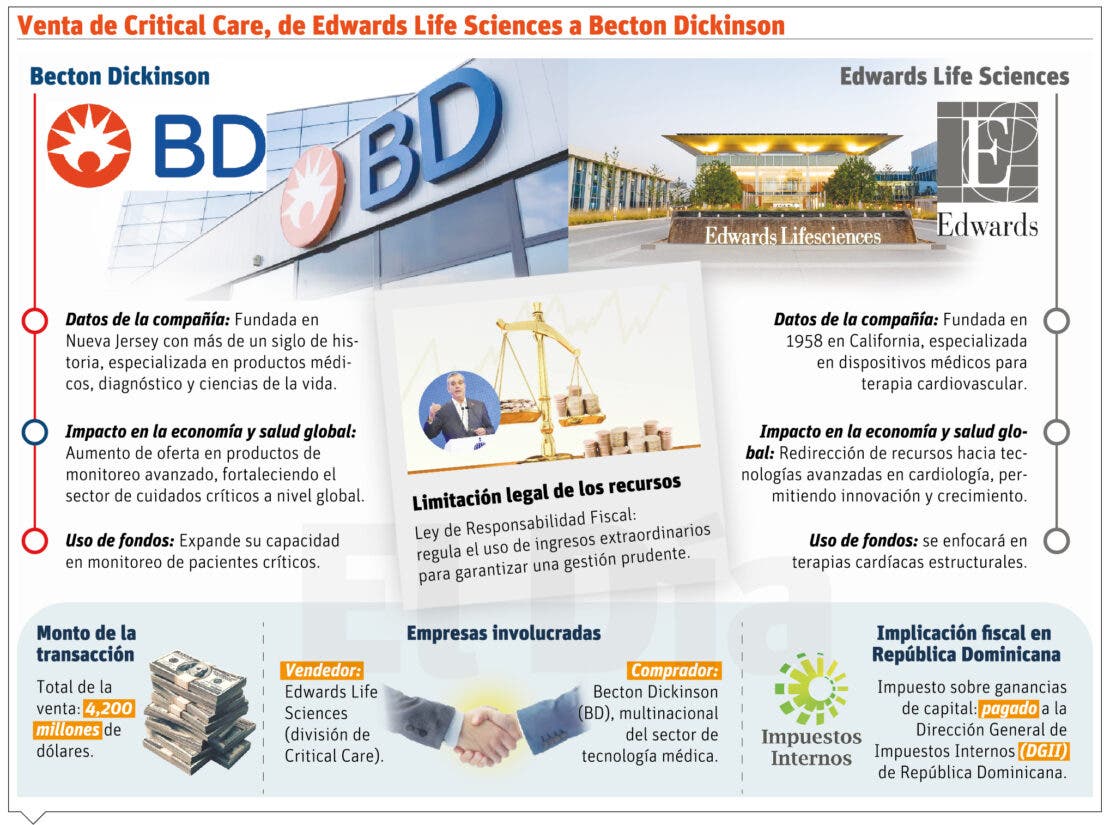

Saint Dominic.-In one of the most relevant financial operations of the year in the pharmaceutical world, the medical technology company Edwards Life Sciences has sold its critical care division, Critical Care, to Becton Dickinson (BD) for US$4.2 billion, in a transaction carried out legally in the Dominican Republic, by the company having residence in the DR since it is in the country under the free zone regime.

Since it was executed on Dominican soil, taxes on the capital gains generated will be paid to the General Directorate of Internal Taxes (DGII).

The Critical Care division of Edwards Life operates under the free zone regime, which makes it one of the few corporate transactions of this magnitude that have been carried out in the country in recent years.

The DGII has already received an advance payment of 900 million pesos, and it is expected that the remaining 22,000 million pesos will be paid in two installments: one in this month of November and the other in May of next year.

However, although these resources represent a significant injection for the treasury, the Dominican Government cannot freely dispose of them due to the restrictions established in the Fiscal Responsibility Law.

Said regulations impose limits on the use of extraordinary income, thus guaranteeing prudent management of public finances, which means that these funds will have a specific use under certain regulations.

Your specialty

Edwards Life, a global company founded in 1958 and headquartered in California, United States, specializes in the production of advanced medical devices, primarily in the areas of cardiovascular therapy and critical care monitoring.

With a focus on developing heart valve innovations, Edwards has been a recognized leader in the medical arena, providing solutions to improve the quality of life for patients with serious heart problems.

Its Critical Care division focuses on monitoring patients in critical condition, providing equipment and technologies that allow monitoring of vital functions in real time.

This includes everything from sensors and catheters to advanced monitoring systems used in hospitals and intensive care units around the world.

The use of this technology is essential to improve clinical results and reduce complications in patients with serious diseases, which makes this division a strategic piece within the company.

BD gets bigger

For its part, Becton Dickinson (BD) is a multinational with more than a century of experience in the medical technology sector, based in New Jersey, United States.

Its business is based on three main segments: medical products, diagnostics and life sciences. BD has pioneered the manufacturing of innovative medical devices, from syringes and sample collection systems to advanced drug delivery technology.

Offer expansion

By acquiring Edwards’ Critical Care division, BD not only expands its product offering, but also strengthens its capacity in monitoring patients in critical condition, integrating new technologies and specialized human resources.

This acquisition will allow BD to position itself even more solidly in the global critical care market, taking advantage of Critical Care’s facilities in the Dominican Republic and the expertise of its local employees.

For Edwards Life Sciences, the sale of its Critical Care division represents an opportunity to further focus on its core business: structural cardiac therapies, a segment in which it is a global leader.

By divesting its monitoring division, Edwards will be able to redirect its resources to the research and development of advanced technologies in cardiology, allowing it to innovate and expand in an area that promises high profitability and sustained growth.

In the case of Becton Dickinson, the purchase of Critical Care allows it to diversify its portfolio and respond to the growing global demand for solutions for monitoring patients in critical condition, an urgent need in the current context of health services.

With this acquisition, BD is positioned to offer a complete suite of products for hospitals and medical centers seeking to optimize the treatment of patients in highly complex situations.

The transaction has sparked interest in the Dominican tax sphere. Since it was done within the country, capital gains taxes will be paid to the DGII.

Resource income

This tax represents unscheduled income for the State, at a time when additional resources could be valuable for the execution of public policies and improvements in basic services.

However, despite this considerable income, the Fiscal Responsibility Law imposes restrictions on the State on how it can use these resources.

Cardiovacular

— Intensive Care

Edwards Lifesciences is a global leader in medical innovations focused on cardiovascular disease, as well as critical care and surgical monitoring. It has a focus on helping patients.

Specialized free zones.

free zone. In recent years, the Dominican Republic has seen notable growth in the installation of medical device companies in its free zones, consolidating itself as an important manufacturing center for the medical device sector in Latin America.

The reasons for this trend include tax incentives, a strategic geographic location, modern infrastructure, and a highly trained workforce.

The country has managed to attract important multinational companies dedicated to the manufacturing of high-tech products in the health sector.

In addition, the country has free zones specialized in the production of medical devices, which have cutting-edge and safety technology.