The Ibovespa closed down 3.06% this Monday (2), in the first trading session of the year. Benchmark index of the Brazilian stock market, it closed at 106,376.02 points. In the last two weeks of last year, it accumulated a high of 6.7%.

The dollar jumped in front of the real this Monday, starting 2023 on a high. The spot US currency gained 1.52%, at R$ 5.3580 on sale, the highest daily appreciation since November 25 (+1.838%) and the highest closing level since November 28 (5.3645).

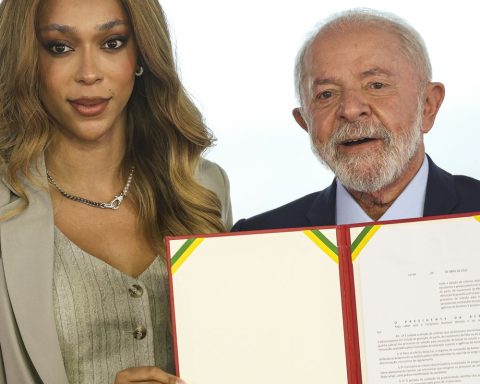

The reasons for this result are the distrust in relation to President Luiz Inácio Lula da Silva. Lula took office on Sunday promising to revoke the spending cap, while emphasizing the role of public companies, such as Petrobras, in the country’s development and revoking acts that advance the privatization of several state-owned companies.

They also displeased the extension of fuel exemption, which the Minister of Finance, Fernando Haddad, asked the previous government not to extend, and the appointment of professionals without much experience to command public banks.

This Monday, Finance Minister Fernando Haddad said that the fiscal framework to be presented this semester by the government needs to be reliable and demonstrate the sustainability of public finances, and that he will not accept a fiscal result this year that is not better than the current one. deficit forecast of 220 billion reais.

However, the lack of details on the configuration of the country’s next fiscal framework continues to be a reason for discomfort in the financial market.

*With information from Reuters Agency