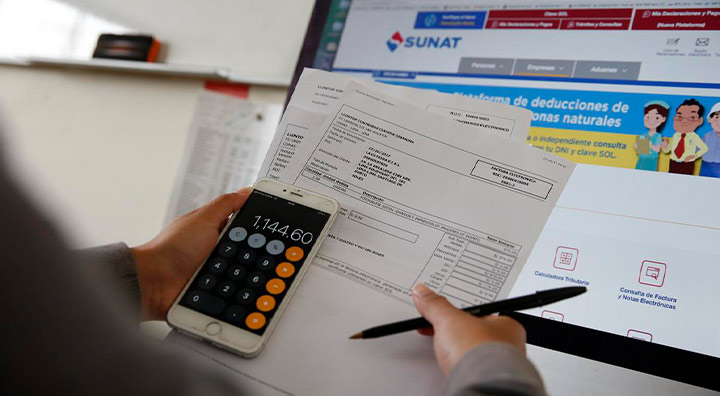

Through Superintendency Resolution No. 304-2024/SUNAT, SUNAT made official the deadlines for taxpayers to comply with the Annual Affidavit of the Income Tax and the ITF of the year 2024.

Schedule for businesses and companies

The schedule for the presentation of the Annual Affidavit of Income and ITF by companies will begin on March 26 and will end on April 9, 2025, the dates being established according to the latest number of the RUC.

Extension of deadlines for natural persons and MYPE

Law 31940 provided for the extension of the deadline for submitting the Annual Affidavit and payment of Income Tax for individuals and MYPEs whose annual income does not exceed 1,700 UIT.

Virtual forms will be available on the following dates:

Virtual Forms No. 710: Annual Income – Simplified – Third Category and No. 710: Annual Income – Complete – Third Category and ITF will be available in SUNAT Virtual starting January 2, 2025.

Virtual Form No. 709 – Annual Income – Natural Person will be available in SUNAT Virtual (www.sunat.gob.pe) and in the SUNAT People APP as of March 31, 2025.

As every year, the personalized file with reference information will also be available, which must be verified and, if applicable, completed or modified by the declarant before submitting their Declaration to SUNAT, and will be available:

- a) As of March 31, 2025for natural persons without a business – Virtual Form No. 709, with information on income, expenses, withholdings and payments of the Tax, as well as withholdings and payments of the tax on financial transactions.

- b) As of February 17, 2025for businesses or companies – Virtual Form No. 710: Simplified and Complete, with information on the balance in favor, payments on account and Tax withholdings, as well as the ITAN actually paid that has not been applied as a credit against the payments on account of the tax.

Who is required to declare?

Natural persons who:

• They would have received Fifth Category Income (on the return) and, at the same time, deduct expenses for leasing and/or subletting of properties.

• Workers who receive Fourth (independent) and/or Fifth Category Income and Foreign Source Income who have a favorable balance.

• Those who have received Fourth and/or Fifth Category Income who attribute rental and/or subletting expenses to their spouses or cohabitants.

• Those who have a balance to pay for First, Second and Work Income and/or Foreign Source Income.

• Those who carry forward balances in favor of previous years and apply them against the tax and/or have applied said balances against payments on account for Fourth Category Income.

In the case of companies, the obligation to present the 2024 Income Tax Return is maintained for those taxpayers who:

• They would have generated Third Category income or losses of the General Regime or the Mype Tax Regime (RMT).

• Persons or entities generating Third Category Income that have carried out operations taxed with the Financial Transaction Tax (ITF) for having made the payment of more than 15% of their obligations without using money are required to present the declaration. in cash.

Now available in Yape! Find us at YAPE Promos.

RECOMMENDED VIDEO