The local economic conversation has several elements that are repeated insistently. One of the most persistent is the increase in tax pressureunderstood as the quotient between total tax collection and gross domestic product (GDP). When a tax reform genuine, aimed at facilitating the creation of wealth, with broader tax bases, lower and more reasonable rates, less evasion, informality and avoidance, it is perfectly possible to obtain greater collections in absolute and relative terms. When this occurs, the tax/tax ratioGDP tends to grow because collections tend to increase: tax bases grow, cross controls increase, economic activity grows, the simplification of the system allows the tax administration to be more efficient and incentives to avoid tax compliance are reduced. Both components of the ratio become larger simultaneously. Collections increase and the economy grows in a healthier and more sustained way.

How to achieve this transition in the Dominican Republic? The key is to concentrate energy on establishing the institutional conditions so that wealth creation is the norm and, as a consequence, economic mobility becomes the usual outcome within the economy. This change can only be achieved with profound structural transformations, the same ones that year after year they try to replace with public spending or with an expansive monetary policy that, in the end, generate inflation, debt and greater future pressure on the taxpayers themselves.

The main transformation, the mother of all reforms, should be the tax reform, as explained in the previous paragraph. Otherwise, the issue of tax pressure It will continue to be repeated almost as a ritual.

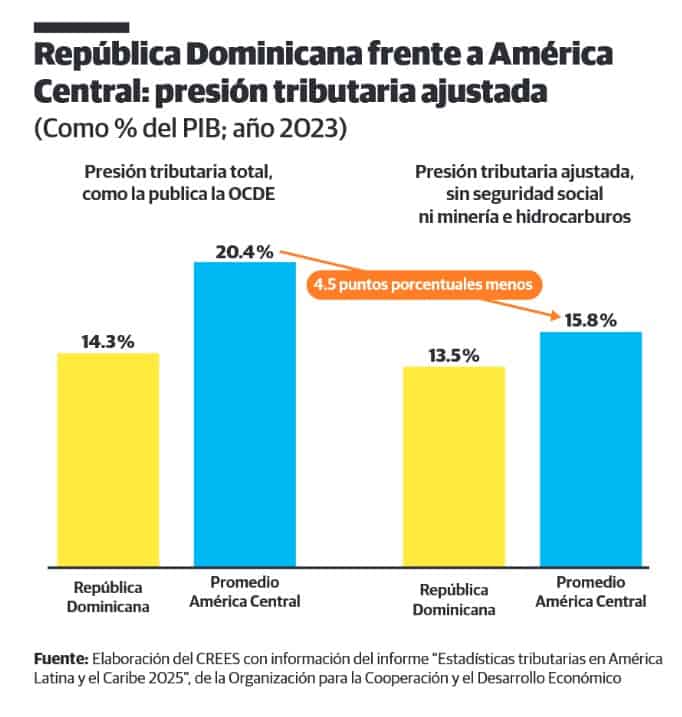

In these last paragraphs of the year, before the Christmas break, it is worth including some details about the tax pressure. First: if social security contributions are added to traditional tax revenues, the tax pressure Dominican Republic is lower than that of many nations in the region and that of member countries of the Organization for Economic Cooperation and Development. It is not the same to make comparisons with nations where social security contributions increase the government’s coffers than with the Dominican Republic, where – fortunately and thanks to the latest structural reform we have had – these resources go directly to the individual capitalization accounts of the workers.

Second precision: the GDP includes all spending financed with public debt. Therefore, the greater the fiscal deficit and the debt to finance public spending, the more the denominator inflates. GDPmaking the tax pressure “apparent” to be minor. Countries with greater irresponsibility in their public finances tend to exhibit ratios of tax pressure lower, not because they collect little, but because their GDP It is enlarged by public debt.

Third: exemptions, exonerations and special regimes reduce income, but the added value and expense associated with these activities are included in the GDP. The result is another distortion that makes international comparisons of tax pressure.

Finally, informality. International guidelines indicate that national accounts should estimate the informal economy as best as possible so that the GDP better reflects reality. But by including informality in the denominator and not being able to include the taxes that informal workers do not pay, a new distortion is generated: the tax/tax ratio.GDP is artificially smaller.

There is an effective way to approach taxes so that the tax pressure do not take up so much time in an economy that needs transformations to create wealth and greater mobility.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Crees).