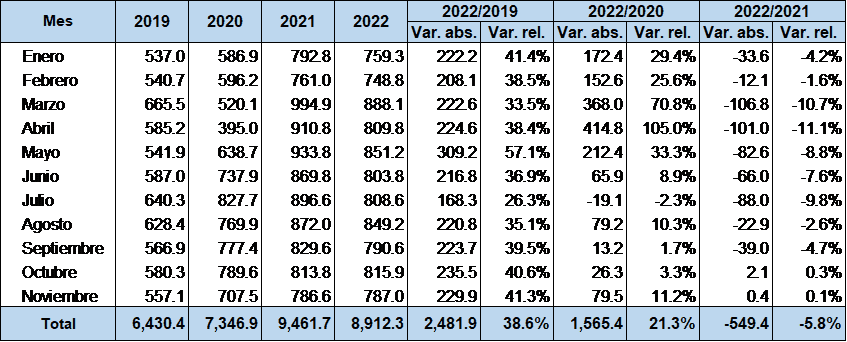

The total amount of the remittances received between January-November 2022 in the Dominican Republic decreased 5.8% when compared to the same period last year, meaning 549.4 million dollars less. However the central bank He is optimistic and maintains that this year could close with flows of around 10,000 million dollars.

The central bank of the Dominican Republic reported today that between January-November 2022 the remittances received achieved a figure of 8,912.3 million dollarswith which he reiterates his estimate at the beginning of the year of a closing of around 10,000 million dollars.

In November 2022particularly, the remittances added up 787.0 million dollarsregistering, for the second consecutive month, a slight year-on-year increase of 0.1%, and with respect to the same month of 2019, the year before the pandemic, growth is 27%, the bank reported.

With this result, the institution indicated that it reaffirms the establishment of the new level of flows of remittances monthly around 800.0 million dollars.

In this sense, he observed that, when comparing this amount of November 2022 with the average value in the same month for the pre-pandemic period of 2015-2019, which was 454.6 million dollars“a significant increase is observed.”

“These resources contributed by the diasporawithout a doubt they have a multiplier effect on consumption, investment and financing of the most vulnerable sectors”, said the central bank.

The issuing entity explained that the economic performance of the USA is one of the main factors that continues to influence the behavior of remittancessince from that country came 588.0 million dollars83.8% of the flows in November through formal channels.

“During said month, the non-manufacturing Purchasing Managers’ Index (PMI) of the Institute for Supply and Management (ISM) registered a value of 56.5 in November, higher than the 54.4 registered in October, indicating a service sector expansion of the North American economy, where mainly the Dominican diaspora in the US,” he said.

“These resources provided by the diaspora undoubtedly have a multiplier effect on consumption, investment and financing of the most vulnerable sectors”

The euro and the remittances

The central bank also highlighted the reception of remittances through formal channels from other countries, such as Spainfor a value of 45.0 million dollars6.5% of the total, this being the second country in terms of total residents of the Dominican diaspora abroad is concerned, as well as Haiti and Italywith 1.2% and 0.8% of the flows received, respectively.

The rest of the reception remittances is divided between countries as Switzerland, Canada and Panamaamong others.

“A relevant aspect that affects shipments of remittances from euro zone countries is the euro depreciation against the US dollar. With a lower value relative to the dollar, more euros are needed to cover the same needs, so it is to be expected that shipments of remittances in that currency increase, which has not allowed a greater increase in the flow received, ”explained the bank.

“In fact,” he added, “the remittances originated from said area they stayed in a similar level to November 2021, increasing in euros by 0.1%, despite the fact that, converted into US dollars, a 10.5% decrease in value is reflected”.

remittances by provinces and gender

Regarding the distribution of the remittances received by provinces, the central bank pointed out that the National District got the higher proportion34.9%, followed by the provinces of Santiago and Santo Domingo, with 14.3 and 9.0%, respectively.

This indicates that more than a half (58.2%) of the remittances is received at metropolitan areas from the country.

Analyzing the flows of November 2022 according to the gender of the recipient, males predominatewith 53.5%, while women captured the remaining 46.5% of the remittances received through formal channels.

After analyzing the recent evolution of the external sector, the outlook for the central bank for the end of the year they contemplate significant currency flows by concept of remittancestourism, exports and foreign direct investment.

“This will contribute to maintaining the relative stability of the exchange rate that is currently observed, in such a way that the national currency has an accumulated appreciation of 4.2%”, he projected.

The institution highlighted that this greater flow of foreign currency has also allowed the accumulation of international reserveswhich are located on the $13.7 billionrepresenting about 12.1% of the gross domestic product (GDP) and equivalent to about 5.7 months of imports, metrics that exceed the levels recommended by the International Monetary Fund.