“The sum of steel and aluminum exports of chapters 72, 73 and 76 to 2024 is equivalent to only 1.0% of the total exports of Mexico and 0.26% of GDP, so its direct impact would be limited,” he explains The research center document.

And, although it is recognized that there would be a negative effect, this would be limited. As observed in 2019, after the application of 10% tariffs during the first period of Donald Trump, Mexican exports of these products decreased less than 10%.

The argument on which the measure is based on the US trade deficit in this sector, as well as the growth of the capacity installed in other countries. In the case of Mexico, this justification does not apply, since the balance is overravery in favor of the United States, the report explains.

However, the main concern of Americans is that “part of the steel that Mexico exports to the United States could be of Chinese origin.” The industrialists of the sector in Mexico, however, are stopping making it clear that it is not.

United States, since 2018, has applied rules under section 232, “forcing to declare before the US Custom and Border Protection that steel had melted and poured into North America to avoid 25% tariffs and declare that aluminum in raw material does not It came from China, Russia, Bielorusia or Iran to avoid 10%. “

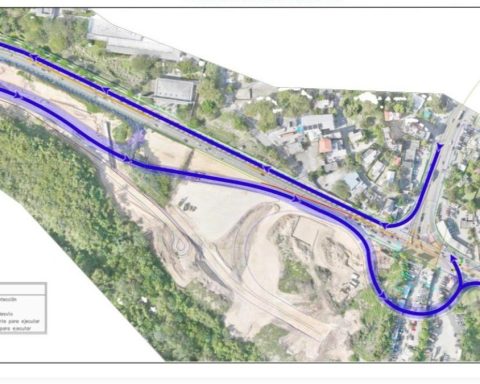

This has led Mexican sidewalk companies to invest not only in their productive capacity, but in the replacement of raw material imports. For example, Ternium Mexico is in the construction of its steel at the fishery siderúgica, with an investment of more than 3.5 billion dollars. This will allow the company to replace a part of its steel imports from its Brazilian plant.

Texas and Nuevo León, the most affected states

The main steel and aluminum supplier countries for the United States in 2024 were, in order of importance, Canada, Mexico, South Korea, Brazil and China representing 58.7%; While the main import states are Texas, Illinois, California and Michigan, with a 42% participation in 2024, said the document of BBVA. And it was anticipated that the main effect will be seen in the American industry in terms of price increase and also in lost jobs.

In 2018, analysts say, steel and aluminum tariffs derived in price increases of 2.4 and 1.6% respectively.

From the Mexican perspective, exports 14 of steel, aluminum and derived to the US are distributed mainly between entities with manufacturing profile in the northern and center of the country. Nuevo León exports 35.6%, followed by Coahuila with 13%, Baja California with 8.6%and Tamaulipas with 7.9%.

Investor confidence in the US

In February, investor confidence in the United States stock market fell significantly, with the appetite index due to the risk of S&P Global IMI lowering from +15% in January to -27%.

The main concern of investors is the deterioration of the political and macroeconomic environment, together with the impact of economic policies.

In fact, tariffs are one of the main concerns, since it is feared that an increase in commercial protectionism affects economic growth both in the United States and globally. In addition, side effects are mentioned as a possible increase in inflation and a more restrictive position of the Federal Reserve.

“Tariff conversations and the increase in geopolitical tensions have clearly affected the feeling of investors, with the political environment, the fiscal policy and the central bank policy now seen as negative factors for the market, while the positive opinions about the United States Economics have decreased, “said Chris Williamson, executive director of S&P Global Market Intelligence, in an analysis.

Beyond steel and aluminum, however, real concerns, both for Mexican and Americans are 25% tariffs to the rest of Mexican and Canadian merchandise.

In addition, Donald Trump pointed out on Tuesday that, as of April 2, he would impose tariffs on imports of cars, chips and pharmacists.

Mexico is especially exposed to Donald Trump’s tariffs, in case it applies. In 2023, Mexico’s exports represented 33.16% of GDP and most of its exports are to the United States.