The owner of Banco Azteca was the first to publicly raise his hand to try to buy the bank after its sale was announced.

In his Twitter account, Salinas Pliego said that in addition to the purchase, the operation would have to be arranged and Banamex invested in technology.

I was thinking about buying Banamex and decided NO.

It takes too much time and investment, and then you have to fix your operation and invest in technology.

I prefer to INVEST IN MY CUSTOMERS than @Azteca Bank and compete (and beat) whoever buys that problem ??. pic.twitter.com/tS5ZUzCZz8

– Ricardo Salinas Pliego (@RicardoBSalinas)

June 22, 2022

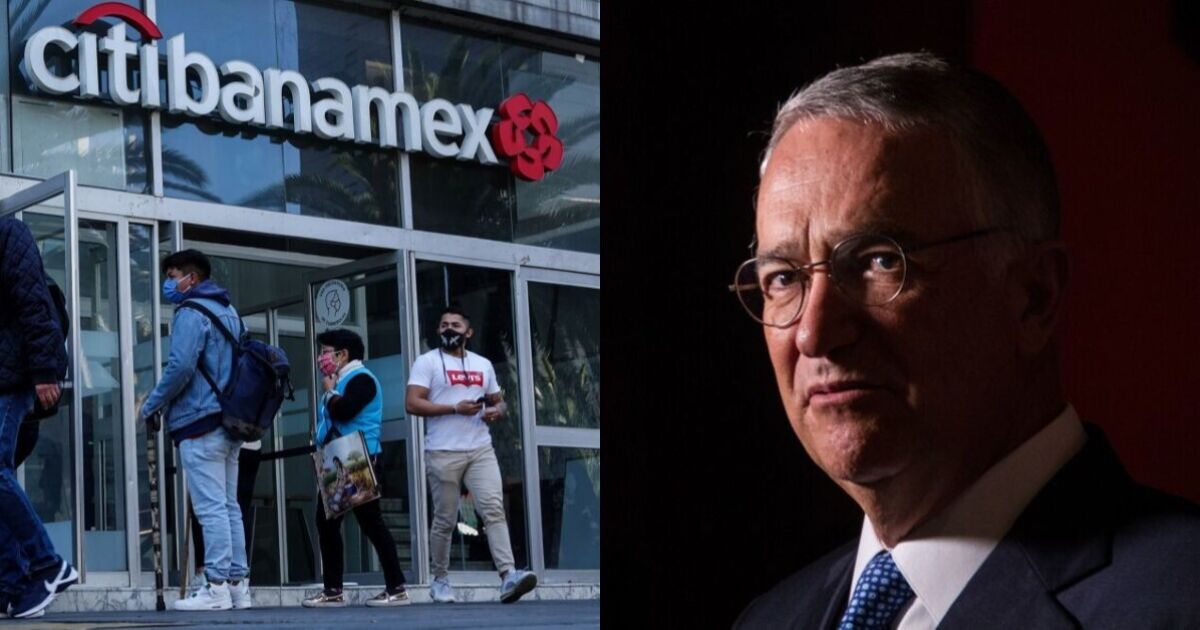

Despite Salinas Pliego’s decision, there are still several interested parties in Banamex, including two new contenders: Germán Larrea, who owns Grupo México, one of the largest mining consortiums in Latin America, and Banco Mifel.

In addition to that entities such as Santander, Banorte and Inbursa have already expressed their interest in the assets.

The businesses that are sale They are the Banamex brand, the branches and customer accounts, the cultural heritage that includes buildings in the Historic Center (such as the Iturbide Palace), the payroll credit business, cards, mortgages, auto and SMEs. The Afores and insurance business will also be put up for sale.

Mexico is home to the world’s largest network of Citigroup branches. The decision to separate is in line with CEO Jane Fraser’s drive to streamline operations and focus on wealth management and US credit card offerings.