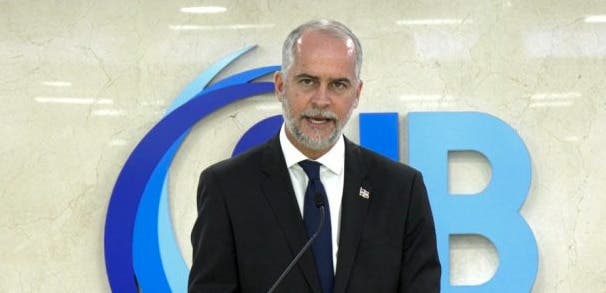

He highlighted the efforts made to face the collapse of the economy due to the pandemic

The Superintendent of Banks highlighted the important role played by the National Financial System to face the collapse of the economy in 2020, product of the pandemic of the coronavirus, and its spectacular recovery in the year just ended.

Alexander Fernandez W.. said that as monetary politicsBefore such an extraordinary and surprising situation, a massive injection of liquidity was made into the Dominican economy to keep the payment system afloat, to reduce market interest rates and therefore reduce the economic burdens of companies and families. .

Fernández W explained that thanks to these policies In recent years, the lowest levels of interest rates, both in pesos and in dollars, have been achieved in Dominican history, and that is saying a lot.

Interviewed by Héctor Herrera Cabral in the D’AGENDA program that is broadcast every Sunday on Telesistema Canal 11, the official from the area financial The official added that there were also elements linked to the regulatory flexibility of the way in which loans are qualified, and to punish or not a bank for restructuring or refinancing a loan from a debtor of all kinds, whether commercial, business or physical.

“The message that was sent, and we also in the current administration has maintained, is that the burden must be accommodated on the fly, we have to be flexible and recognize the situation that debtors are facing, which is not a matter of will of payment, if not that there is indeed an external situation that requires a very relevant flexibility, and in effect this was achieved, “explained Alejandro Fernández.

He insisted that the institution he directs was consistent with the debtors, who are ultimately those who make up the assets of

financial institutions, “for example, what could be expected from the situation of the country’s large companies, with some specific sectors apart, from their financial statements as of December 2020, given the magnitude of the economy being closed for several months” .

“So, compared to that, in a traditional scenario one would have had a deterioration in the ability to pay, and therefore in the qualification of these loans, and then the banks would have had to establish greater provisions, reduce their appetite for risk, if they wanted to lend more to companies or industry, and that would have led us to a perverse and negative cycle”, he pondered.

He gave that, instead, the signal that was sent, by recognizing that the numbers of 2020 would not be the most flattering and representative of the reality of companies and the economy, from there, by decision of the Monetary Board, a series of measures relaxation.

Alejandro Fernández specified that he told the commercial banks that, although it is true that flexibility messages were being sent, they could not pay dividends or withdraw resources from their capital, from the entity’s equity base, because everyone had to contribute.

“And so they did, especially during 2021, to the point that we reached the highest levels of equity strength in the history of our country, although the measures are until 2023, given the numbers and the economic reactivation that banks have, it is highly likely that many will decide not to take advantage of that and that we will return to an ordinary cycle in terms of dividend payments, or the asset management of entities”, he stressed.

The official highlighted the support given by the financial sector to tourism, one of the hardest hit by the coronavirus, by restructuring their loans due to the cash flow situation they presented during the pandemic, and was granted a grace period from 12 to 18 months, only paying interest, until reactivation was achieved.

Private commercial credit portfolio exceeds RD$740 billion with 12% growth in 2021

The private commercial credit portfolio of the national financial system exceeded 740 billion pesos last year, according to preliminary figures from the Superintendency of Banks of the Dominican Republic.

According to said data from the institution directed by Alejandro Fernández W, said portfolio had a growth of 12 percent in the same period of time.

The participation of that amount is headed by Commerce and others with 25.5%, Industry and Manufacturing 14.8. Hotels and Restaurants 11.4, Construction 10.7, real estate activities 10.4, Financial Intermediation 6.4, Transportation and others 4.5, while the Agriculture sector and others 3.4, among other productive activities in the country, which also had access to bank credit.

In that same order, the interannual growth of credit was for Commerce and others of 10 percent, Manufacturing 9%, Hotels and restaurants 17%, while Construction grew by 12, Financial Intermediation 40 percent and Electricity, Gas and Water 26%.

Alejandro Fernández highlighted the intelligence that Dominicans are having, to the point of preferring credit facilities in personal loans, installments, and mortgages, instead of resorting to credit cards, which was something that he recommended prior to assuming the functions that today he performs

“But what is vehicle loans, consumer loans in general, excluding credit cards, mortgage loans, to Micro, Small and medium-sized companies, and to commerce in terms of the private sector, all are growing in real terms”, he assured. .

The Superintendent of Banks highlighted the levels of efficiencies with which the country’s banking institutions are operating, since he, as a financial analyst, used to criticize that the entities for each peso of income spent up to 65 cents, now that level has dropped, to the point that there are banks that are spending 55 cents for each peso that is deposited.

“So we are seeing higher levels of efficiency, largely because digitization and this new virtuality in which we are all living has helped a lot to maintain the level of activity without incurring the same operating expenses that were previously generated. ”, he explained.

He added that this is the future, thinking about what is the agenda from 2021 to 2024, and beyond, because there are already millions of Dominicans who are connected to their financial institutions through their digital applications.

Says the DR closed 2021 with the lowest interest rate in history and is in first place in savings and low delinquency in the region

Alejandro Fernández highlighted that, for the year that has just passed, the national financial system had the lowest interest rate on loans, both in dollars and pesos, in Dominican history.

The weighted average interest rate, as of December 2021, is 8 percent according to preliminary figures from the regulatory and supervisory body of the national financial system.

He also highlighted the reduction in delinquency that, according to preliminary figures from the Superintendence of Banks, stood at December 2021, on average 1.2 percent in the private commercial sector.

“For example, you compare the delinquency levels, which is the loan portfolio that is past due, that is in arrears, not current, and the levels of us are the lowest in the entire region, and for those loan portfolios that are not in force, which is behind schedule, the bank has also been making provisions and reserves to respond to it, in a way that is the highest in the entire region, and this when our numbers are effectively reflecting reality”, he stated.

He recalled that, although it is true that when the pandemic began, in the transition, there was a period of grace, of deferral, of postponement in the payments of many of the loans for both companies and households, starting in August of In 2020 the whole world began to regularize, normalize, honor the payment of its commitments, and therefore the delinquency is at those levels.

“And in that sense, and it is something that I have wanted to highlight, as superintendent of the banking sector, and in that sense I must speak of banks as providers, of users, and it has been extraordinary as the ordinary Dominican, from the smallest to the medium and the largest, they have honored their commitments in these times of economic and financial crisis at a global level”, said Alejandro Fernández.

He added that “it is something of which we Dominicans should feel very horrified and very proud, because if in addition to an economic, health, unemployment crisis, a crisis in the payment system, or a financial crisis, had been added to us, then not only do we see that the Dominican continued to honor his commitments, but also that he maintained his confidence in both the Dominican peso and the national banking system.”

He also highlighted that “financial savings, in the banking system, increased in an extraordinary way, to the point that, in relative terms, in relation to the economy, we are among the first five countries in the entire region with the highest savings rate in the world.” Dominican household, which is channeled through the banking system.

In another order, the Superintendent of Banks highlighted the importance that his administration has given to the protection of the user of the national financial system, with the creation of an application called ProUsuarios Digital in which more than 40 thousand Dominicans take to the Superintendence of Banks in your pockets.

There they can consult their credit history, they can interact with the institution, and process their claims to the banking entities, if they have abandoned or inactive accounts, and more than one hundred million pesos have already been validated, in said accounts, through that tool.

In another order, Alejandro Fernández said that in the next few days the Superintendence will be issuing a resolution with the idea of being more flexible to open a bank account at the base of the pyramid, and squeeze people with certain risk profiles, who can include a person like him who is a public official, and the same will be done with other high-risk activities to which greater details of the origin of their resources and the economic activities to which they are dedicated will be required.