Another week closes with news in the markets, with many realities affected by the impacts of the drought. Farm prices in Uruguay remain firm and sheep slaughter soared prior to the reduction of operational capacity in the coming weeks; grains suffer from financial instability and soybean, in particular, responds to the drop due to the abundant supply from Brazil; and in wool the trend was cut bass guitarist.

Steer at US$ 4.15

The price of the steer stabilized at averages between US$4.10 and US$4.15 per kilo casing until mid-week, and somewhat lower on Thursday and Friday due to a cooling off in industry demand. A disparity of up to US$ 0.20 is maintained between top steers –difficult to find– and general cattle.

The cows this week were quoted from US$ 3.70 per kilo for the lots with little finishing requirement, up to US$ 3.85 for the top ones.

For heifers there are also differences between the special ones for supply that are paid from US$3.90 to US$4 per kilo, while other plants spend US$3.80 to US$3.90 for general heifers.

Markets in El Observador.

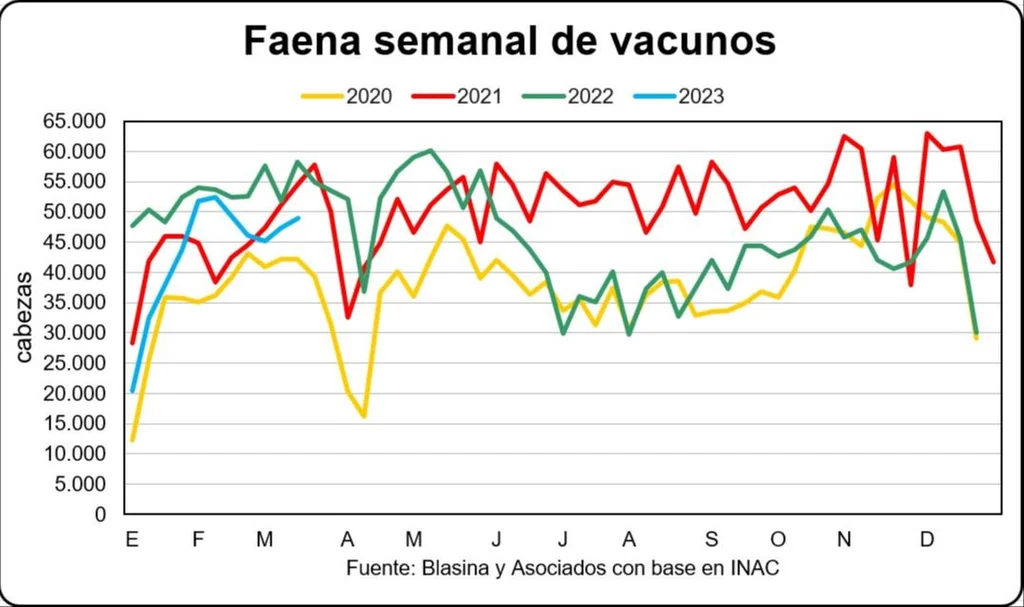

Slaughtering increased its pace and rose for the second consecutive time to 49,018 heads (March 12-18), an increase of 3.5% fed with farms with a lower quality of fat finish as a consequence of the loss of status due to water deficit. Some traction by special pointed steers and heavy-carcass cows was added by the kosher crews that operated in some meatpacking plants.

As of next week, the slaughter capacity will be reduced by licenses in various slaughterhouses, including San Jacinto and Las Piedras, and the plants are more purchased and with longer entries.

Markets in El Observador.

The rains alleviate the fodder prospects and allow the supply to be reduced in less vulnerable categories; they had a more immediate effect on the references of the replacement cattle than on the fat one.

In local farm prices, there is no evidence of an impact of the rehabilitation of China on exports from Brazil, suspended since February 23 due to a case of atypical mad cow, and announced this thursday.

The four-week embargo may have had a certain impact on the recovery of exports from Uruguay, which shipped 26,502 tons to China until March 18, compared to 27,554 last year. A difference of only 3.8%, when in January and February Chinese demand was 17% and 19% below the same months of 2022.

Total, the volume of beef exported in March is 8.9% below that of March 2022. A contrast with respect to previous months; in January it had fallen 29% and in February 34%.

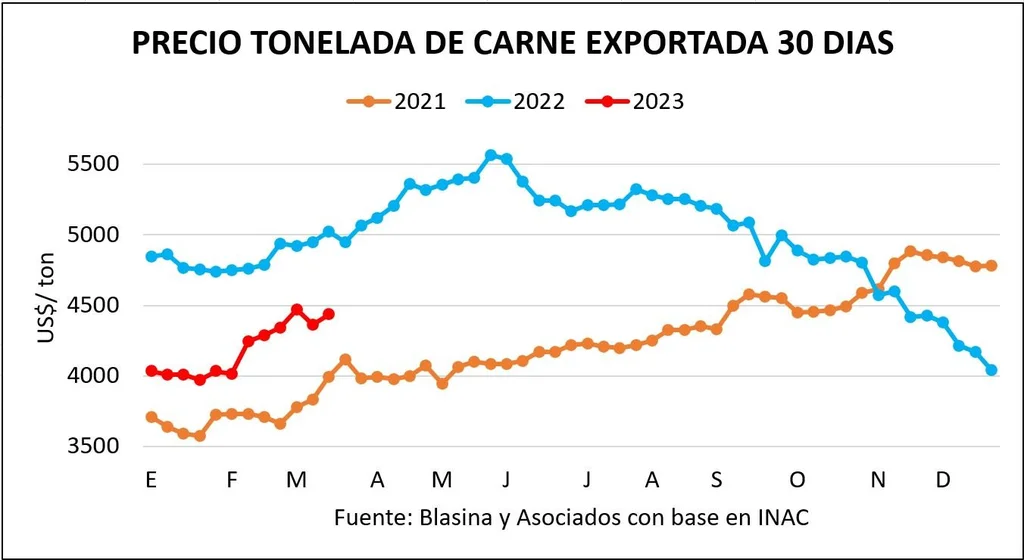

Almost 100,000 tons of beef have been exported at US$427 million, when in 2022 118,000 tons had been shipped with a turnover of US$576 million.

The international price per ton of beef remains firm at US$ 4,436 for the last 30 daysa price 12.4% lower than that of 2022 but 13.5% higher than that of 2021.

The broker Juan Lema, director of Agromeals, said that the 10% boost in the average value since the beginning of the year is more influenced by the European market, and that the stability in the prices of China draws attention, “very cautious in the validation of price increases” with slight variations from US$100 to US$200 per ton.

In the European Union, until a few weeks ago the Hilton cuts were above US$16,000 a ton and in the last four weeks they dropped to around US$13,000 to US$13,500, said Lema on the Tiempo de Cambio program on Radio Rural .

In terms of volume, China will continue to buy a lot: in the first two months of 2023, imports of beef grew by 36%.

China has a large stock of merchandise, more than one million tons, which means that there are no major price changes until the second half of the year as consumption becomes more dynamic and stocks are diluted.

Markets in El Observador.

The price of a ton of sheep meat continues on an upward trajectory. The weekly price was US$4,009 and that of the last 30 days was US$3,921, 9% above the floor of US$3,593 at the end of January.

The slaughter of sheep, for its part, gave a jump of 12% and in the last week it once again set an annual record of 48,146 heads, a figure that is not achieved outside of the year-end harvest. As a reference, it is enough to mention that it is a task 85% higher than the previous year.

The accumulated figure for the year rose to 359,369 heads when the previous year there were 281,394 on the same date. The industrialization of lambs increases almost 38% so far this year and 22% that of sheep.

Exports, unlike the beef market, are much higher than last year: 33% more tons according to data from the National Meat Institute (INAC) as of March 18.

Markets in El Observador.

volatility for grains

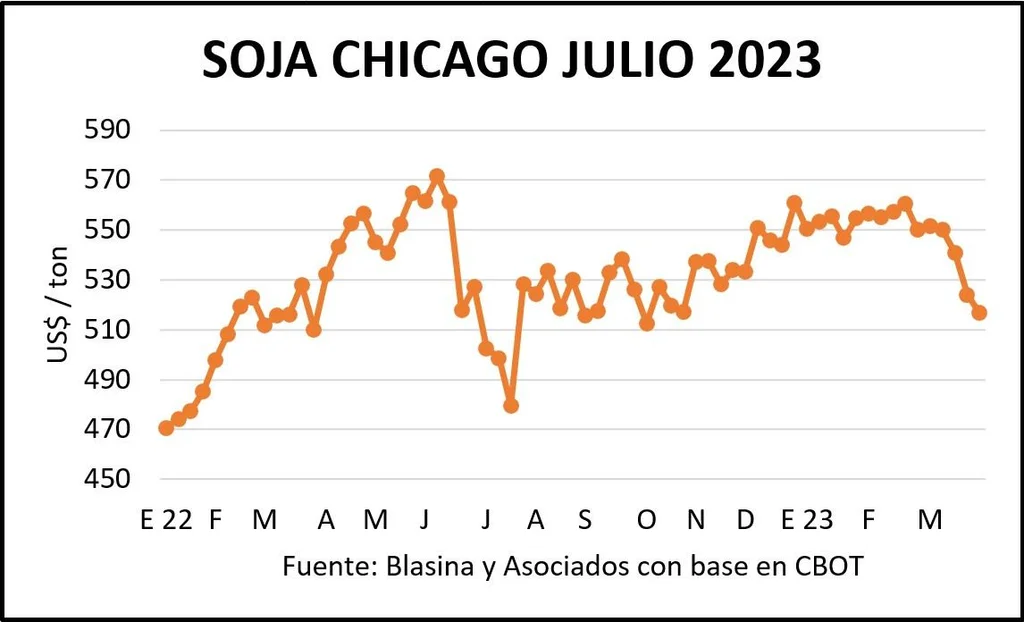

The price references for grains in Uruguay ended last week with drops for soybeans and stability for corn and wheat.

Soybeans are trading between US$515 and US$525, while corn remains at US$330 and wheat at US$290 a ton.

The rains did not arrive in time for soybeans in Uruguaywhere the agricultural area of the southeast coast has not even received rain in recent days. Some 600,000 tons are expected to be lifted with a yield of 500 kilos per planted hectare and approximately 30% of the lost area..

Soybeans ended the week one notch higher than Thursday, where they hit a seven-month low, causing concern for producers. In the last three weeks, the July position fell from US$550 to US$516 a ton, a deepening drop due to the sales of investment funds given the uncertainty of the financial sector and the new rate adjustment of 0.25 points resolved by the United States Federal Reserve.

The Brazilian harvest continues to push values down, flooding the Chinese market and with enough margin to supply mills and oil companies in Argentina, compensating for the absence of its own grain. Both Argentina and Uruguay see crops deteriorating day by day and the final harvest figures continue to shrink according to the forecasts of private organizations.

The rains of the last days in Argentina do not improve the prospects of obtaining a harvest of 25 million tons, 45% below the average of the last five harvests.

The lower-than-expected placement of US soybeans in China in volumes is another bearish factor.

This Friday wheat rose sharply in the Chicago market due to rumors that Russia may stop exporting the grain as a result of the conflict with the West over the invasion of Ukraine.

The price rose US$10 per ton between Thursday and Friday, to US$253 for the May position and US$257 for the July position. Although it closed the week below the prices of last Friday, the values rebounded from the 20-month lows -US$ 243- that had been reached this week.

Corn improved its price at the end of the week, with US$253 per ton in the May position and US$245 for July. The firm demand for US corn from China supports the market, while bearish signals arrive due to the possible expansion of area in the United States for the 2023/24 campaign.

Markets in El Observador.

wool cut trend

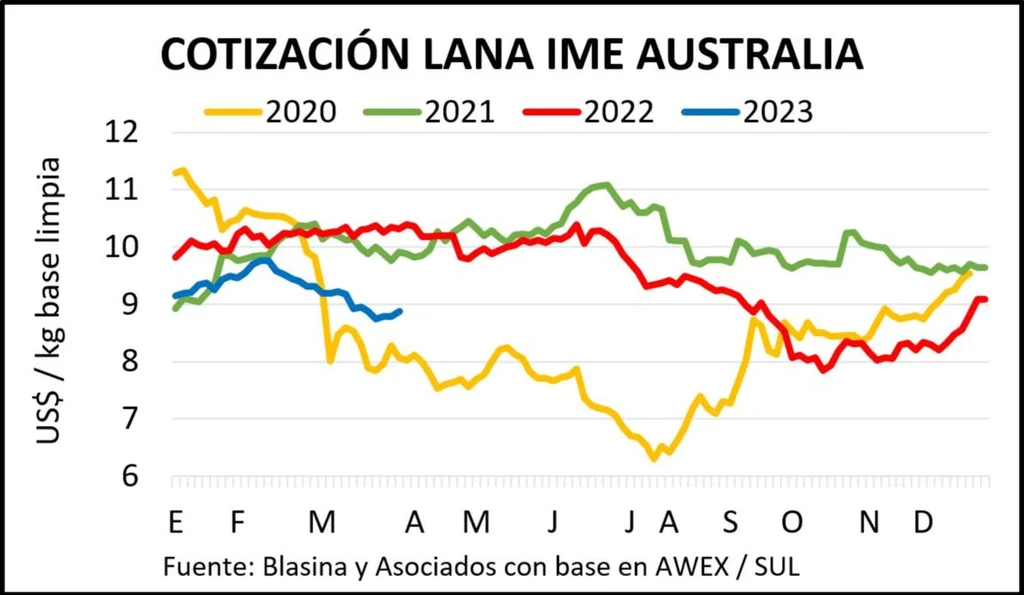

Wool cut a five-week downward streak. Chinese demand and -mainly- the strengthening of the Australian currency drove the recovery of 1.6% in the Eastern Markets Indicator (IME) in Australia, which closed the week at US$ 8.88 per clean base kilo. The current price is 14% below a year ago.

In local currency, the decline stopped, although the rise was only AUD 0.1 as a result of the exchange rate.

The increases were concentrated in Merino wool from 19 to 21 microns, with much interest from the Chinese industry, which is advancing in the recovery of activity after the post-covid reopening. Firm sales in this segment raised the commercialization percentage to more than 90% of the offer.

The other side was in the finer sector, with low volumes and quality problems for the offer of less than 18.5 microns, which pushed values down.

In crossbreed wools of more than 25 microns, the price remained stable due to the demand also from China, with a client acquiring 27.5% of the available supply.

The fluidity of operations continues to be affected by logistical difficulties for shipments in Australian ports. There is an expectation in the market due to the reports that an important operator will increase its participation starting next week, which would allow decongesting stocks, a problem that mainly afflicts slats in the medium and large sectors.

In the local market, the limited operations were concentrated in Corriedale wool from 26 to 28 microns at around US$ 1 per kilo of dirty base, a reference that has been maintained for months with few variations.

“Businesses are quiet, with that slate price of US$1 per kilo for 28 microns; the sales that are made are from people who need to do it, but there are many producers who at that price do not part with the wool”commented the president of the Corriedale Breeders Society, Mariano Rodríguez.