the links of these activities; operational capacity, for the introduction of regulatory measures at the level of the tax administration.

In the same way, own inspection and control strategies are proposed as goals; and strengthening the operational capacity of the territorial structure of the General Tax Directorate (DGI).

“We are in the development of a VAT compliance improvement plan, which is transversal to the entire economy, since VAT is one of the main taxes in terms of collection”indicated a high source of the AFIP in a contact with the press.

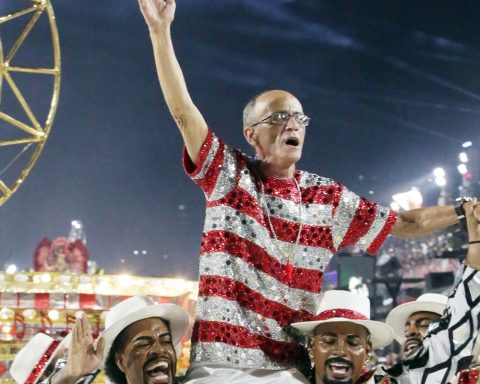

In addition to this, the body in charge of Carlos Castagneto has planned a series of international commitments established around VAT, a tax that usually has a fluctuating behavior.

The implementation of the ‘Strategic Plan’ allowed, within the framework of the closed negotiation with the IMF, that “there is practically no need to give up anything at all”, they explained.

In this sense, they emphasized that “it was the ‘Strategic Plan’ that guided the commitments with the Fund.”

“One of the things that was worrying was the issue of risk management and matrices, and advice was agreed with the Fund based on experience in other countries on risk management systems”they stressed from the AFIP.

In this regard, they maintained: “We needed to see what the experience was like in other countries and now we are making a comprehensive plan to improve VAT and Profit compliance.”

They mentioned that another item to be resolved is the maneuvers that exist in the export of non-granary primary agricultural products, among which are potatoes, onions and garlic, among others.

In data estimated by the AFIP, a VAT non-compliance gap of 34.3% was reached in 2022, recovering pre-pandemic levels, while by 2023 it plans to reduce it to 31.5%.

However, from the organization they recognized that the projected mark of 31.5% continues to be “a bestiality” and warned that in Profit the level of non-compliance “is higher”.

“We know that evasion in Argentina is very high and implies greatly strengthening the agency’s capabilities; that is why we want to end this year by leaving the technology developed and validated“, they stressed.

For this, the AFIP works on a system for measuring non-compliance in Profits.

“We got to work on that, we made a commitment to the Fund on that and we made a commitment to do the Earnings Default Gap measurement,” they added.

They explained in this sense that “it is measured from the bottom up, for example, taking the results of the inspections carried out by the Administration, and in a few months we will have the first measurement of the breach of default in Profits that has been done in Argentina “, they anticipated.

The segments to be analyzed will be legal persons, which account for 80% of the declared income; small and medium businesses; and human persons.

Another point highlighted by the organization led by Castagneto is that “refunds also play a role in collection, and last year more than $12,000 million was paid in refunds to 343,000 human beings.”

In the first month of the current year, for its part, there were $7,000 million to 140,000 people, “with which we want the agency, as a cobra, to also comply with the returns.”