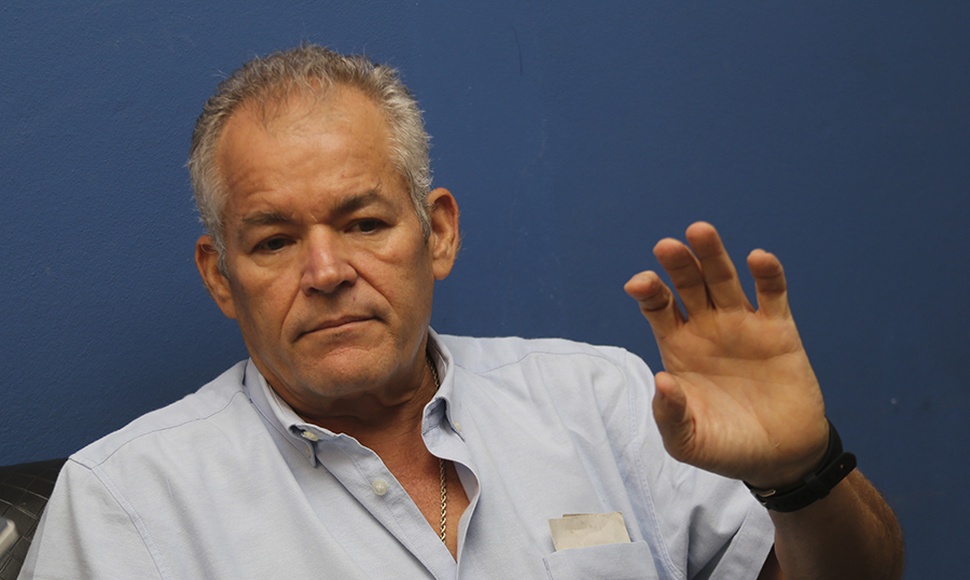

“The war in Ukraine only made it even more complicated, a market that was already very, very complicated. And I’m not exaggerating,” says the president. of the Nicaraguan Association of Formulators and Distributors of Agrochemicals (Anifoda), Mario Hanón.

Agrochemicals (herbicides, insecticides, antiparasitics, fertilizers, etc.) are a silent but key element in the production chain, which is especially true in a country like Nicaragua, with an intense agricultural vocation. The excessive increase in its prices, first due to the 2019 tax reform, then due to the global logistics crisis, and now due to the war in Ukraine, concerns businessmen, economists and producers alike.

One of them is Don “Mateo”, he asks us to protect his identity who sows a small plot in the north of Nicaragua. The producer is worried because his pocket has witnessed how the price of a quintal of urea that he needs to fertilize his bean plantation has risen, from the 700 cordobas for which he bought it, to the 2,200 cordobas that it now costs him a quintal.

“Manpower rose 7%; fuel also goes up in pricebut what they pay me for my products does not rise at the same rate as costs,” he says, recalling that he has to fertilize about three times, and that prices of fungicides, insecticides and herbicides have risen, “besides we are the the only country in Central America where these inputs pay taxes”.

Without invalidating don Mateo’s concerns, Hanón, the president of Anifoda, warns that bean farmers are among those who will have the least reason to worry, because “since it is a legume, it does not need as much fertilizer, but crops such as corn or vegetables, they will have to decide between fertilizing very little, or simply not fertilizing”.

So that productivity does not suffer, “producers will have to apply the products with the maximum efficiency possible, improving the management of fertilizers, and using lower rates of nutrition, which implies that agricultural yields may be affected, in some crops more than in others. It all depends on the producer’s wallet, ”he clarified.

check on agribusiness

At the other end of the list of items destined for local consumption, are the large industrialized crops, such as coffee and sugar cane, whose main market is abroad, in addition to rice, because they all have a high dependence on fertilizers.

“Growers… are crying about the costs of fertilizers. We already had problems in supply chains and freight costs, but if fertilizer prices tighten now, that will impact food costs, ”said an economist who preferred to keep his name anonymous. .

His expert opinion is that “exporters of items such as coffee, peanuts, and sugar cane will be able to transfer these overprices to external consumers,” in the same way that the domestic market will have to absorb increases in items such as rice, beans, and White corn.

Hanon envisions that the most affected crops will be coffee and rice, because “since before the start of the war in Ukraine, the mills had bought enough fertilizers, so they are more prepared, not coffee or rice, those that the crisis finds very exposed, because the main applications to coffee are from May onwards, and those of rice, between May and July, which implies that they will be greatly affected by the rise in prices.”

A relief for the coffee growers is that the market is paying more than 200 dollars per quintal, which gives them greater capacity to buy inputs, “as long as the banks adjust the qualifications”, so that they adjust to the new costs that they must deal.

blow after blow

The approved tax reform without consensus in 2019, it affected all sectors. In the case of agrochemicals, “VAT makes everything more expensive, because it taxes the value of the product, freight, everything!”, so that costs reach an almost unmanageable level for producers and consumers.

When the world seemed to stop in 2020, as a result of the covid-19 pandemic, the price of fertilizers ceased to be a matter of concern, but when the economy started up again, the demand increased significantly, beyond what was expected. that could cover the offer, Hanon explained.

The result was that raw materials such as diammonium phosphate (DAP), muriate of potassium (MOP), ammonium sulfate, ammonium nitrate, and other elements such as Nitrogen, Phosphorus and Potassium, which are the primary elements used in agriculture, explained the union leader.

The increase in the cost of freight, and the disturbances that the war in Ukraine caused in the markets, led to a ton of urea, which cost 200 dollars, today costing more than a thousand; DAP started at $400 and never let up, to the point where it hovers between $1,250 and $1,300, surpassing the levels it had in 2008, when it hit $1,200. Potassium muriate jumped from 300 to 1,200 dollars a ton, “for the first time in history. This is a record of records. It had never happened,” Hanon said.