April 22, 2023, 9:19 PM

April 22, 2023, 9:19 PM

Given the liquidity problems of the fassil bank, the presidential spokesman Jorge Richter – along the same lines as what was said by the Minister of Economy and Finance, Marcelo Montenegro- argued that the financial institution should make a analysis your situation and consider “monetizing” your assets.

“It is necessary that they are observing the possibility of monetize properties what does he have bank”, Richter specified in time to point out that in any situation, event or scenario that may occur “the deposits, the money of the Bolivian men and women who trusted Banco Fassil are guaranteed”.

He stressed that there is a law and a certain Quantity of resources to face any eventuality and thus guarantee the savings of the population.

It should be remembered that for weeks the savers of Banco Fassil have problems to withdraw your money because the entity gradually lowered the amount of cash that can be withdrawn until reaching a limit of Bs 200 per person.

The problems are also transferred to the collection that other financial entities do for the transfer of money to Fassil clients that went from Bs 35 to Bs 70, as a sign of distrust in Banco Fassil.

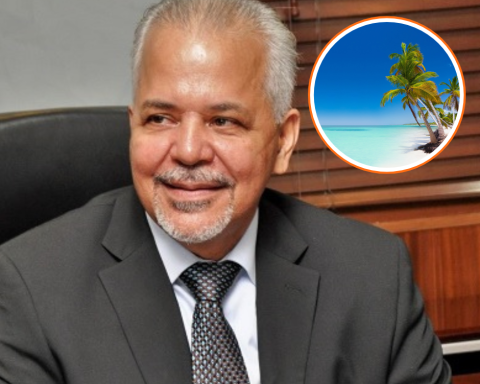

In order to provide certainty, the executive director of the Financial System Supervisory Authority (ASFI), Reynaldo Yujra, reaffirmed that the country’s financial system is “solid, robuststable and reliable”, so rejected speculation about.

Yujra denounced that in the social networks, mainly, there are comments from people “who generate doubts on the Bolivian financial system” and recalled that article 491 of the Financial Services Law sanctions this type of action.

According to ASFI data, the deposits report a growth of 4.3% (Bs 9,083 million), going from Bs 209,891 million in February 2022 to Bs 218,974 million in the same month of this year.

Meanwhile, the credit portfolio it grew by 8.1% (Bs 16,132 million) “at a much more dynamic rate”, increasing from Bs 200,384 million in February 2022 to Bs 216,515 million in the same month of the present management.

Refering to delinquent in the financial system The national rate is 2.6%, a lower rate compared to the region, which is currently 3.1%, which “shows the good quality of credits” in the country. Likewise, the “solvency It is above the required level.