The total gross collection of the General Tax Directorate (DGI) it reached $49,273 million in January and had a real year-on-year growth of 9.7%, as reported by the agency on Thursday.

For its part, net collection, that is, discounting tax refunds, reached $43,937 million with a real year-on-year increase of 7.4%.

The difference between the gross and net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by DGI or by cash/bank refunds.

Consumption taxes

Consumption taxes were the main source of income for the state treasury and totaled $29,014 million with a growth of 23.7%.

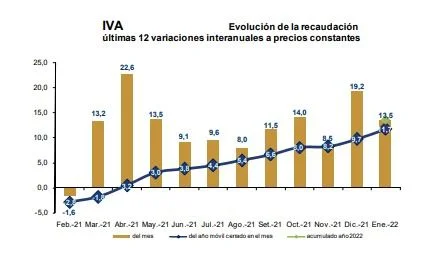

Among them stands out VAT collected which totaled $23,984 million, which represented 48.7% of the total gross collection with a real variation of 13.5% year-on-year.

While, Imesi’s collection reached $5,029 millionand represented 10.2% of the total gross collection with an annual expansion of 18.9%.

income taxes

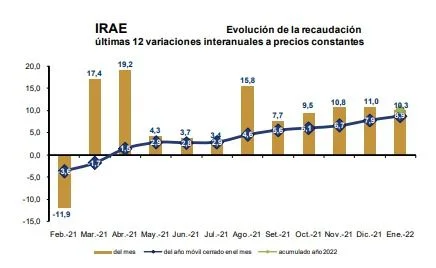

The collection of the Tax on the RIncome from Economic Activities (IRAE) it reached $6,039 million and had a real year-on-year increase of 10.3%.

Finally, the collection of the Income Tax Personal Income Tax (IRPF) reached $8,705 million, and fell 0.3% in real terms.

Income tax collection category II (paid by workers) fell 5.3%, while category I (to capital) increased 32.7% in the year-on-year comparison.

In the speech before the General Assembly this Wednesdaythe president Luis Lacalle Pou, announced the government’s intention to reduce the Social Security Assistance Tax (IASS) and increase the deductions allowed in the lowest bands that pay personal income tax in 2023, if “satisfactory results” were obtained in the economy in 2022.