In force since August, the fee for online purchases of products up to US$50 is expected to raise R$700 million this year. The executive secretary of the Ministry of Finance, Dario Durigan, confirmed the estimate in a press conference to detail the 2025 Budget proposal.

“The Remessa Conforme has already been approved. It does not require legislative effort, but it will allow for approximately R$700 million more this year that can go into this account,” said Durigan. The secretary added that this number was used by the Senate to approve the package of measures that compensate for the tax relief of the payroll for 17 sectors of the economy and for small municipalities.

For 2025, the Secretary of the Federal Revenue Service, Robinson Barreirinhas, said that the government does not yet have an estimate. According to him, the government is waiting for the performance of the Remessa Conforme Program in the coming months to make a more precise calculation for next year.

“We are very conservative in our projection for next year, precisely because we have no history. August was the first month of revenue collection. Based on the August result, we may have some information, but it will probably take two or three months to have a reasonable history,” explained Barreirinhas.

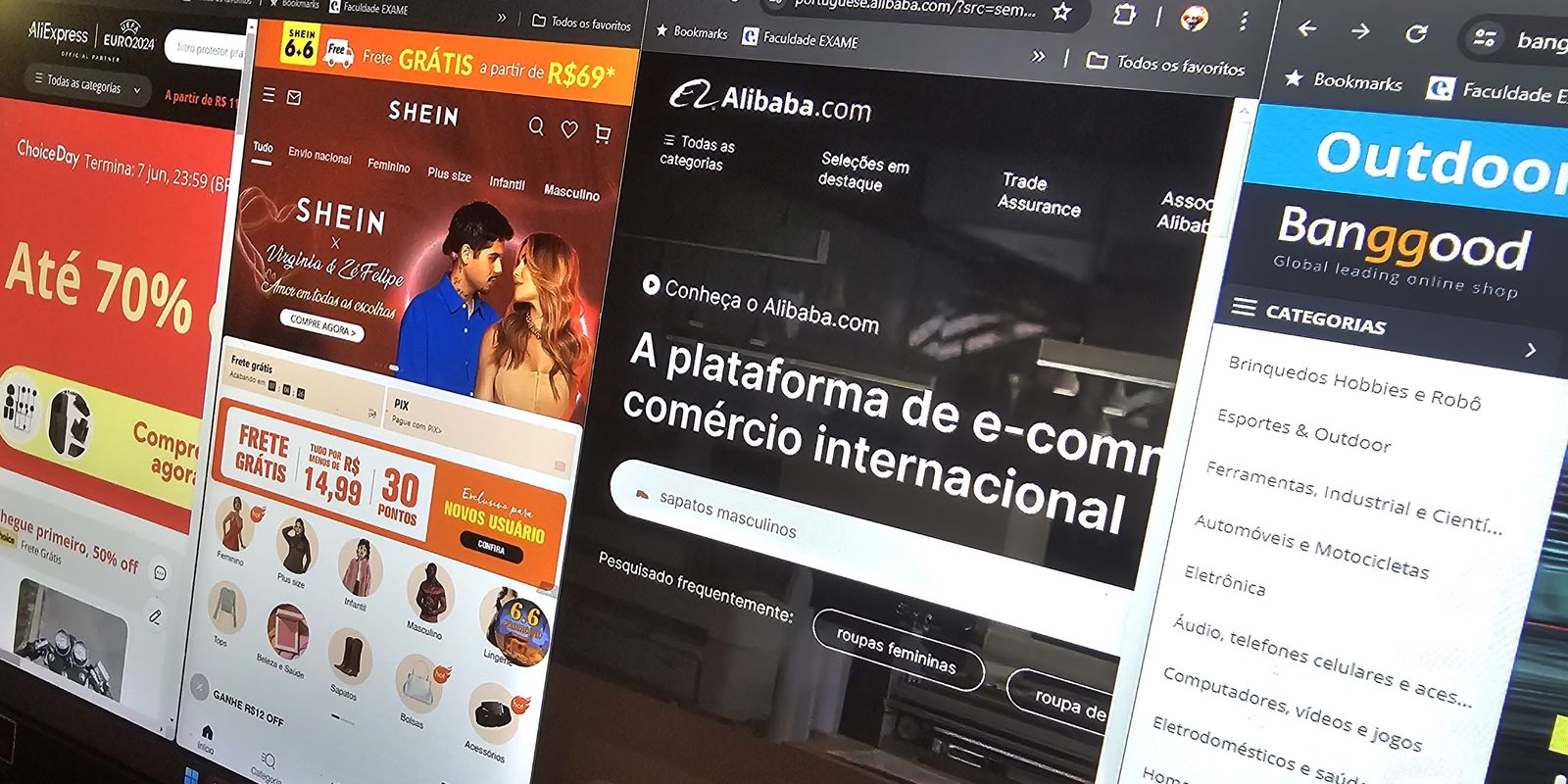

In June of this year, Congress approved a 20% tax rate on purchases of imported products worth up to US$50 from websites that have joined the Remessa Conforme Program. Products worth between US$50.01 and US$3,000 will be taxed at 60%, with a fixed deduction of US$20 from the total tax amount. For purchases from websites that are not part of Remessa Conforme, the Import Tax corresponds to 60%, if a commercial transaction is proven.

After a year of exemption, the collection of Import Tax on purchases of up to US$50 was resumed in August. In addition to the import tax, purchases on foreign websites have been subject to a 17% Tax on the Circulation of Goods and Services (ICMS) since July of last year, a tax collected by the states.